- Many ETH traders exited their positions out of the volatility fear.

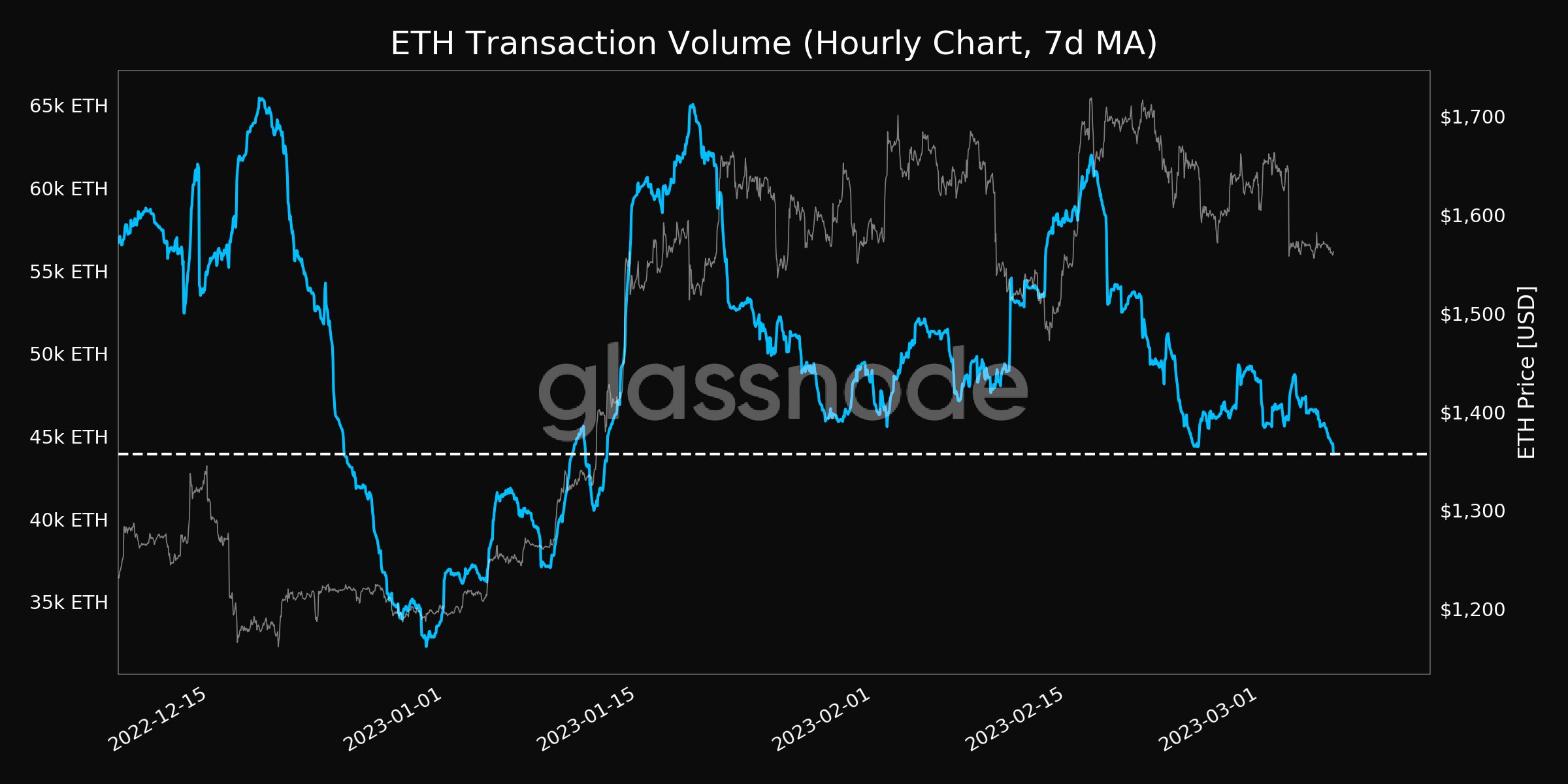

- Interestingly, the number of transactions on the network declined.

Ethereum, in the last month, enjoyed a rally as its prices surged due to increasing demand. However, traders did not exhibit the same enthusiasm toward ETH at the beginning of March.

Realistic or not, here’s ETH’s market cap in BTC’s terms

According to Nansen.ai’s tweet, all-time PnL traders who profited $40k or more saw a 50% decrease in ETH holdings since May.

Reportedly, most of the PnL DEX traders have halted the majority of their trading activities as they are expecting high volatility in the near future.

Proceeding with caution

On the other hand, retail investors have continued to buy ETH on a large scale. This was indicated by the number of non-zero addresses on the Ethereum network which reached an all-time high of 95.04 million addresses.

These addresses were observed to be holding on to their ETH instead of selling.

The reduction in the number of ETH transactions over the last month backs up the previous statement.

Additionally, the overall interest in the Ethereum NFT market also declined. According to Santiment’s data, the number of NFT trades being made on Ethereum fell considerably over the past month.

This also impacted the average gas usage on the network which fell in accordance with the NFT trades on the network.

You only get one short

As a result of these events, the number of short positions taken against ETH began to increase. Coinglass’ data showed that the percentage of short positions taken against Ethereum rose from 49% to 51% in the past month.

Read ETH’s Price Prediction 2023-2024

Nonetheless, despite these factors, the validators on the Ethereum network continued to increase.

Staking Rewards’ data indicated that over the past month, the number of validators on the Ethereum network rose by 5.71%. Additionally, the revenue produced by these stakers also increased by 24.23% during the same timeframe.

As the Shanghai Upgrade inches closer, it’s important to note that multiple factors will influence ETH’s prices going forward.

Source: https://ambcrypto.com/decoding-ethereums-current-state-ahead-of-shanghai-upgrade/