- XRP now holds 14.19% weighting, up from nothing in previous years.

- Bitcoin and Ethereum remain capped at 35% each, but dominance is shrinking.

- Analysts see support at $2.91–$2.97 and potential upside toward $3.60.

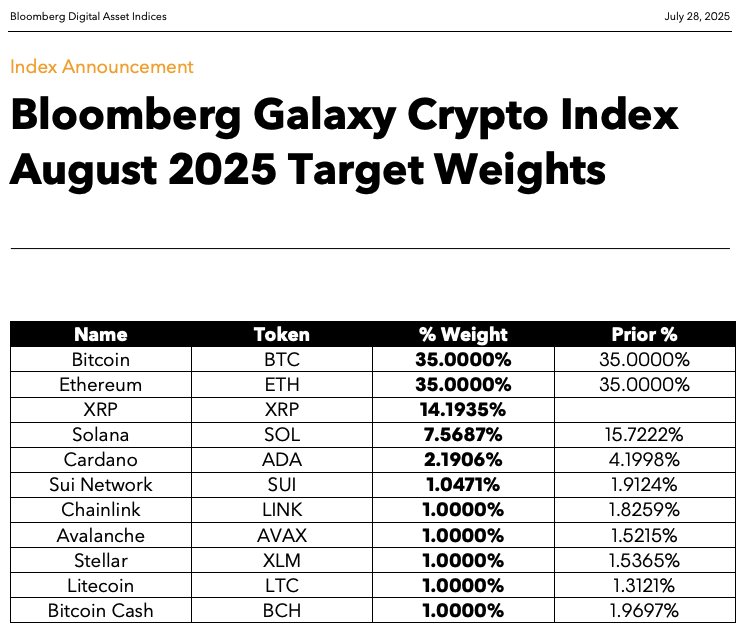

The latest Bloomberg Galaxy Crypto Index (BGCI) update for August 2025 has reshaped weightings across the board. Bitcoin and Ethereum remain capped at 35% each, but their dominance is slipping as other assets gain share.

Solana’s weighting dropped to 7.56% from more than 15%, while Cardano was cut to 2.19%.

Related: Altcoin Season Indicators Strengthen as Bitcoin Loses Market Share

XRP Emerges as the Biggest Change

The standout change is XRP’s return to the index with a 14.19% weighting, after having been absent in previous years.

Its inclusion marks a sharp reversal from 2018, when it was initially part of the index but later excluded. Many analysts tied its removal to the SEC’s lawsuit against Ripple.

What do weightings mean in a crypto index?

In a crypto index like the Bloomberg Galaxy Crypto Index, weightings show how much each cryptocurrency counts toward the total index value.

- A higher weighting means the asset has a bigger impact on the index’s performance.

- A lower weighting means the asset contributes less.

Bloomberg structures the BGCI so that no asset can account for more than 35% of the index or less than 1%. XRP was part of the index when it launched in 2018, but it was later taken out without an official reason. Many analysts link its removal to the SEC’s lawsuit against Ripple.

How are XRP supporters reacting?

Reacting to the same, attorney and XRP supporter Bill Morgan wrote, “XRP at 14% at the expense of Link, Litecoin and all the others except BTC and Ethereum.”

How is XRP performing in the market?

XRP’s price has climbed sharply since Donald Trump returned to the presidency, pushing above $3. Investor support for the token has grown, helped in part by the end of its long-running legal battle with the SEC. A few weeks ago it was confirmed that the case is closed and Ripple is no longer under the cloud of securities claims.

What do analysts see in the charts?

On the charts, XRP has been holding recent lows while building a potential new uptrend. Analysts said that the market is testing key resistance levels, with the next area to watch near $2.91–$2.97 as a possible support zone. If XRP can form a clear five-wave pattern on the upside, momentum could carry the price toward $3.60 and higher.

For now, the market shows strength, but the real test will be whether XRP can sustain a higher low on its next pullback. That would confirm the uptrend rather than just a short-term bounce.

Related: XRP Price Bullish Outlook Linked to RLUSD Expansion, Whale Accumulation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/xrp-14-percent-bloomberg-crypto-index/