- Hedge funds’ record +500% ETH shorts clash with $2B Ethereum inflows—market primed for big swings.

- Extreme short bets vs. institutional accumulation puts ETH on edge for a massive move—up or down.

Ethereum’s [ETH] short positions have surged by +500% since November 2024, marking the largest bearish bet against the cryptocurrency ever recorded. In the past week alone, short positioning has risen by +40%, according to The Kobeissi Letter.

Wall Street hedge funds appear to be aggressively shorting Ethereum, even as its price remains relatively flat.

The spike in short exposure comes amidst lingering fears about Ethereum’s underperformance compared to Bitcoin. Since the start of 2024, Bitcoin [BTC] has outperformed Ethereum by nearly twelve times.

Analysts are speculating that hedge funds are anticipating a bearish outlook for Ethereum or attempting to suppress its price.

Source: X

$2B inflows suggest…

Despite the overwhelming short positions, Ethereum saw $2 billion in fresh ETF inflows in just three weeks, with a record-breaking $854 million weekly inflow, per The Kobeissi Letter.

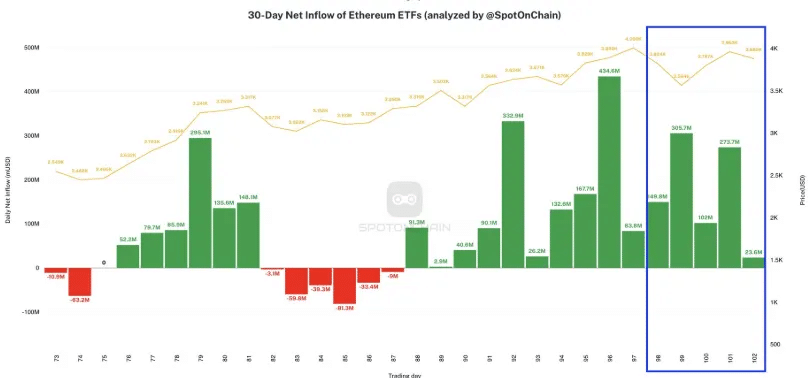

The chart shared by Spot On Chain confirms this data, highlighting consistent accumulation starting in late December 2024.

Source: X

Notable inflows were observed on Day 97 ($434.8M) and Day 100 ($275.7M), indicating strong institutional interest during this period.

However, Ethereum’s price has remained largely stagnant, raising concerns that the influx of funds may be offset by heavy shorting activity.

Analysts note that this tug-of-war between accumulation and bearish positioning could lead to heightened volatility in the weeks ahead.

The flash crash wiped out over $1T

On the 2nd of February, Ethereum experienced a 37% price drop within 60 hours, erasing over $1 trillion in crypto market value.

Remarkably, the flash crash occurred without any significant news catalyst, drawing comparisons to the 2010 stock market “flash crash.”

Source: X

The Kobeissi Letter suggests this event may have been influenced by extreme short positioning and thin liquidity. Volume spikes were observed around key events, such as the crash on the 2nd of February and Inauguration Day.

This signals that large players might be actively positioning for major market moves.

Could Ethereum be headed for a short squeeze?

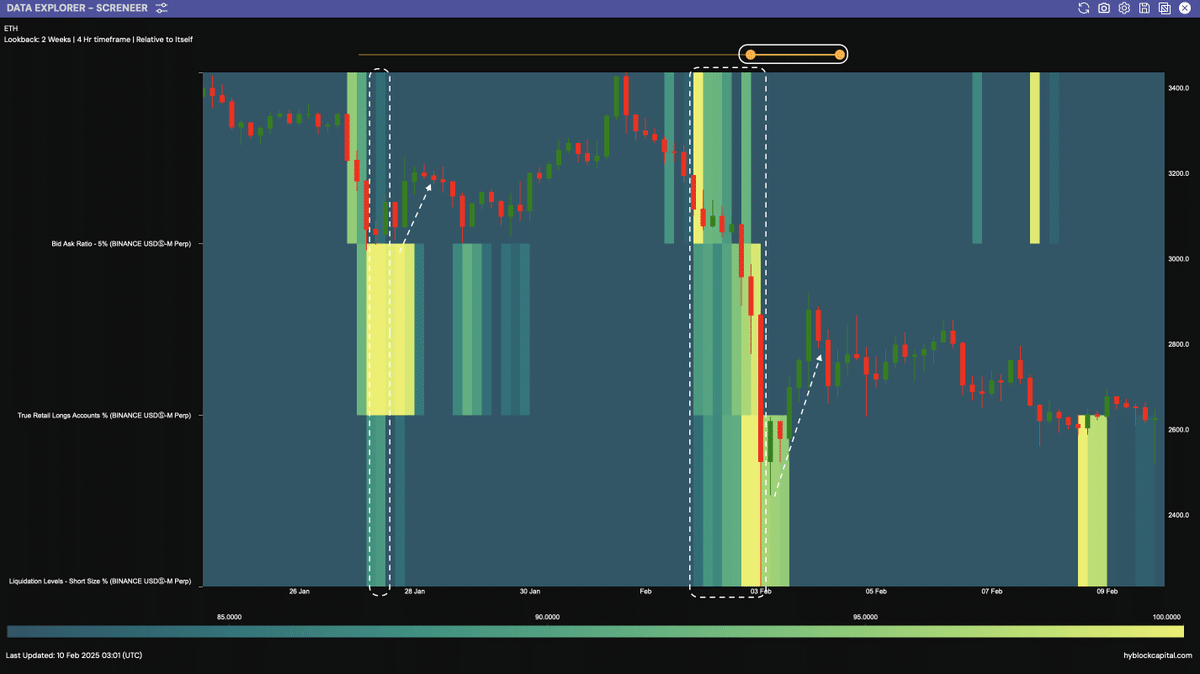

Crypto analytics firm Hyblock Capital notes that Ethereum is now approaching levels where multiple indicators align, including the Bid-Ask Ratio, Retail Long%, and Short Liquidation Levels.

Historically, when these metrics reach extremes, Ethereum has trended upward.

Source: X

Additionally, a TD Sequential buy signal was recently flashed for Ethereum, signaling a potential price rebound.

Analysts warn that if hedge funds’ short positions are miscalculated, a violent short squeeze could reverse the trend.

This could create one of the largest price surges Ethereum has ever seen. Ethereum’s current market dynamics remain a battle between hedge funds’ bearish bets and institutional accumulation, making the next move highly unpredictable.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Additionally, a TD Sequential buy signal was recently flashed for Ethereum, a potential price rebound.

Analysts warn that if hedge funds’ short positions are miscalculated, a violent short squeeze could reverse the trend, creating one of the largest price surges Ethereum has ever seen.

Ethereum’s current market dynamics remain a battle between hedge funds’ bearish bets and institutional accumulation, making the next move highly unpredictable.

Source: https://ambcrypto.com/ethereum-2b-etf-inflows-vs-500-short-positions-surge-what-next/