- U.S. proposes Digital Asset Market Clarity Act, influenced by bipartisan efforts and critical market needs.

- Bill assigns CFTC primary oversight over digital commodities.

- Immediate discussions focus on combining with stablecoin legislation.

Representative French Hill and other bipartisan lawmakers proposed the Digital Asset Market Clarity Act, seeking to enhance U.S. crypto market regulations through a comprehensive bill.

This development targets regulatory clarity and encourages a balanced approach to innovation, benefiting entrepreneurs and investors alike.

Clarity Act Defines New Regulatory Paths for Crypto Platforms

Republican lawmakers, led by Representative French Hill, introduced the Clarity Act, aiming to refine the U.S. crypto market’s regulatory landscape. The bipartisan effort includes co-sponsors like Representative Ritchie Torres, highlighting the act’s cross-party appeal. The bill, spanning 236 pages, was presented on May 29, 2025, demanding significant changes while following prior initiatives, including the Financial Innovation and Technology for the 21st Century Act.

The Clarity Act now proposes a system where crypto platforms must choose their regulatory path between the CFTC or SEC, based on asset types. Registering crypto platforms may gain temporary CFTC registrations. Furthermore, the bill clearly identifies that payment-type stablecoins are not securities, providing more flexibility for stablecoin issuers. DeFi projects might see varied regulation, with some exceptions from SEC oversight.

Market reactions are mixed. Ritchie Torres stated that “The CLARITY Act will deliver clear rules of the road that entrepreneurs, investors, and consumers deserve.” Conversations about merging this bill with stablecoin legislation highlight the challenges of creating unified cryptocurrency policies.

Historical Context and Bitcoin Market Volatility

Did you know? The debate to merge the Clarity Act with stablecoin legislation echoes prior attempts to streamline crypto regulation, similar to efforts during 2021-2024. The current effort may address previous roadblocks and bring consistent oversight.

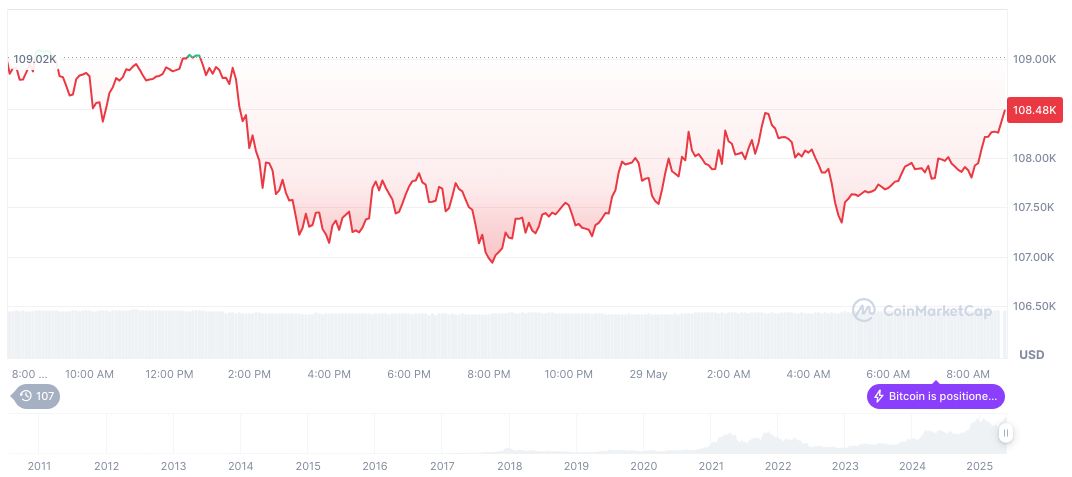

Bitcoin’s current price is $104,918.32, with a market cap of $2.08 trillion and a 24-hour trading volume of approximately $60.89 billion. Market dominance is at 62.93%, showing a slight price decrease of 3.04% in the last 24 hours. Notably, its price increased by 27.78% over the past 60 days, as per CoinMarketCap data.

Insights from Coincu research emphasize potential outcomes from this regulatory move. By assigning oversight to the CFTC, the Clarity Act may encourage market stability and improve investor confidence. However, regulatory gaps remain a priority for subsequent reviews. Representative French Hill remarked, “I am proud to introduce the bipartisan CLARITY Act with my colleagues. Our bill brings long-overdue clarity to the digital asset ecosystem, prioritizes consumer protection and American innovation, and builds off our work in the 118th Congress.”

Source: https://coincu.com/340649-us-crypto-market-clarity-act/