- Major U.S. stock indexes and crypto-related stocks fell on October 30.

- The Dow and Nasdaq saw notable declines.

- Bitcoin dropped 4.76%, triggering widespread crypto asset declines.

On October 30, 2025, all major U.S. stock indexes opened lower alongside cryptocurrency stocks, marking a broader market downturn.

This concurrent decline highlights ongoing investor caution amid equities and digital asset fluctuations, impacting companies like MicroStrategy and Coinbase.

U.S. Stock and Crypto Indices Slide Amid Economic Worries

On October 30, 2025, the major U.S. stock indexes opened lower, with declines in the Dow, S&P 500, and Nasdaq marking another challenging day for investors. Among the affected stocks, crypto-related shares such as MSTR, CRCL, and COIN noted declines, reflecting the broader market sentiment. MicroStrategy and Coinbase, major players in the crypto space, experienced stock price drops alongside smaller entities like SBET and BMNR. No official statements from company leaders like Michael Saylor or Brian Armstrong were available regarding this decline.

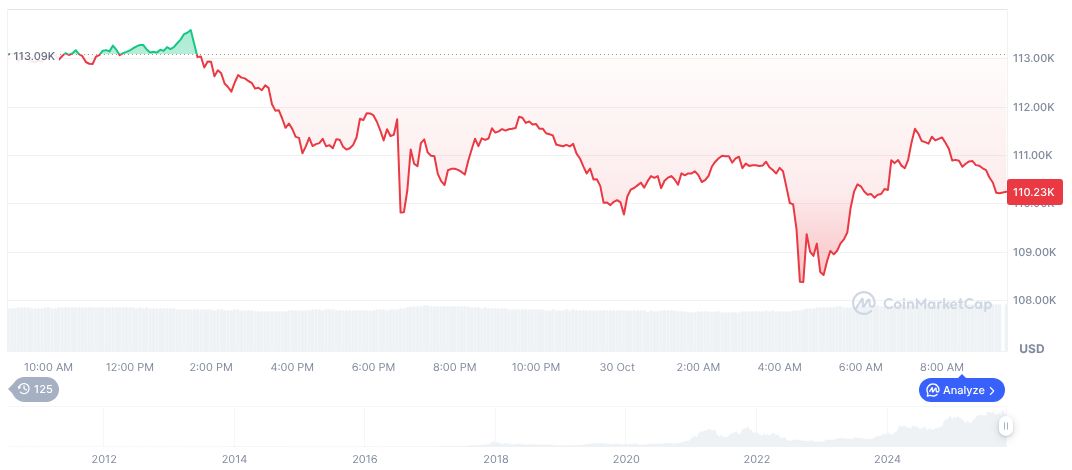

The decline in equity markets coincided with a sharp drop in Bitcoin and Ethereum prices, where Bitcoin fell below $108,000, marking a 4.76% drop within 24 hours. Ethereum also traded below $3,900, indicating substantial negative momentum across cryptocurrencies. On-chain data showed significant net outflows, with Arbitrum experiencing a $57.1 million withdrawal. $590 million was liquidated across networks, predominantly from long positions, impacting market liquidity and sentiment.

Amid these movements, there were no major public statements from prominent crypto figures like Arthur Hayes or CZ. Community discussions highlighted potential catalysts, yet official channels were quiet. No new regulatory updates from entities such as the SEC were noted, leaving market participants to speculate on possible reasons for the selloff.

Bitcoin, Ethereum Declines Reflect Major Market Challenges

Did you know? Historically, declines in crypto-related equities often track broader risk asset selloffs, mirroring events following Federal Reserve comments.

According to CoinMarketCap, Bitcoin (BTC) currently is valued at $107,428.15 with a market cap of 2.14 trillion. Possessing a market dominance of 59.34%, it experienced a 3.59% drop within the past 24 hours, amidst a substantial shift in the trading volume to $74.47 billion. With a circulating supply nearing its max cap of 21 million, Bitcoin’s recent downturn follows a 5.34% decline over the past 30 days, as detailed by CoinMarketCap.

The Coincu research team indicates potential recovery scenarios tied to rate cut expectations and institutional inflow as discussed in community dispatches. Historically, equity and crypto markets have experienced recoveries post-macro events if supported by fundamental shifts or policy interventions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-stock-crypto-indexes-drop/