Arthur Hayes just triggered alarm bells across the crypto market—dumping millions in ETH, PEPE, and ENA as U.S. tariffs and economic fears rattle investor confidence.

The BitMEX co-founder offloaded over $13 million in crypto assets this week, citing growing macroeconomic uncertainty. His move comes as Bitcoin and Ethereum dip sharply, raising concerns that a deeper correction could be underway.

“So $BTC tests $100K, $ETH tests $3K,” Hayes noted in an X post, citing looming tariffs and a weak U.S. jobs report. “No major economy is creating enough credit fast enough to boost nominal GDP.”

Breakdown of Hayes’ Multi-Million-Dollar Sell-Off

Blockchain data from Arkham Intelligence confirms Hayes used his wallet (identified as 0x6cd6) to transfer large volumes of ETH, PEPE, and ENA to centralized exchanges, including Binance and Cumberland DRW, for liquidation.

ETH: Hayes unwrapped and sold 2,373 ETH worth approximately $8.32 million.

ENA: Offloaded his entire holdings of 7.76 million ENA, valued at $4.62 million.

PEPE: Transferred 38.86 billion PEPE tokens worth about $415,000.

Arthur Hayes liquidated significant holdings in Ethereum, Ethena, and PEPE, signaling a strategic exit from these assets amid growing market uncertainty. Source: intel.arkm/Arthur-Hayes

These sales represent a significant shift in portfolio strategy. Hayes has since converted most of his holdings into USDC, with stablecoins now accounting for over 80% of his wallet balance, which totals $27.9 million.

U.S. Tariffs and Weak Jobs Data: The Core Catalysts

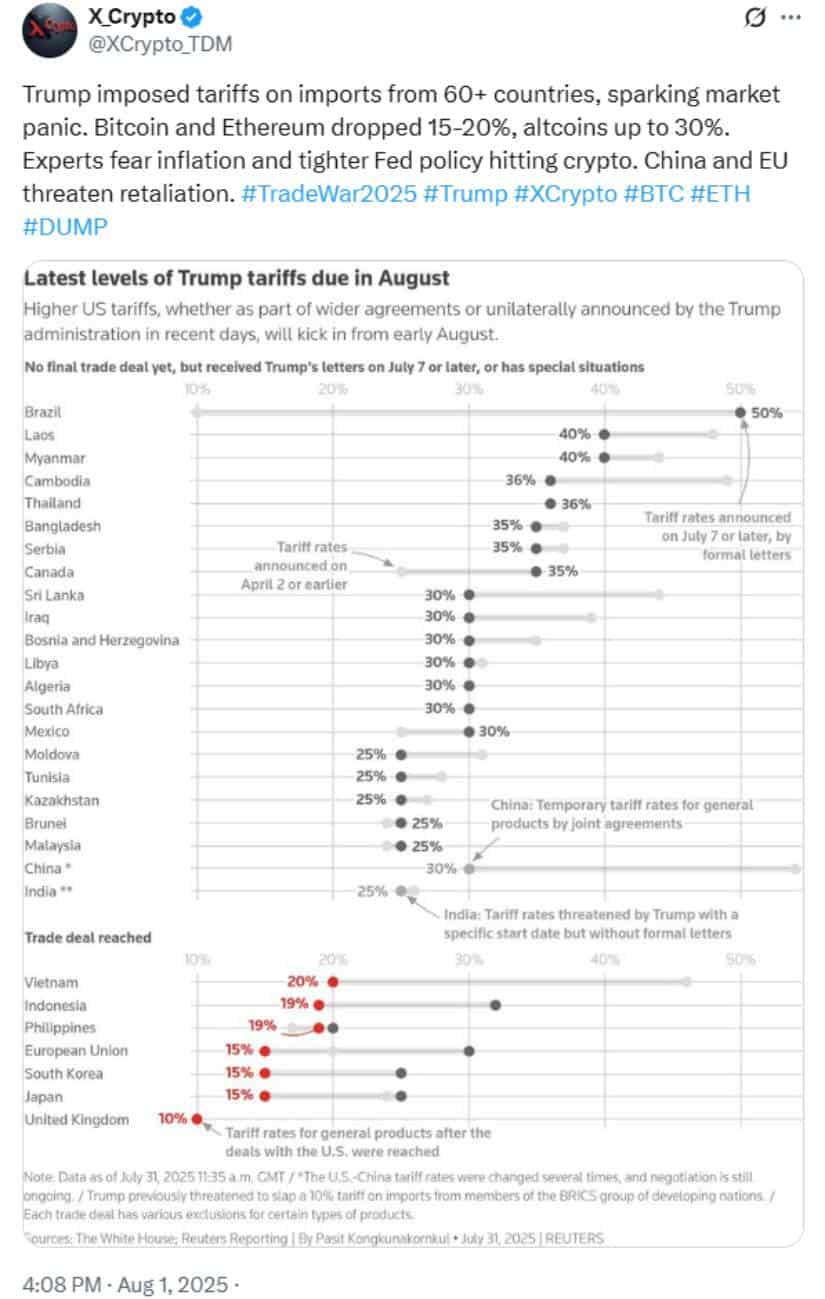

Hayes attributed his bearish positioning to two key developments: new U.S. tariffs introduced by the Trump administration and the disappointing U.S. jobs report. Tariffs affecting major global economies took effect on August 1, with additional duties set to roll out by August 7.

Trump’s new tariffs on over 60 countries triggered a sharp crypto sell-off, with experts warning of rising inflation, tighter Fed policy, and potential retaliation from China and the EU. Source: X_Crypto via X

In his view, the combination of tighter trade policy and economic stagnation could drag risk assets lower. “Markets believe the tariff bill is coming due in Q3,” he said, forecasting a Bitcoin retracement toward $100,000 and Ethereum dipping to $3,000.

Whale Activity Reflects Growing Uncertainty

Hayes is not alone. Whale wallets have been active across the board:

Wallet 0x3c9E deposited 26,182 ETH (~$93.7 million) to exchanges like Binance, OKX, and Kraken over the past 48 hours.

Coinbase and Binance also routed thousands of ETH to Wintermute, likely utilizing its OTC services to reduce market impact during large-scale sales.

This flurry of activity reflects rising caution across institutional and high-net-worth crypto investors, reinforcing fears of a prolonged market downturn.

Not Everyone Is Selling: SharpLink Doubles Down on Ethereum

In contrast to Hayes’ cautious exit, SharpLink Gaming—the second-largest Ethereum treasury behind Bitmine—took the recent dip as a buying opportunity. The company acquired an additional 14,933 ETH (~$52.5 million) using USDC, bringing its total holdings to 464,209 ETH (valued at $1.63 billion).

SharpLink Gaming boosted its Ethereum holdings with a $108.57M USDC investment, acquiring 14,933 ETH and bringing its total stash to approximately $1.63B. Source: @IcompassTech via X

Analysts note that such divergent strategies among whales suggest polarized sentiment in the market. While some see macro headwinds as cause for retreat, others remain focused on long-term accumulation.

Market Reaction and Outlook

The broader crypto market has shed over 7.5% in value over the past week, with Bitcoin down 3.9% and Ethereum sliding 6.5%. Bitcoin currently trades around $113,500, while Ethereum hovers near $3,500.

Ethereum (ETH) was trading at around $3,467, down 4.05% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Although some relief came late Friday after Polymarket traders raised the probability of a September rate cut to 70%, volatility is expected to remain high due to ongoing U.S.–Russia tensions and uncertainty surrounding monetary policy.

“This isn’t a meltdown—it’s a recalibration,” one analyst commented. “Hayes is hedging his bets, but the long-term bull case isn’t necessarily off the table.”

Final Thoughts

Arthur Hayes’ crypto sell-off amid growing macroeconomic pressures has become a focal point in the ongoing market correction. Whether this signals a deeper downturn or a temporary shakeout remains to be seen, but one thing is clear—whale behavior is driving headlines, and retail investors are watching closely.

As August unfolds, the crypto market is at a crossroads: Will institutional caution trigger a deeper sell-off, or will buy-the-dip strategies by players like SharpLink win out?

Source: https://bravenewcoin.com/insights/crypto-market-crash-arthur-hayes-dumps-13-3m-in-ethereum-pepe-and-ethena-amid-u-s-tariff-concerns