- Ethereum declined by 5.41% in 24 hours as bearish market sentiment persisted.

- An analyst started eyeing a new ATH of $4723.

Over the past month, Ethereum [ETH] has experienced a strong downtrend. Although the broader cryptocurrency markets have seen high fluctuations, ETH has suffered the most from the current market conditions.

In fact, as of this writing, ETH was trading at $2289. This marked a 5.41% decline over the past 24 hours.

Prior to this, ETH has attempted to break out from the downtrend, recording gains on weekly charts. However, the losses on daily charts have outweighed the gains over the past week.

Despite these conditions, an increase in trading activities shows ETH’s signs of life. Thus, over the last 24 hours, trading volume has surged by 81.42% to $13.67 billion.

If these trading activities are buying activities, it would mean hope, while a whale sell-off would mean risk for further correction.

While ETH has faced difficult times, the altcoin’s conditions have left analysts talking. Popular crypto analyst Javon Marks is one of them.

Although ETH is struggling, the analysts see ETH rallying to $4723.5, citing the 2023 cycle.

What prevailing market sentiment says

In his analysis, Marks cited 2023 where ETH made 165% gains to rally.

Source: X

According to his analysis, the current market conditions mirror the previous cycle and these conditions are emerging again. If the last cycle’s conditions reemerge, it will lead to an upward movement to $4723.5.

Also, a breakout from that level will lead to historical highs of $8100, representing a 2x price surge.

When ETH reached the Go Time levels noted by the analysts, it experienced a sustained upward momentum for three consecutive months to hit $2717 by January 2024 before declining again.

Broadly, the overall analyst’s sentiment is highly bullish, which would result in ETH hitting a new ATH.

Is ETH ready to rally?

Undoubtedly, Marks provides a positive outlook that would see ETH hit a record high. While these historical patterns highlighted are promising, the current market conditions have borne the burnt for ETH’s recovery.

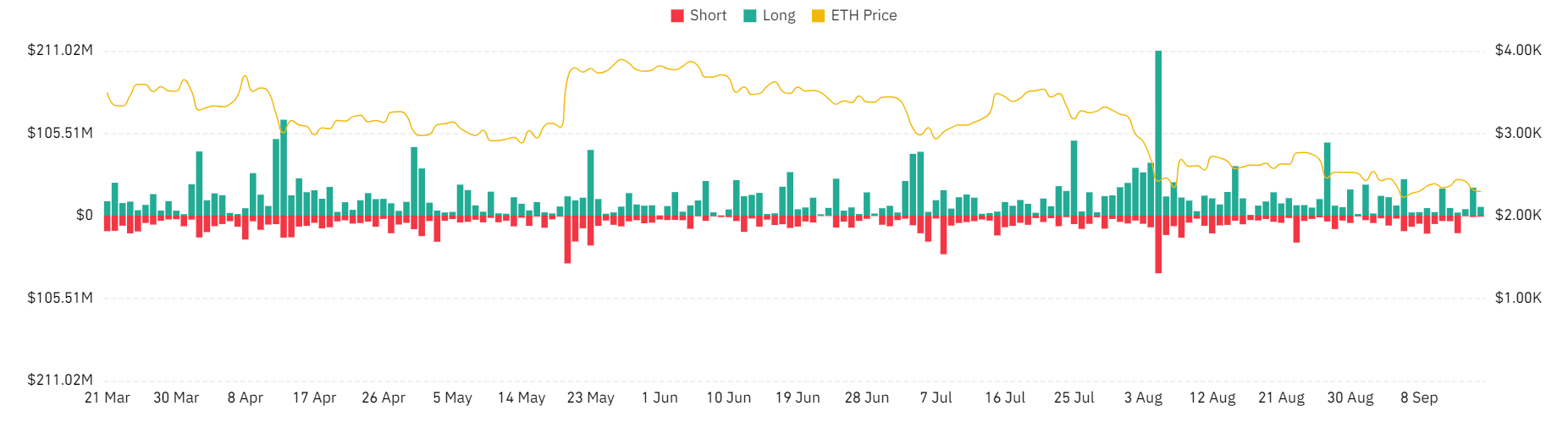

Source: Coinglass

For starters, the last 24 hours have seen long positions worth $46.97 million been liquidated for ETH, alongside $2.93 million in short positions.

This massive liquidation of longs that shows investors betting on market recovery were forced out of their positions.

The fact that investors are unwilling to pay premiums and hold their positions suggested a lack of confidence in future prospects.

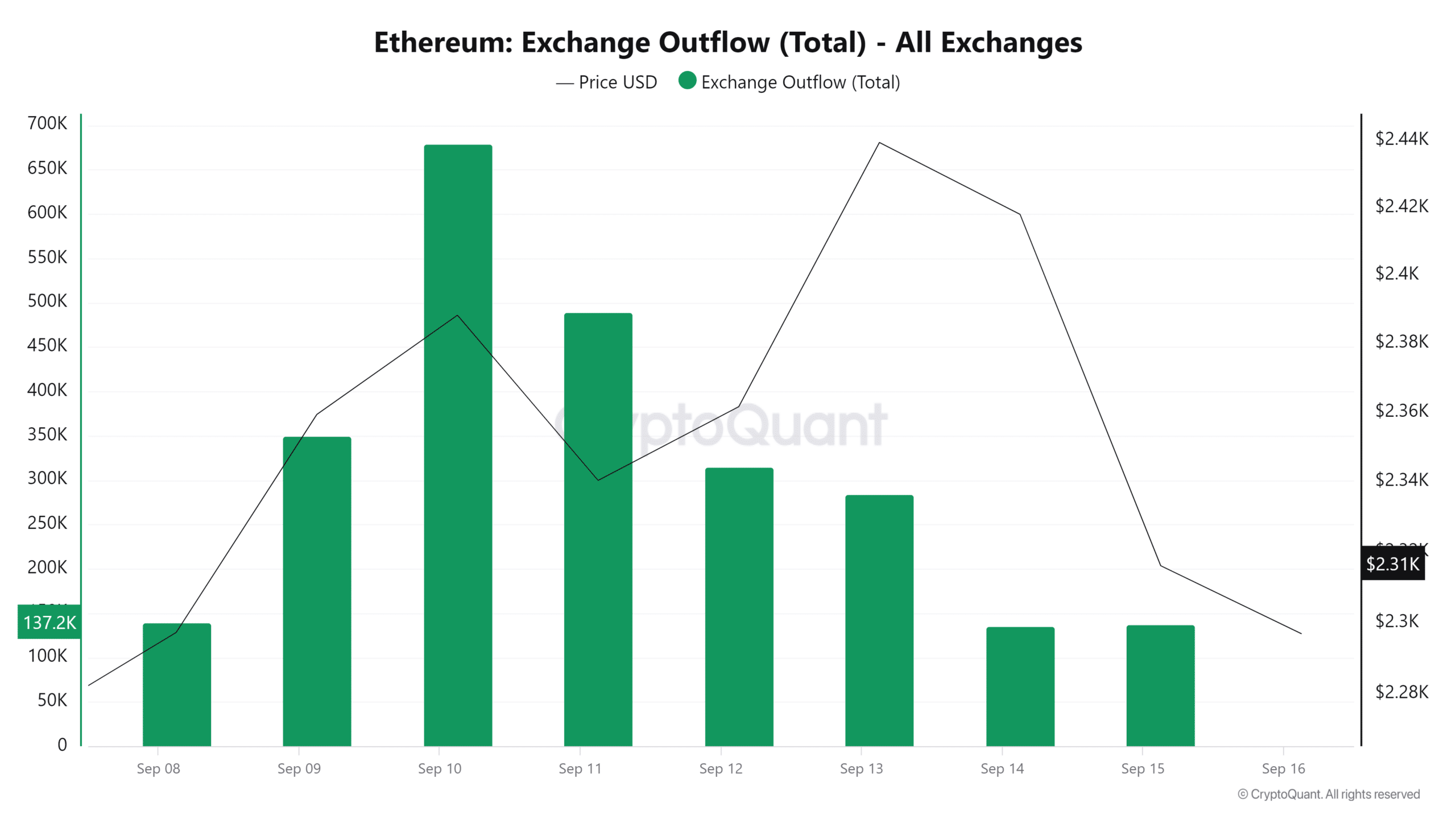

Source: CryptoQuant

Additionally, Ethereum’s exchange outflow declined from 679119.6 to 71794.34 over the past seven days. The decline shows less accumulation by holders, with fewer investors moving their assets off the exchanges.

This is another bearish signal, as it shows investors are waiting for an opportunity to sell rather than commit to long-term holding.

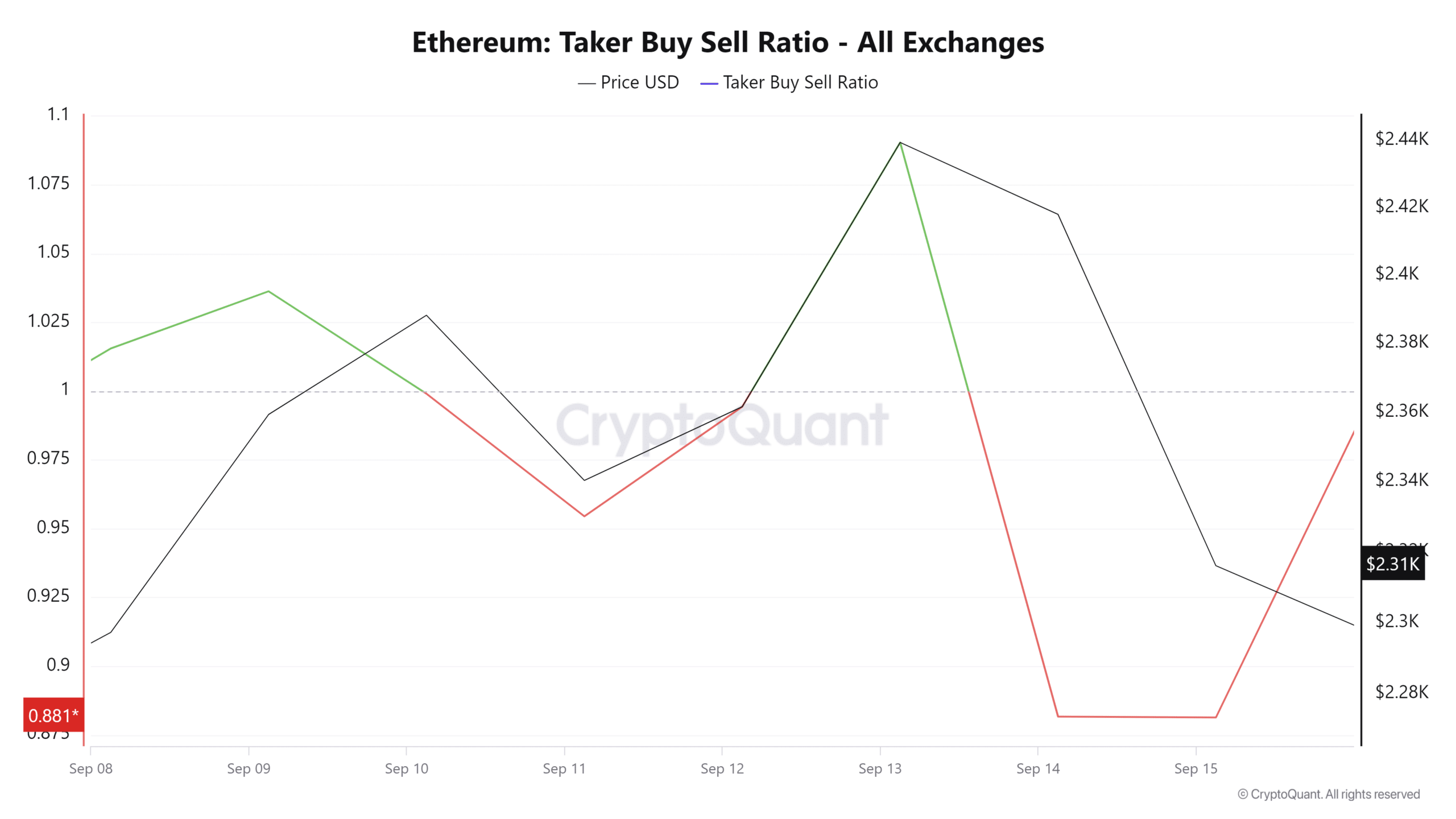

Source: CryptoQuant

Finally, the Taker Buy Sell Ratio declined over the past few days to 0.88, showing that investors were engaged in aggressive selling than buying.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Simply put, the current market conditions do not support a short-term price recovery. As indicated by the Taker Buy Sell Ratio, the recent spike in trading volume suggests increased selling activities.

Thus, if the current market conditions hold, ETH will fall to the next support level of around $2114 before attempting another upward movement.

Source: https://ambcrypto.com/despite-ethereums-recent-decline-why-eth-can-still-reach-4-7k/