Bloomberg analyst James Seyffart shared that the Altcoin Season has begun, thanks to corporate treasury activity. In that context, Tom Lee’s Bitmine added another $167 million worth of ETH to its balance sheet. This marks its second consecutive purchase in just two days.

Bloomberg Analyst Declares Altcoin Season

In a recent interview with Milk Road, Bloomberg analyst James Seyffart stated that digital asset treasury companies (DATCOs) have delivered significant gains. This comes despite individual tokens performing below past cycle highs. He argued that institutional moves are the real driver of the current market dynamic.

“I think this is the alt season. This has been the alt season. These DATCOs, I mean, they’ve been on absolute fire,” Seyffart said.

Earlier this week, Nasdaq-listed BNB Network Company boosted its Binance Coin holdings by $33 million. This brought its total to 388,888 BNB valued at about $330 million. This makes it the largest corporate treasury holder of BNB globally, echoing the Bloomberg analyst’s views.

However, he cautioned against drawing comparisons with Bitcoin ETFs, noting that altcoin investment products are unlikely to generate the same level of demand.

Instead, Seyffart expects products that combine multiple assets to capture more institutional capital. He highlighted that large investors typically avoid concentrating risk in a single altcoin.

For example, Canary Capital submitted a filing to the U.S SEC for an ‘American-Made Crypto ETF.’ This was designed to focus on digital assets with U.S. ties, potentially including XRP, SOL, and ADA.

BitMine Expands Ethereum Treasury

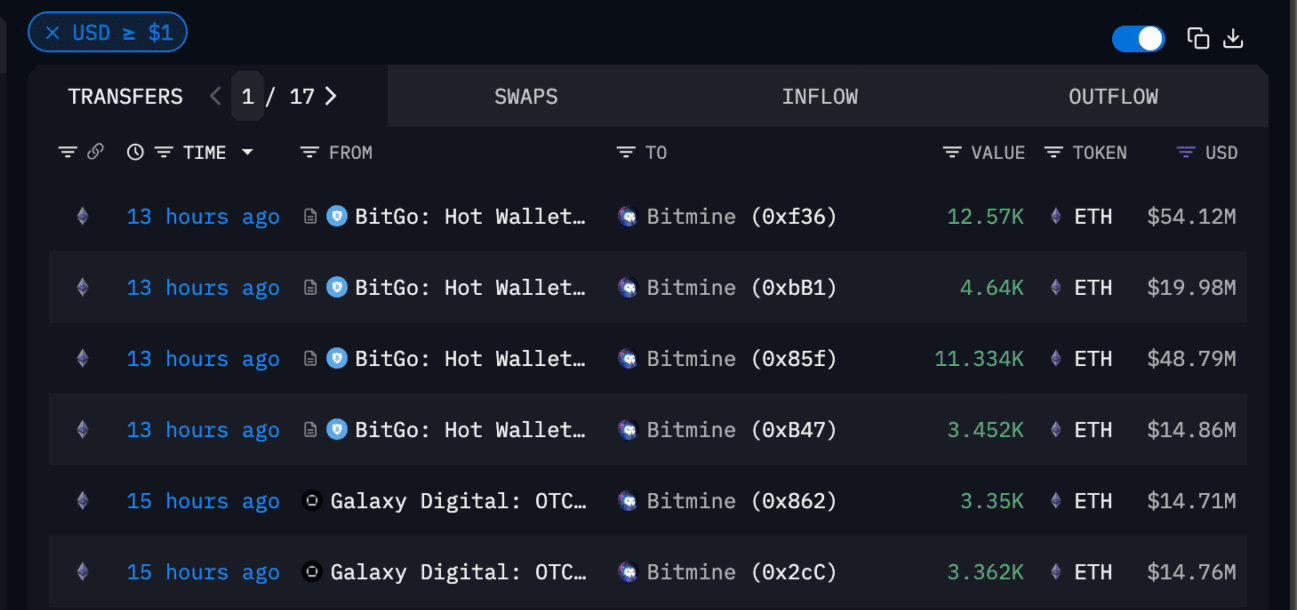

Among the institutional players leading the charge is Tom Lee’s BitMine. The company made its second major Ethereum purchase in just a week. They acquired an additional 38,708 ETH, valued at around $167 million.

This builds on an earlier $358 million buy. BitMine purchased 14,665 ETH from Galaxy Digital, while FalconX moved more than 65,000 ETH into fresh wallets. This brought the total treasury valuation over $8.08 billion.

These moves have contributed to Ethereum outperforming the broader market in the past month. It also reflects how treasury allocations can spark price strength during periods of subdued retail activity.

Tom Lee’s treasury expansion underscores Seyffart’s view that institutional strategies are shaping the trajectory of Altcoin Season.

Another altcoin seeing treasury growth is XRP. In August, Japanese gaming and blockchain firm Gumi disclosed the purchase of XRP worth $17 million. This was a move made to back its push into financial services and cross-border payment systems.

Furthermore, Galaxy Digital partnered with Mill City Ventures to oversee a $450 million SUI treasury program. These moves reflect a growing trend in which corporations are treating altcoins as strategic treasury assets.

The Bloomberg analyst emphasized that the combined effect of these moves is proof that an Altcoin Season is already underway. He also added that large-scale treasury allocations, ETF discussions, and strategic corporate investments are now carrying the momentum for these tokens.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.