- U.S. Senators request an investigation into Binance’s ties with Trump family crypto project.

- Concerns include compliance risks and potential conflicts of interest.

- The letter demands explanations for Binance’s plea deal compliance and future U.S. market plans.

U.S. Democratic senators have requested an investigation into Binance’s connections with the Trump family’s digital asset project. The inquiry aims to examine a $2 billion investment involving the stablecoin USD1.

The controversy highlights potential compliance risks and conflicts of interest, raising concerns about Binance’s operations in the U.S. It also coincides with cryptocurrency regulation debates.

Senators Push for Probing $2 Billion Binance Investment

A group of Democratic senators, including Chris Van Hollen and Elizabeth Warren, submitted a letter demanding a Treasury and Justice Department investigation into Binance’s involvement with the Trump family’s digital asset project. The letter points to a $2 billion investment through USD1 stablecoin, managed by an Abu Dhabi investment company, MXG.

Immediate implications involve scrutiny over Binance’s compliance with prior legal agreements and its ability to responsibly manage U.S. operations. The senators have emphasized the importance of regulatory oversight, given prior violations of anti-money laundering rules by Binance.

Senator Elizabeth Warren, U.S. Senator, – “The Trumps and Witkoffs, in essence, are receiving a cut of the deal between an entity of a foreign government, MGX, and a private entity, Binance, with significant business before the U.S. government.”

Market reactions are intensifying as investors express concern over potential repercussions on Binance’s U.S. market presence and crypto legislation. Key figures such as Senator Warren have openly criticized the arrangement as a serious breach, referencing Binance’s historical legal challenges.

Did you know? Binance’s issues with U.S. regulation echo similar past controversies faced by major tech firms dealing with data privacy and compliance.

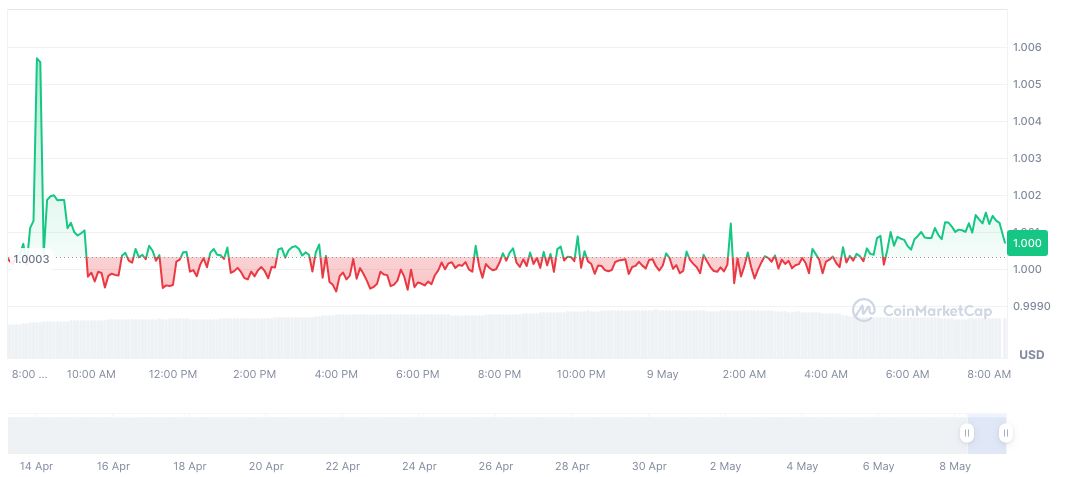

World Liberty Financial’s USD1 stablecoin is trading at $1.00, maintaining a market cap of $2.13 billion with a 24-hour trading volume of $89.09 million, according to CoinMarketCap. Despite minimal price changes, USD1’s role in political controversies impacts its investment appeal.

Insights from Coincu research team suggest heightened regulatory scrutiny could lead to stricter compliance standards for crypto firms operating in the U.S., potentially impacting global operations and industry confidence.

Source: https://coincu.com/336669-us-senators-binance-trump-crypto-investigation/