- Webull reintegrates Webull Pay LLC to relaunch crypto trading.

- Regulatory clarity in the U.S. and globally shapes decisions.

- Market reflects optimism with share price gains post-announcement.

Webull Corporation (Nasdaq: BULL) has announced plans to reintegrate Webull Pay LLC into the group for relaunching cryptocurrency trading on its platform.

The reintegration is driven by improved regulatory clarity, both in the U.S. and internationally. This signals optimistic market potential, as seen in previous successful rollouts in Brazil.

Webull Sees Market Boost Following Crypto Trading News

Webull Corporation has decided to bring Webull Pay LLC back into the Webull group, planning to resume cryptocurrency trading. The consolidation ensures Webull Pay Inc. becomes a direct subsidiary of Webull Corporation, following approval from the board and shareholders. The company aims to expand its cryptocurrency offerings, influenced by enhanced global regulatory clarity. According to Anthony Denier, President of Webull:

Webull’s relaunch reflects confidence in returning cryptocurrency trading to its platform, currently active in Brazil. The initiative looks to extend these services to additional markets throughout this year. This aligns with efforts in the financial services sector as companies adjust to new blockchain technology possibilities.

“The improving clarity of cryptocurrency regulations, both in the United States and internationally, underlies our decision to bring crypto trading back to our platform. With this consolidation, the Company will be better positioned to meet the needs of our customers. We are excited about the evolution of the financial services industry as it begins to adopt blockchain technology, and we’ve already seen great success with our rollout in Brazil. We look forward to tapping additional markets this year.”

Positive reactions encompass market sentiment, with Webull’s upcoming plans appearing favorable to shareholders, signifying potential value. Webull’s stock saw an uptick post-announcement, underscoring market optimism aligned with the cryptocurrency plan’s reinstatement.

Webull’s Regulatory Strategy for Cryptocurrency Expansion

Did you know? Brazil’s earlier rollout of Webull’s cryptocurrency trading demonstrated a successful user uptake, setting a potential benchmark for upcoming expansions.

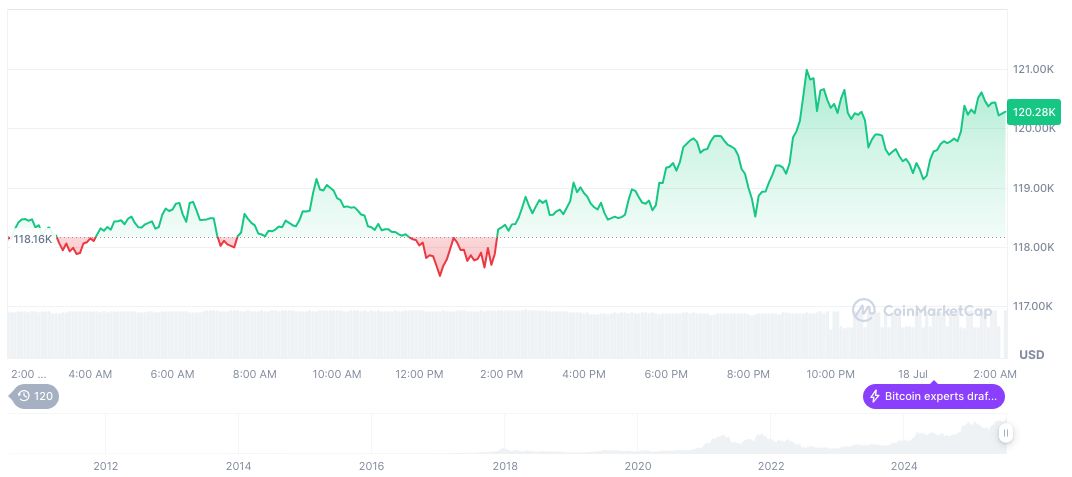

Bitcoin (BTC) is priced at $118,777.12 with a market cap of $2.36 trillion, maintaining a 60.80% market dominance, according to CoinMarketCap. The 24-hour trading volume stands at $78.52 billion, with a price change of 0.14% over the same period. The circulating supply of BTC is 19,893,943 out of a maximum 21 million supply.

Coincu research suggests that cryptocurrency maturity aligns with regulatory advancements, paving the way for increased institutional acceptance. Webull’s model could influence broader fintech applications, emphasizing the industry’s growing comfort with blockchain technologies and digital currencies under structured guidance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349378-webull-restart-crypto-trading/