- U.S. stock markets rise, while key digital currency stocks fall.

- Coinbase down 1.27%, MicroStrategy drops 2.18%.

- Bitcoin holdings by firms affect market sentiments.

The three major U.S. stock indexes closed collectively higher, while digital currency concept stocks including Coinbase, MicroStrategy, and Marathon Digital saw declines on July 26.

This divergence highlights underlying tensions between digital currency stocks and broader market trends, despite strong performances in traditional stock indexes.

U.S. Stocks Climb Amid Declines in Crypto Sector

The three major U.S. stock indexes closed higher, with firms engaged in cryptocurrencies witnessing a decrement. Coinbase experienced a 1.27% drop, Strategy decreased by 2.18%, and Marathon Digital noted slight declines. These adjustments come amid positive overall stock performance, suggesting concerns tied to cryptocurrency engagements.

Immediate impacts involve fluctuating Bitcoin prices which heavily influence these companies’ stock values. Strategies involving aggressive Bitcoin accumulation appear to be contributing factors. Michael Saylor, CEO of MicroStrategy, has stated, “We are strategically accumulating Bitcoin as a reserve asset.” This quote reflects cryptocurrency’s complex relationship with broader markets.

Industry leaders, such as Michael Saylor (MicroStrategy) and Brian Armstrong (Coinbase), have not issued recent statements. Market observers are noting possible short-term corrections resulting from crypto-specific strategies that influence stock movements despite a generally positive stock environment.

Bitcoin Prices Impacting Digital Asset Companies’ Stocks

Did you know?

The correlation between digital currency stock performance and Bitcoin price highlights ongoing sensitivity to broader market trends. Historically, Bitcoin halvings have impacted cryptocurrency-focused firms like Marathon Digital.

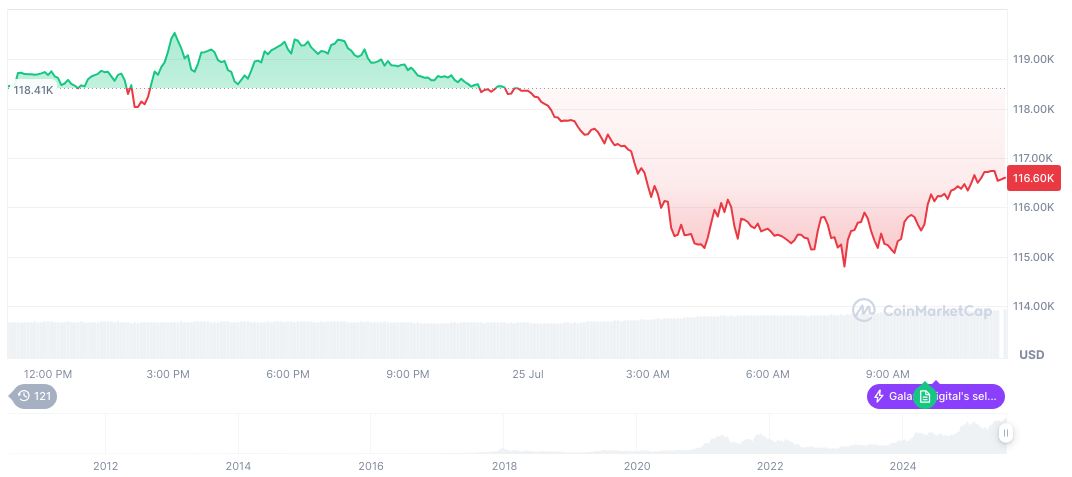

Based on CoinMarketCap, Bitcoin (BTC) currently values at $117,493.75 with a market cap of $2,337,828,523,431. The 24-hour trading volume reached $102,061,697,314, marking a 39.83% change yesterday. Despite recent fluctuations, Bitcoin maintains a 60.56% market dominance, signaling its significant role in broader market dynamics.

Coincu research indicates increasing regulatory scrutiny and market adjustments. Strategic Bitcoin investment persists as a key driver, influenced by regulatory environments and technological advancements. This includes Bitcoin’s influence on company strategies amid broader financial assessments, reflected in current stock performances.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-stock-indexes-rise-crypto-fall/