In Brief

- Ethereum drops below $2.9K but $2.8K support may trigger a short-term rebound.

- Whales continue accumulating ETH while retail investors are selling off.

- $3,200 price level is crucial for confirming a potential local bottom for ETH.

Ethereum’s price recently dipped below the $2.9K mark, sparking concerns about its short-term outlook. However, analysts are observing that the $2.8K level could serve as a significant on-chain support zone.

This level has historically been crucial in marking cycle bottoms, providing a potential foundation for a rebound. Market sentiment is currently mixed, with some viewing this as an opportunity for a short-term recovery.

Key Support Level and Market Indicators

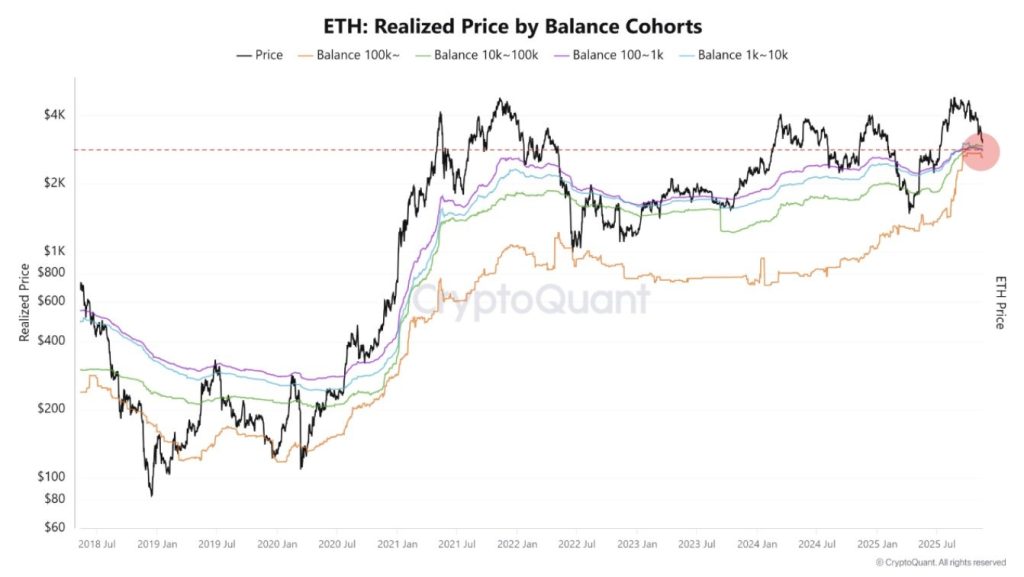

Ethereum’s drop below $2.9K has triggered alarm bells for many traders, but the $2.8K range offers potential stabilisation. This price point aligns with historical realised price levels, which have been key indicators of price reversals in the past.

The balance by holder value metric shows a clear shift in market dynamics: while retail investors have been selling off, whales with over 10K ETH have continued to accumulate. This trend suggests that larger, long-term investors are confident in Ethereum’s future, even as short-term traders exit.

Additionally, the decline in forced liquidations at new lows indicates that selling pressure is diminishing. Short positions have been expanding, and this could set the stage for a short squeeze if the price begins to rise, especially in a low-liquidity environment.

Potential for a Price Reversal

Ethereum’s price performance indicates that a recovery above $3,200 would be necessary to confirm a local bottom.

However, if the price fails to reclaim this level, further downside risks could emerge. The recent ETF outflows, particularly from large institutions like BlackRock, suggest that institutional confidence may be waning, which could weigh on Ethereum’s price.

On the other hand, if the $2.8K support holds, Ethereum could experience a short-term rally. The ongoing market rotation, with whales buying while retail investors are selling, reflects a shift that often precedes a price reversal.

How Ethereum behaves at these key levels will be crucial for determining its next major price move.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/eth-2-8k-key-support-level-signals/