- The U.S. macroeconomic data release could impact crypto markets.

- Markets show elevated optimism but remain sensitive to surprises.

- Bitcoin and Ethereum highly exposed to data volatility.

The upcoming U.S. macroeconomic schedule includes significant data releases that may affect global financial markets, including cryptocurrencies, from July 1 to July 4, 2025.

These events are crucial as they may shift market trends and impact the current optimistic sentiment in crypto markets, which could quickly change with macroeconomic volatility.

U.S. Reports Set to Shape Crypto Market Sentiment

U.S. macroeconomic agencies will release a series of reports, including ISM PMIs and employment data, which are closely watched by investors worldwide. Macroeconomic reports impact financial markets significantly, especially affecting risk assets such as cryptocurrencies. The cryptocurrency community eagerly waits for updates, as these reports often dictate market movement.

Significant market shifts could occur as traders react to unexpected data, leading to changes in asset flows. Institutional investors keep a close eye on these numbers, potentially altering their strategies based on the outcomes. Market sentiment can shift quickly, moving from optimistic to cautious in response to economic indicators.

Vital market reactions are expected, with key figures from the crypto sector, like Vitalik Buterin, highlighting the importance of swift DeFi protocol response to economic surprises. Analysts and influencers will likely provide real-time comments after these crucial releases.

“Dual governance mechanisms are vital for handling sudden market disruptions and for ensuring DeFi protocols adapt quickly to external shocks, such as unexpected macroeconomic prints.” — Vitalik Buterin, Co-Founder, Ethereum

BTC and ETH Volatility Historical Trends Analyzed

Did you know? Historically, U.S. macro surprises have triggered major volatility in BTC and ETH, turning investor sentiment rapidly.

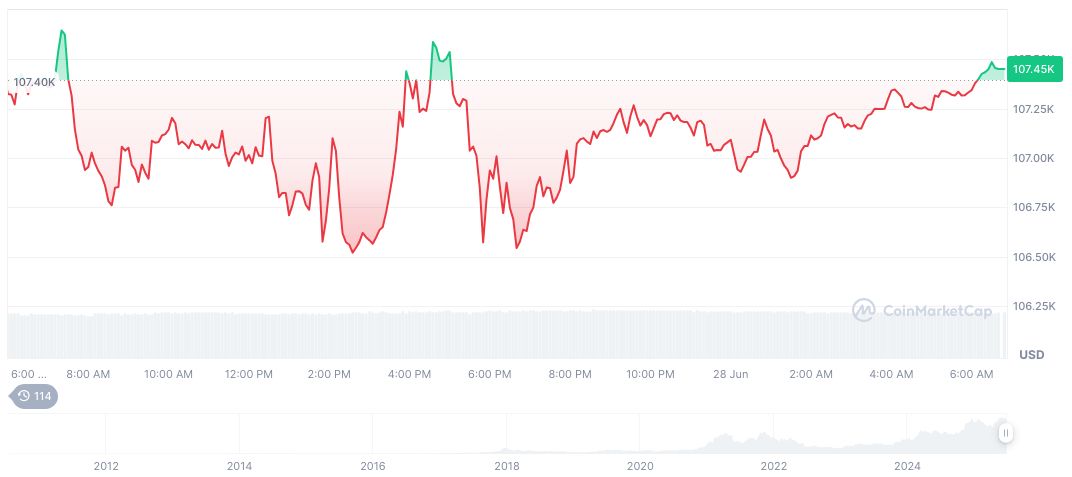

As per CoinMarketCap, Bitcoin (BTC) is trading at $107,340.71 with a market cap of $2.13 trillion and market dominance of 64.88%. Its 24-hour trading volume decreased by 10.09%, while prices improved by 0.50% in the last 24 hours and 3.38% over the week. Stability is seen amid volatility, given BTC’s diverse price fluctuations over the past 90 days. Data as of June 28, 2025.

According to the Coincu research team, the upcoming macro releases could significantly impact cryptocurrency valuations, potentially influencing regulatory outlooks and market strategies. Monitoring regulatory responses and market reactions will be vital as traders adjust to new economic information and its implications on technological advancements within the crypto sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345706-us-economic-data-crypto-markets/