- WIF had a short-term bullish outlook at press time.

- The rally is likely to struggle to push beyond the $2 resistance.

dogwifhat [WIF] saw five days of green candles as the bulls pulled the prices higher. The Bitcoin [BTC] move past the $60k resistance level also buoyed the market-wide sentiment.

The memecoin was trending higher in the short term, but is likely to run into a stern resistance zone at the $2 region. Should traders go long, or should they fade the move and prepare to go short?

Answers from the range formation

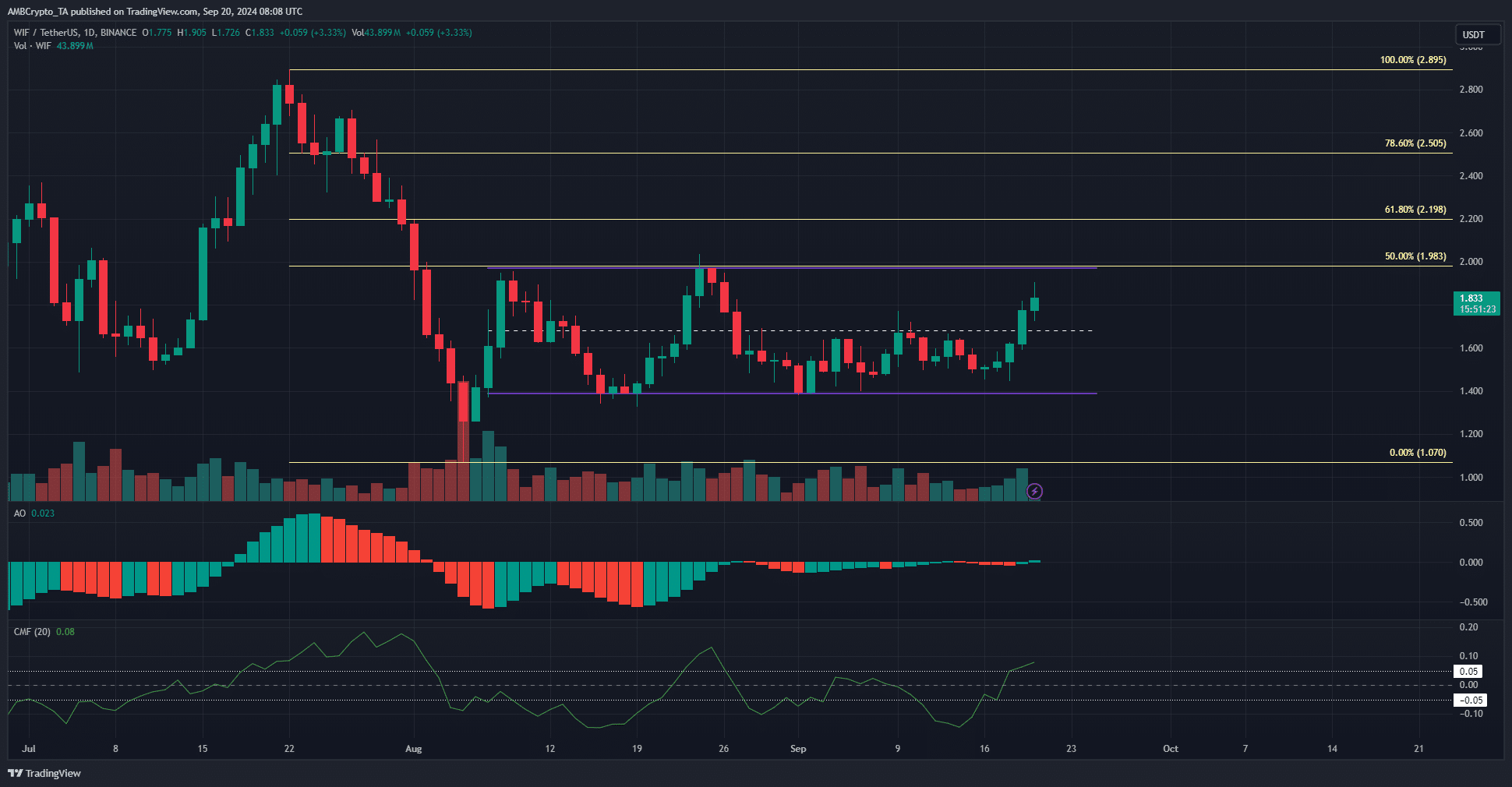

Source: WIF/USDT on TradingView

dogwifhat has traded within a range since the second week of August. This range extended from $1.39 to $1.98, and the mid-range level at $1.685 has served as resistance over the past three weeks.

WIF bulls finally breached it, and the CMF climbed above +0.05 to indicate high buying pressure in the market. This is enough to propel the memecoin to the range highs, but it might not see a breakout.

The Awesome Oscillator made a bullish crossover and signaled a momentum shift on the daily chart. While this is another encouraging signal, traders should be ready for a WIF rejection at $2.

It is usually better to trade a range as it is than anticipate a breakout. A daily session close above $2 would change the swing traders’ biases.

The liquidation heatmap highlighted the range formation

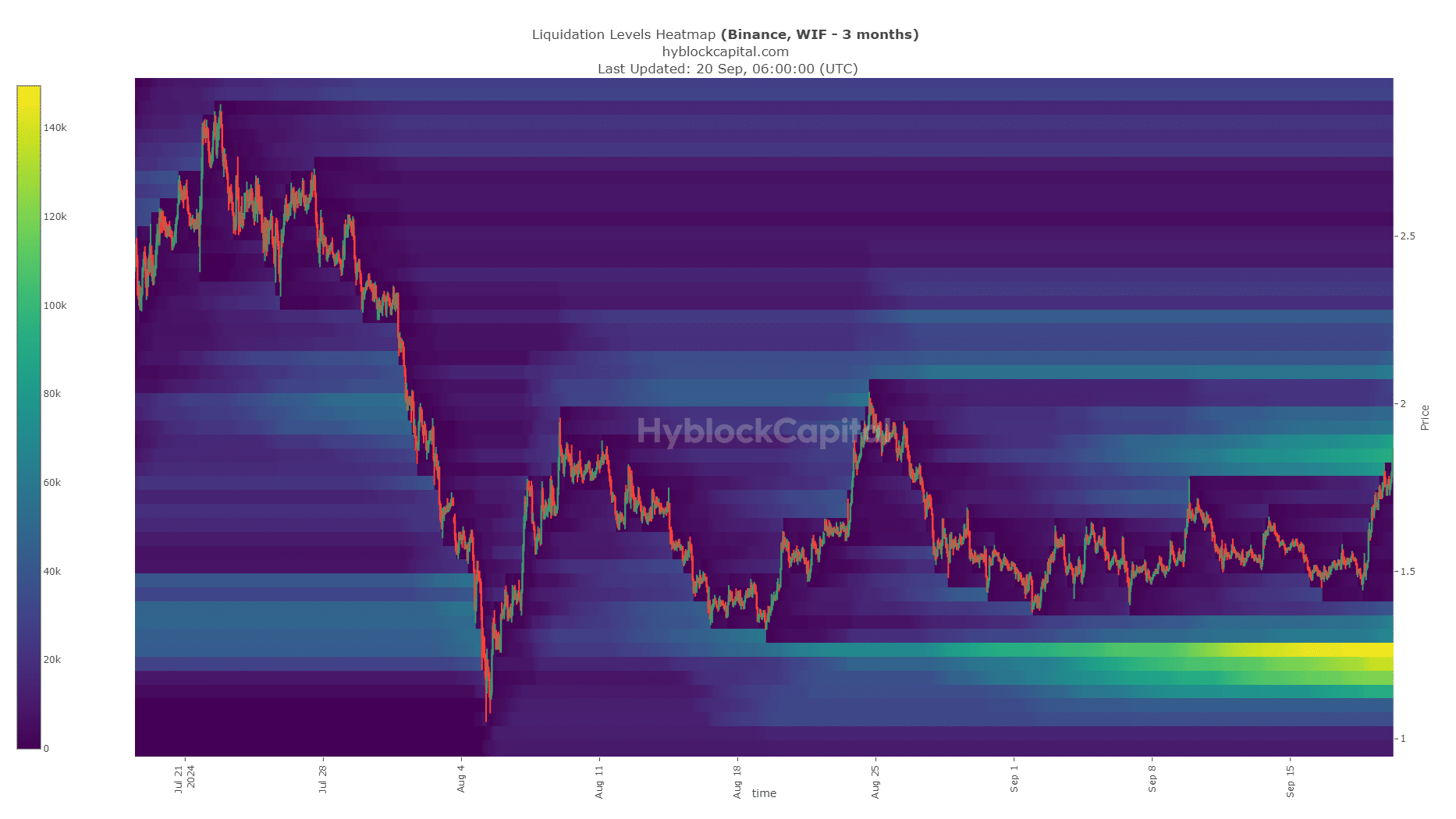

Source: Hyblock

Is your portfolio green? Check out the WIF Profit Calculator

The liquidation heatmap marked levels slightly different from the ones seen on the price action front. A sizeable pool of long liquidations has built up in the $1.22-$1.26 region, way below the range formation of recent weeks.

The $1.88 region was also highlighted as a short-term target where a price reversal could occur. Beyond that, the $2.09 and $2.06 levels are the next bullish targets for swing traders to take profits at.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Source: https://ambcrypto.com/wif-crypto-targets-2-but-this-could-delay-the-bulls/