- US and UK finalize a major trade agreement in May 2025.

- Trade cuts tariffs on steel and automotive exports.

- Potentially positive for cryptocurrencies, easing trade frictions.

On May 8, 2025, the US and UK finalized a comprehensive trade agreement, as announced by President Trump.

The agreement reduces tariffs on UK steel and automotive exports, possibly enhancing global trade relations.

US-UK Trade Deal Strengthens Economic Ties in 2025

The United States and United Kingdom recently finalized a major trade agreement. President Trump described the agreement as a “comprehensive and complete” deal. According to President Donald Trump, “We’re closing in on a trade agreement that will provide significant relief for British steel and automotive exports, which have faced unjust tariffs.” This agreement significantly strengthens their ongoing economic cooperation. Both countries have overcome several bilateral issues, and the final agreement is expected to boost their economic collaboration significantly.

The trade deal cuts tariffs on UK steel and automotive exports, directly benefiting UK manufacturers. Conversely, the agreement includes concessions on digital services taxes and lower tariffs on U.S. agricultural exports. These adjustments show the willingness of both nations to find mutual ground while reinforcing their economic partnership.

Global market reactions suggest a positive response to the agreement, potentially boosting the allure of risky assets. Notably, Trump’s other economic policies aim to bolster the cryptocurrency sector in the US. The trade agreement with the UK represents a broader US effort to fortify foreign economic ties.

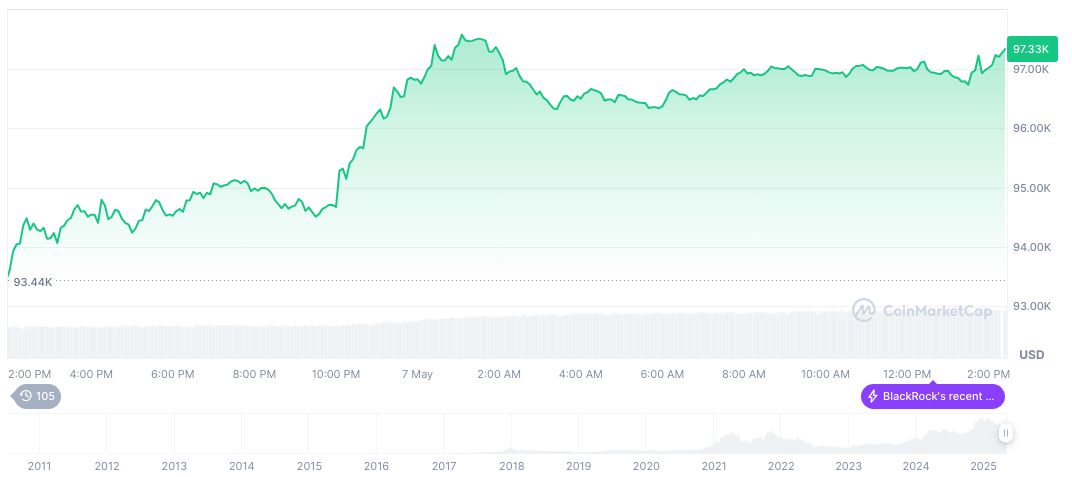

Bitcoin Rises as Trade Agreement Fuels Market Optimism

Did you know? The US-UK trade agreement could mark a significant shift in global trade dynamics, reminiscent of the post-WWII economic alignments that laid the groundwork for unprecedented international collaborations.

As of May 8, 2025, Bitcoin is priced at $99,824.64, reflecting a 2.99% increase in the last 24 hours, according to CoinMarketCap. With a market cap of $1.98 trillion and a fully diluted market cap at $2.10 trillion, the cryptocurrency maintains 64.08% dominance. Bitcoin’s stability between $77,000 and $87,000 in April highlights its buoyancy amid broader economic policies.

According to the CoinCu research team, the trade agreement and related economic policies can potentially boost institutional interest in digital currencies. Such collaborations may create a more stable and supportive environment for cryptocurrencies, driving growth amid evolving global economic landscapes.

Source: https://coincu.com/336344-us-uk-trade-agreement-impact/