The Binance Coin price has plunged in the past few months, a trend that accelerated on Monday when it dropped by 8% to $805. BNB price has slumped by 41% from its highest point this year. So, will the BNB price rebound as the amount of money on its RWA network doubles?

Binance Coin Price Crash Continues Despite Key RWA Metric Soaring

The BNN price dropped to a low of $800 on Monday, erasing some of the gains it made last week. This drop coincided with the ongoing crypto market crash that affected Bitcoin and most altcoins.

Binance Coin price dropped as the BSC’s role in the fast-growing real-world asset (RWA) tokenization industry continued rising. The amount of money in the network rose by 99% in the last 30 days to over $1.6 billion.

This growth makes it the second-biggest chain in the RWA industry after Ethereum, which has over $11.8 billion in assets. The performance happened as assets of some of the biggest players in the ecosystem like Circle, Securitize, Ondo, and Matridock continued rising.

This growth is notable because analysts believe that RWA is one of the most important use-cases of the blockchain industry, with assets worth trillions of dollars set to be tokenized over time.

In this line, the amount of stablecoins on the BSC Chain has continued rising in the past few months. These assets rose by 3.78% in the last 30 days to $8.6 billion, while the number of holders rose by 14% to 48.5 million. This growth makes BSC one of the most popular chains in the stablecoin industry.

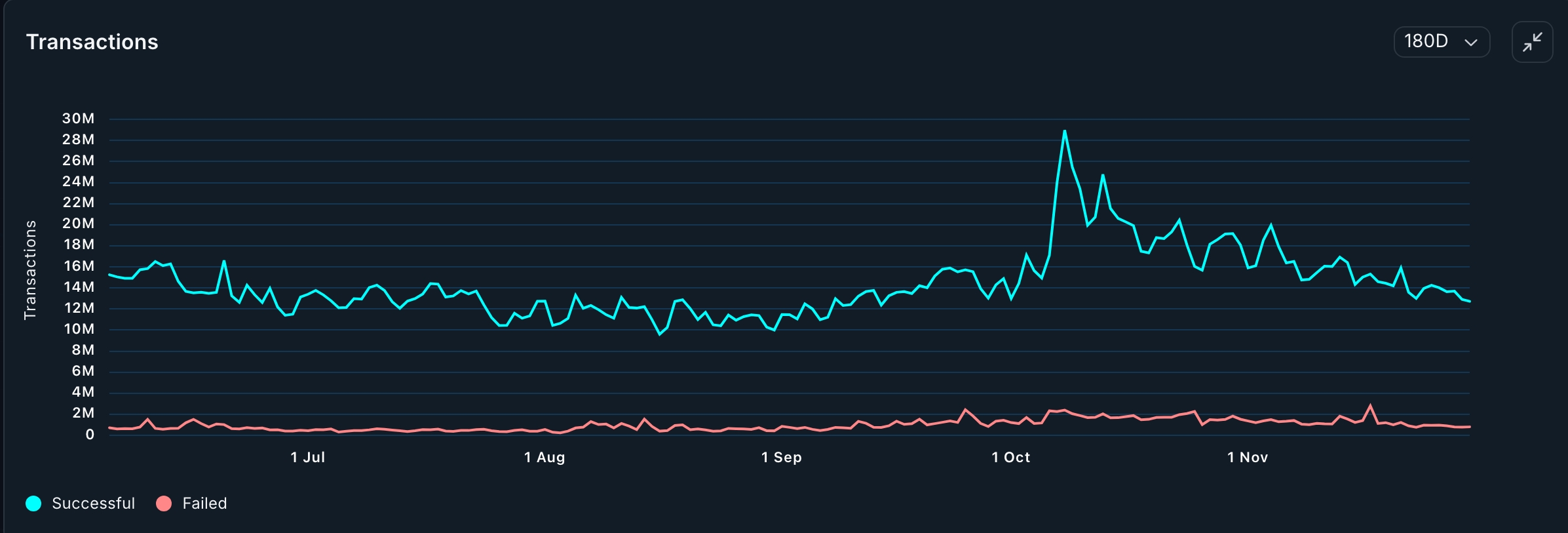

However, some network metrics show that the BSC growth has stalled in the past few weeks. For example, data compiled by Nansen shows that the number of transactions dropped by 118% in the last 30 days to 457 million. As a result, the fees collected dropped by 79% to $14.9 million.

A sharp decline in BSC fees has an impact on the Binance Coin price because of how the network uses its fees. It normally burns most of its fees, meaning that the burn rate may plunge soon.

BNB Price Technical Analysis

The daily chart shows that the BNB price has crashed in the past few months, erasing most of the gains made a few months ago. It has now dropped below the 61.8 % Fibonacci Retracement level, which is often seen as the golden point of the reversal.

The token has moved below the strong, pivot and reverse level of the Murrey Math Lines tool, a sign that bears are in control. It has also dropped below the 50-day and 200-day Exponential Moving Averages (EMA).

The MACD indicator remains below the zero line, while the DMI indicator has moved upwards, a sign that the momentum is continuing.

Therefore, the most likely BNB price forecast is bearish, with the next key target being at $750, which is the ultimate support of the Murrey Math Lines tool.

However, a move above the resistance at the $1000 will invalidate the bearish outlook and point to more gains, potentially to the key point at $1,375, the highest point this year.

Source: https://coingape.com/markets/will-the-binance-coin-price-rebound-as-a-key-rwa-metric-jumps-99/