- Assessing the relationship between USDT dominance and crypto prices.

- USDT flows reveal an almost evenly matched outcome between buyers and sellers.

USDT dominance can reveal a lot about the mood of the market. This is largely because USDT is the largest stablecoin, thus its activity and on-chain flows may reflect on the state of liquidity in the market.

USDT dominance should technically have an inverse relationship with Bitcoin [BTC] and altcoins. In other words, dominant should be higher when cryptocurrencies experience outflows.

For example, while September was mostly bullish for cryptocurrencies, USDT.D experienced a sizable retracement.

Patterns in USDT dominance may also give a rough idea of how the market will behave. USDT.D broke below its 3-month ascending support line on the 19th of September.

It has also been hitting lower highs, indicating declining momentum.

Source: TradingView

Although it kicked off this month with a sign of regaining momentum, USDT dominance cooled off slightly in the last few days. It hovered slightly above its 50% RSI level, indicating a zone of indecisiveness in the market.

If it dips below the 50% RSI level, then this will be considered confirmation of further decline. In other words, liquidity will flow in favor of Bitcoin and altcoins.

On the other hand, a bounce back from the current level may also be on the cards, in which case cryptocurrencies will continue to bleed. This will ultimately depend on market sentiment.

What USDT dominance and flows reveal

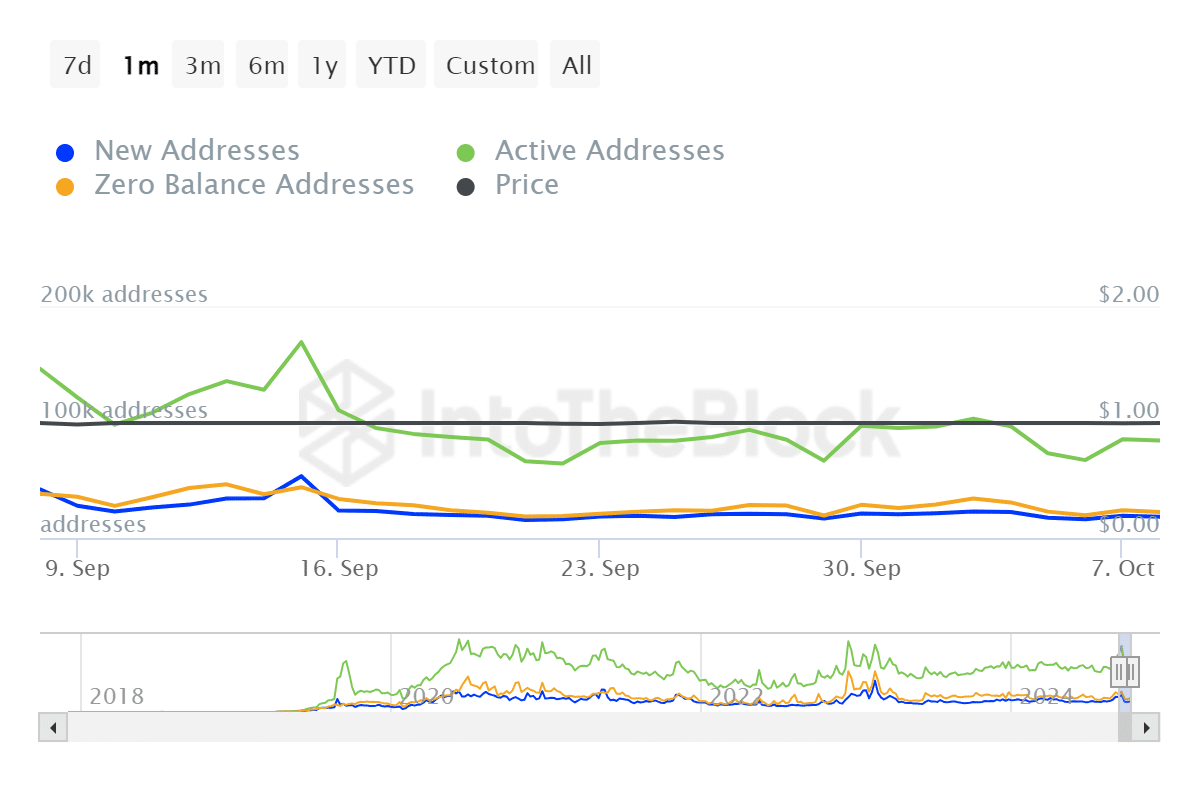

USDT address activity dropped considerably between the 3rd and the 6th of October.

However, it has since bounced back, with the number of active addresses growing from 16,360 addresses to over 18,400 addresses in the last three days.

Source: IntoTheBlock

Addresses with zero balances rose from 19,860 on the 6th of October to 22,530 addresses on the 9th of October.

This suggested that quite a significant number of addresses had moved liquidity from USDT to altcoins, also in line with the USDT dominance decline during the same period.

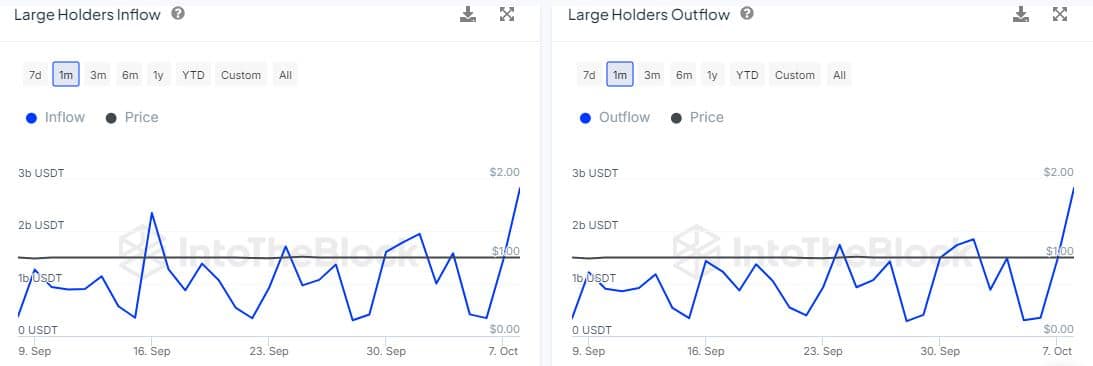

Despite the above observation, large holder flows revealed a bit of a deadlock in terms of directional impact.

Large holders or whales usually have the biggest impact on liquidity flows, and therefore they influence market direction.

Source: IntoTheBlock

USDT large holder flows were almost equally matched in the last 24 hours. Large holder inflows peaked at 2.82 billion USDT, while large holder outflows peaked at 2.83 billion USDT.

Based on the above findings, we can conclude that there was some uncertainty regarding where the market will lean. In other words, it aligned with the prevailing neutral sentiment in the market.

Source: https://ambcrypto.com/what-usdt-dominance-reveals-about-the-health-of-the-crypto-market/