- BitMine increases ETH holdings amid market volatility despite asset value drop.

- BitMine’s ETH now represents 2.9% of global supply.

- Tom Lee emphasizes long-term ETH accumulation strategy.

BitMine Immersion Technologies announced on November 16, 2025, that its total assets, including crypto and cash, reached 11.8 billion dollars despite a decline in ETH value.

The asset total decrease reflects ETH’s price drop, yet BitMine’s increased holdings suggest ongoing institutional interest in Ethereum’s potential.

BitMine Acquires 3.5 Million ETH Amid Market Flux

BitMine, led by Tom Lee, announced the expansion of its Ethereum holdings to 3,559,879 ETH. This significant acquisition comes despite a decrease in overall asset value by $1.4 billion due to ETH’s declining price. The company’s holdings also include 192 BTC, along with equity investments and $607 million in unencumbered cash.

Immediate changes from these actions involve BitMine increasing its Ethereum position by over 54,000 ETH. Despite the ETH price drop, BitMine’s strategy reflects a long-term view on the digital currency’s potential, indicating a sustained commitment to ETH as a key component of its asset portfolio.

“We view ETH as the cornerstone of next-generation finance, and continue to execute our thesis by accumulating at opportune moments, cognizant of cyclical volatility but focused on the decade-long paradigm shift.” – Tom Lee, Chairman, BitMine Immersion Technologies

Market reactions highlight the scale of this Ethereum acquisition, drawing comparisons with previous institutional crypto investments. Tom Lee, BitMine’s Chairman, strongly advocates that Ethereum represents the “cornerstone of next-generation finance,” stressing a strategy rooted in timely accumulation despite market volatility.

Ethereum’s Market Data and Institutional Significance

Did you know? BitMine’s ETH holding is among the largest by a single institution, rivaling previous major acquisitions seen in crypto history, reflecting growing institutional endorsement of ETH’s role in future finance.

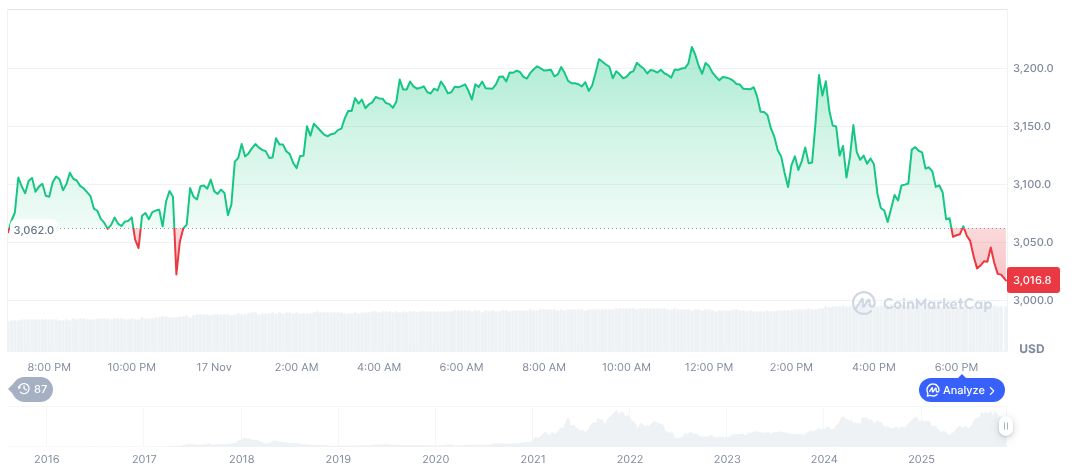

Ethereum (ETH) currently trades at $3,005.08, with a market cap of $362.70 billion and 11.64% market dominance, per CoinMarketCap. Trading volume over the last 24 hours stands at $42.91 billion, reflecting a 57.93% shift. Recent price activity includes a 1.66% decrease over 24 hours and a steeper 27.31% drop over 90 days. Ethereum’s circulating supply is approximately 120,696,215 ETH.

The Coincu research team posits that BitMine’s significant ETH holdings could amplify price volatility if liquidated quickly, though the firm emphasizes stability. Such trends suggest a broader acceptance of cryptocurrency as a core institutional asset, despite potential regulatory challenges.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/ethereum/bitmine-expands-eth-holdings/