- The UK’s FCA will permit the trading of crypto ETNs by retail investors starting October 8, 2025.

- Listed on FCA-recognized exchanges; FSCS does not cover these products.

- In line with growing acceptance of crypto products in EU and US markets.

The UK’s Financial Conduct Authority (FCA) will permit retail investors to trade crypto exchange-traded notes (ETNs) in regulated markets starting October 8, 2025, under specific compliance rules.

This policy shift marks a notable expansion of retail access to cryptocurrency investments in the UK, though without Financial Services Compensation Scheme protection, introducing greater individual investment responsibility.

UK Retail Access to Crypto ETNs Starts October 2025

The FCA announced a major policy change, enabling retail investors to engage in crypto ETNs trading from October 8, 2025. These products must be listed on FCA-approved UK exchanges, in compliance with regulated financial promotion guidelines. This decision follows the ban in early 2021 due to perceived risks. Cryptocurrency market participants are now afforded new opportunities for portfolio diversification and cryptocurrency exposure without directly holding digital assets.

With retail participation allowed, crypto ETNs are set to mirror mainstream products, providing broader access. Due to their exclusion from FSCS protection, investors must independently manage associated investment risks, adapting to the volatile nature of crypto markets. ETNs involving major cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), are likely to dominate the UK market.

The FCA’s announcement has prompted varied responses. While the FCA’s leadership has not issued public statements beyond the official release, experts predict this move aligns with trends in the US and EU.

Industry reactions are expected to evolve as stakeholder input and additional adjustments surface.

Bitcoin Updates and Competitive Market Dynamics

Did you know? The UK’s FCA’s decision reflects a growing trend towards regulatory acceptance of cryptocurrency products, similar to movements seen in the US and EU.

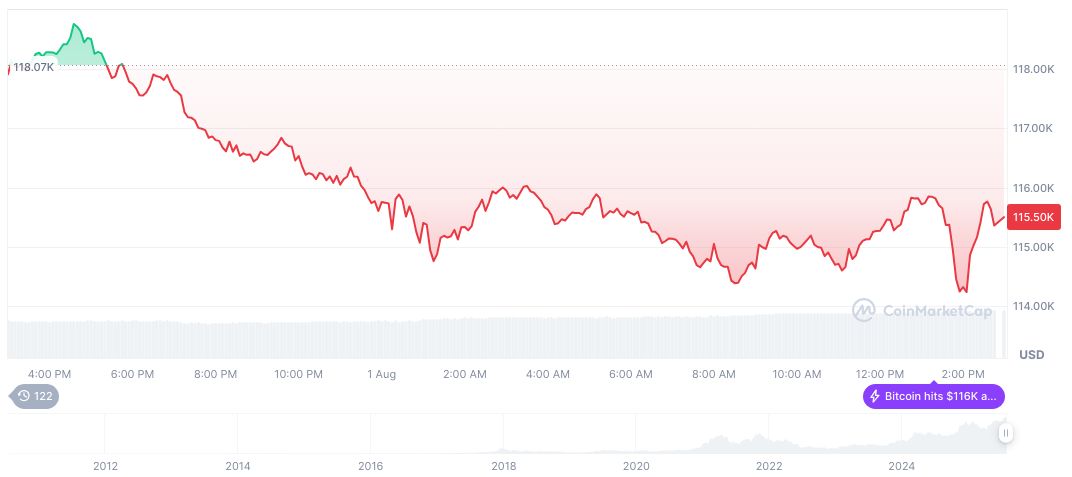

According to CoinMarketCap, Bitcoin’s current price is $113,780.51, with a market cap of $2.26 trillion and dominance at 61.19%. The 24-hour trading volume reached $82.79 billion, experiencing a 9.21% shift. Over 90 days, Bitcoin appreciated by 18.75%. These figures underscore Bitcoin’s persistent market influence amid fluctuating regulatory landscapes.

The Coincu research team suggests that the move enhances the UK’s position among major crypto-friendly jurisdictions. Similar to US and EU markets, the increased focus on regulatory compliance lays a foundation for secure growth in crypto-related financial products.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/uk-retail-trade-crypto-etns/