- U.S. House passes Clarity Act, shifting crypto oversight to CFTC.

- Regulation aims to bring transparency and structure to the digital assets market.

- Market reactions expected as Senate reviews the legislation.

The U.S. House of Representatives has approved the Clarity Act to restructure digital asset markets, moving regulatory authority primarily to the CFTC. The bill, passed on July 18th, now awaits Senate action.

The Clarity Act marks a key step in enhancing digital asset market regulation, with broad implications for asset classification and oversight. The move could streamline processes and foster innovation within the market.

CFTC to Oversee Major Digital Assets Like BTC and ETH

The Clarity Act, sponsored by Congressmen French Hill and Bryan Steil, represents a major recalibration in crypto oversight. Shifting regulation to the Commodity Futures Trading Commission means most digital assets, including BTC and ETH, would be federally supervised as digital commodities. The reorganization seeks to clarify market structure and regulatory transparency.

Regulatory oversight changes imply a fresh look at consumer protection, with the SEC maintaining control over non-commodity tokens. This shift is designed to spur innovation while ensuring responsible financial practices within the digital landscape.

Congressman French Hill, Chair, Financial Institutions Subcommittee, U.S. House of Representatives, noted, “I’m very pleased to see the House continue to advance its approach to a clear market structure for digital assets. I look forward to continued work on this important objective with Chairs Hill and Thompson and my colleagues here in the Senate.”

French Hill expressed optimism, noting, “2025 is pivotal for digital asset legislation. I commend Chairman Hill, Chairman Steil, and the rest of my colleagues.” The Act sparks varied responses, with stakeholders keenly observing the Senate’s next steps. Regulatory clarity and innovation balance emerge as central points of discussion.

Crypto Market Faces Evolutions in Regulation and Innovation

Did you know? In 2024, similar legislation under the FIT21 Act led to brief price rallies and market volatility due to shifts in regulatory clarity.

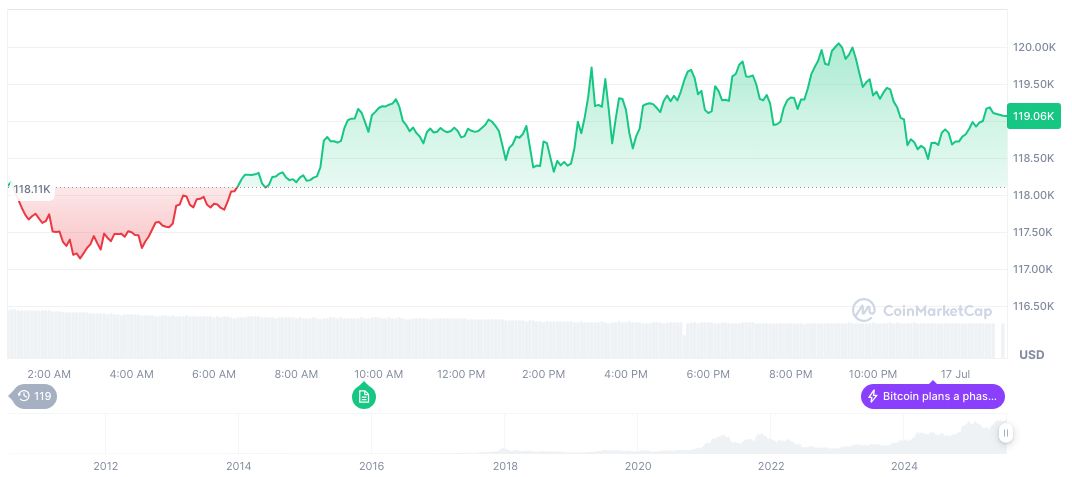

Bitcoin (BTC) currently trades at $120,221.26 with a market capitalization of formatNumber(2391649113775, 2) and a daily trading volume of formatNumber(48946751890, 2), reporting a price increase of 0.74% over the past 24 hours, according to CoinMarketCap. BTC continues to hold a dominance of 61.62% within the cryptocurrency market.

The Coincu research team highlights the Clarity Act’s potential to define regulatory boundaries and foster technological growth in the crypto sector. Implications for global financial markets could emerge as key regulatory balances are struck, with long-term stability and innovation addressed in this evolving digital landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/349275-us-house-passes-clarity-act/