- US prosecutors target $7.1M in crypto linked to investment fraud.

- Bitcoin, Ethereum, Tether, and USD Coin affected.

- No official ChainCatcher or major leader comment noted yet.

A civil forfeiture lawsuit regarding $7.1 million in cryptocurrency has been filed by the U.S. Attorney’s Office for the Western District of Washington, related to a fraud scheme in the petroleum sector.

The suit’s implications underscore increased scrutiny in crypto investments amid growing fraud cases, impacting major coins like Bitcoin and Ethereum.

$7.1 Million Crypto Executed in Fraud Scheme Targeted

According to The Block, the U.S. Attorney’s Office for the Western District of Washington has initiated a lawsuit targeting $7.1 million in crypto assets connected to an alleged investment fraud involving Geoffrey K. Auyeung. Authorities describe the scheme as inventing a fake “crude oil tank custody account” to mislead investors.

Crypto assets seized, including Bitcoin, Ethereum, Tether, and USD Coin, highlight significant challenges in the regulatory landscape surrounding cryptocurrencies. The funds, associated with fraudulent activities, were dispersed across 81 accounts and converted into major digital assets.

Currently, there are no public statements or confirmations regarding the case from ChainCatcher. – Geoffrey K. Auyeung, Defendant

Bitcoin, Ethereum Face Regulatory Scrutiny Amid Fraud

Did you know? In similar past cases, regulatory bodies often strengthen anti-money laundering measures, leading to comprehensive compliance checks across trading platforms and wallets that could delay service for investors.

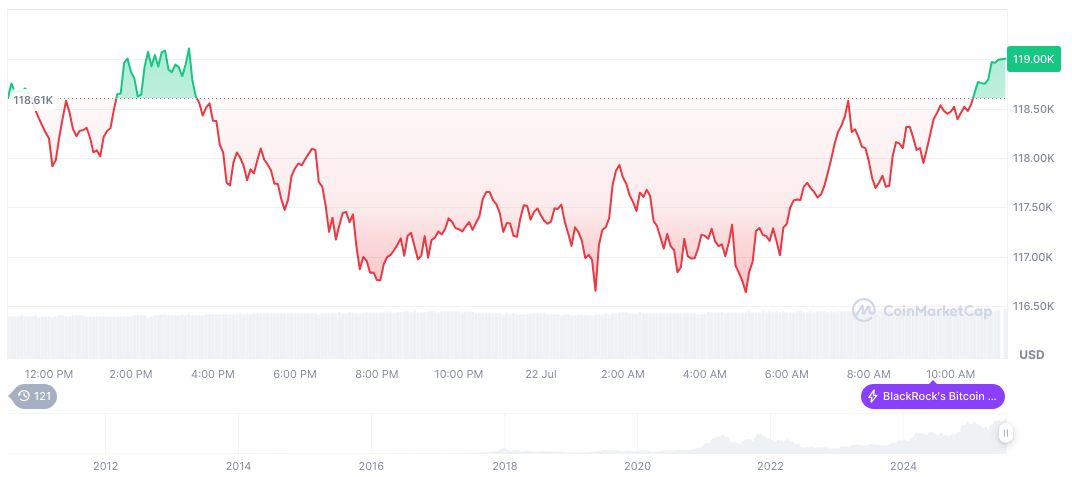

Recent data from CoinMarketCap show Bitcoin’s price at $118,406.96, with a market cap of $2,355,848,647.34 and a dominance of 60.05%. The 24-hour trading volume stands at $71,266,377,48.20, marking a 3.64% decline in activity. The circulating supply is 19,896,200 BTC, approaching its max supply of 21,000,000.

Experts from the Coincu Research Team suggest that such enforcement actions could lead to stricter rules and technological advancements in tracking digital assets.

Regulatory scrutiny may push innovation in transaction transparency, potentially reshaping crypto compliance strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/us-lawsuit-crypto-investment-fraud/