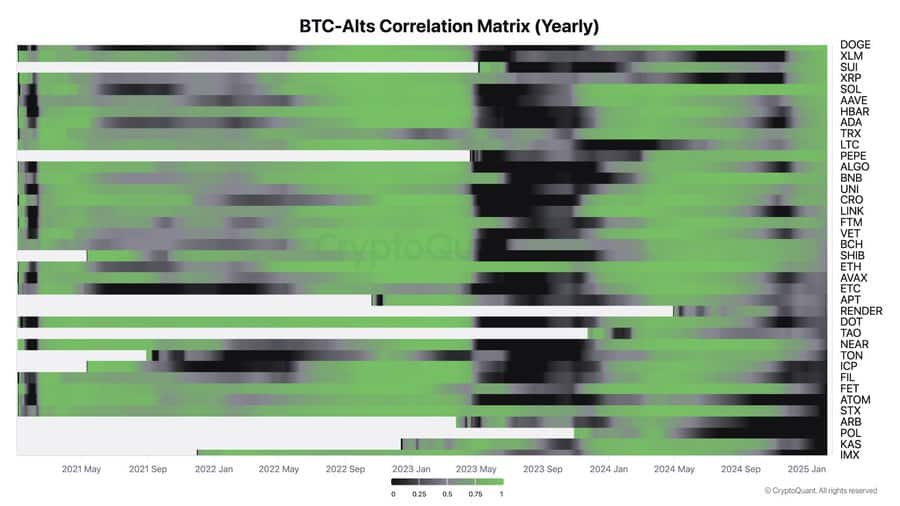

The BTC-Alts Correlation Matrix provides insights into the relationship between Bitcoin and various altcoins over time.

As can be seen on the chart, certain altcoins like Ethereum, Binance Coin [BNB], and Avalanche [AVAX] have continued to maintain a high correlation with Bitcoin, reflecting their tendency to mirror BTC’s price movements.

Source: X

However, a distinct trend of decoupling has emerged, particularly among altcoins like Dogecoin [DOGE], Shiba Inu [SHIB], and Pepe [PEPE], as well as the likes of the Sui Network.

These coins have displayed significantly lower correlations. Their performances have been driven by independent factors such as unique use cases, social sentiment, or ecosystem-specific developments.

Resilient altcoins and memecoin mania

In 2025, altcoins associated with institutional adoption demonstrated some notable resilience. Projects like XRP decoupled from broader altcoin trends, driven by increasing partnerships with financial institutions. This institutional backing has bolstered investor confidence, leading to significant gains on the charts.

Concurrently, the market witnessed a resurgence of memecoins. Despite lacking inherent utility, these tokens outperformed traditional infrastructure coins, propelled by community-driven enthusiasm and speculative fervor. The launch of President Donald Trump’s memecoin, for instance, spurred the creation of over 700 imitators, highlighting the potent influence of social sentiment in this segment.

Psychologically, memecoin investments are often driven by herd mentality, a common trait in speculative markets. Investors often flock to these coins based on prevailing trends rather than fundamental analysis, leading to rapid price surges.

What does this mean for investors?

The decoupling from Bitcoin’s correlation means that investors need to adapt their strategies. With Bitcoin no longer dictating altcoin movements, alternative market drivers are becoming more important. Institution-backed altcoins tied to finance and enterprise sectors show strong potential, offering stability amid market shifts. Meanwhile, memecoins thrive on sentiment but remain high-risk, high-reward bets.

With traditional indicators losing relevance, a targeted approach is key. Investors should prioritize projects with real-world use cases and growing adoption. Infrastructure tokens may continue to lag, making them less attractive. Diversification and a focus on data-driven decisions are essential as the market evolves, requiring investors to navigate with precision in this new, decoupled landscape.

Source: https://ambcrypto.com/2025s-crypto-shake-up-how-memecoins-stablecoins-are-outshining-ethereum/