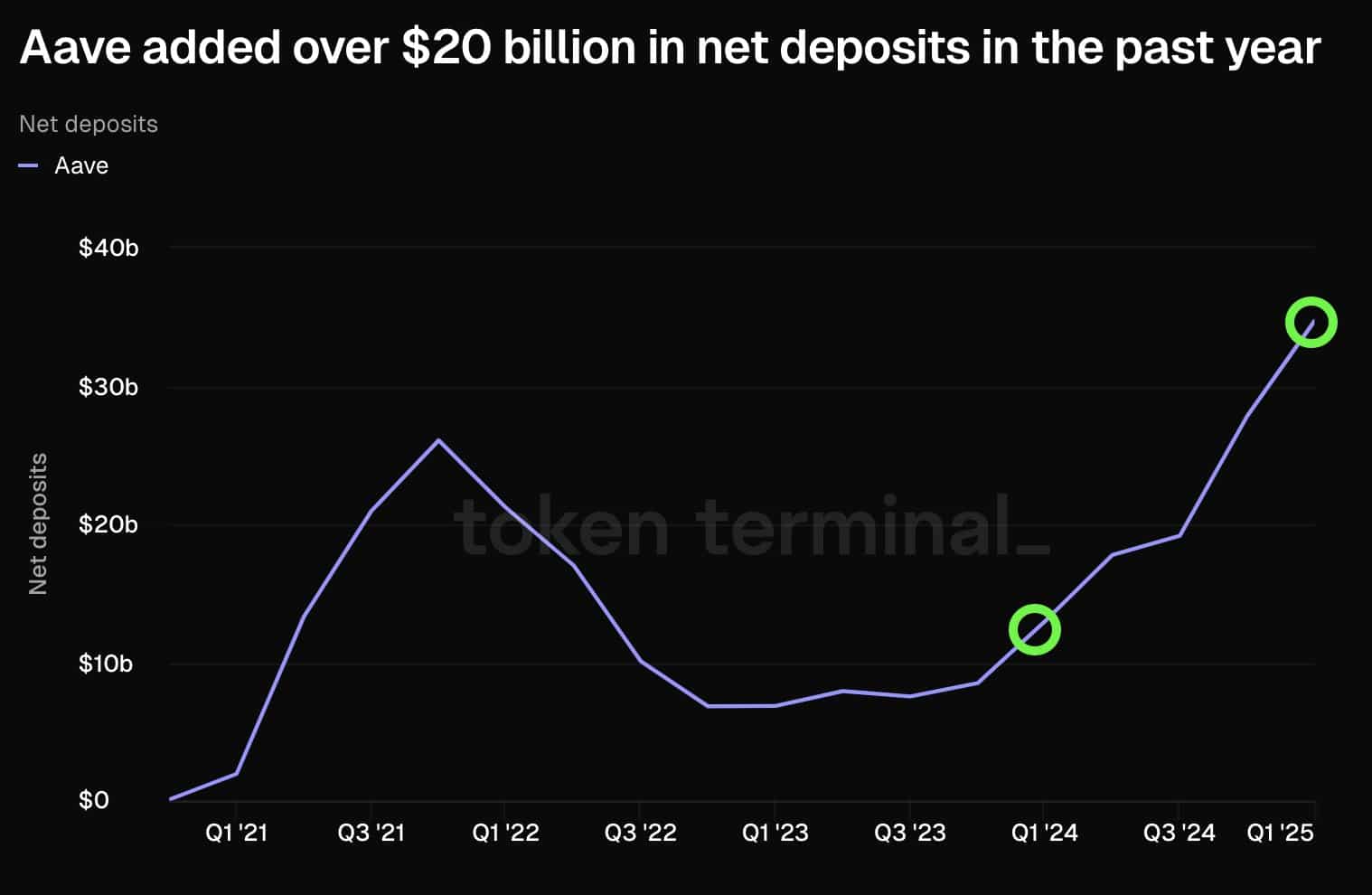

- AAVE has seen over $20 billion in net deposits over the past year

- Ethereum Foundation’s 10k ETH deposit added to the altcoin market’s bullish momentum

AAVE’s on-chain and ecosystem developments have been making waves recently. For instance, Aave Labs on X proposed a gas token framework for GHO, one that enables predictable pricing for gas fees – Particularly in low-fee networks.

According to the latest datasets from Token Terminal, at press time, AAVE had added over $20 billion in net deposits over the past year. Such a wave of capital influx is a testament to growing confidence among the investors in the platform.

Hence, the question – Can it translate to a potential price breakout?

Source: Token Terminal

Ethereum Foundation’s vote of confidence

Adding to the world’s largest liquidity protocol’s bullish sentiment, the Ethereum Foundation just deposited 10,000 ETH (Valued at around $26.74 million) into AAVE. This, according to Whale Insider tweet on X.

This action is a testament to strong institutional confidence in the protocol, further cementing its status as a pillar of the DeFi ecosystem. The aforementioned large deposit from a prominent player such as the Ethereum Foundation may serve as a catalyst for greater investor interest.

Could a potential breakout be on cards as AAVE tests crucial resistance?

Technically, on the daily chart, AAVE seemed to be testing the crucial resistance level at around $260. The recent inflows of deposits may provide the anticipated significant momentum needed to break past this critical hurdle. Historically, AAVE large inflows have preceded price rallies as they hint at greater utility and liquidity.

If AAVE clears the $260-resistance, the next target in line could be the resistance zone at the $280-psychological level.The latest surge in deposits and institutional backing can be the tipping point to generate the required momentum for AAVE to overcome this hurdle. A hike in liquidity and activity are generally associated with bullish sentiments, as they indicate more utilization and adoption.

If the world’s largest liquidity protocol manages to breach this resistance level, it could attract more buyers, pushing the price higher to test higher resistance zones.

Source: TradingView

Source: https://ambcrypto.com/aave-identifying-the-impact-of-new-proposal-eth-foundations-deposit/