- U.S. economic data reduces short-term losses and impacts crypto futures.

- Traders anticipate September Fed rate cuts, affecting crypto strategies.

- Major inflows on Binance indicate market positioning pre-rate decisions.

Following the release of U.S. economic data, traders anticipate the Federal Reserve’s potential interest rate cut in September, influencing cryptocurrency market dynamics across exchanges like Binance and Chainlink.

Major traders respond with significant USDT inflows into Binance, reflecting economic data’s impact on market liquidity and crypto asset positioning.

U.S. Economic Shifts Spark $215 Million Binance Inflows

After U.S. economic data emerged, short-term interest rate futures narrowed previous declines, chiefly because traders still anticipate a Federal Reserve rate cut in September. Major players like Binance noted increased activity, with a $215 million USDT influx recorded in a 24-hour window. Increased stablecoin demand indicates hedging amid macro uncertainties.

WLFI tokens will be launched on the Solana blockchain. – Dario Laverde, Developer, WLFI.

WLFI, a Trump family’s crypto initiative, gains traction with its upcoming Solana launch, as reported by WLFI Developer Dario Laverde. Prospects of rising liquidity sentiments were visible in Binance’s liquidity dynamics, prepping for possible central bank policy transitions.

Stablecoin Demand Escalates as Traders Hedge on Fed Moves

Did you know? The expectation of interest rate cuts by the Federal Reserve historically spurs increased stablecoin activity, reflective of broader crypto market positioning, as traders anticipate favorable liquidity conditions.

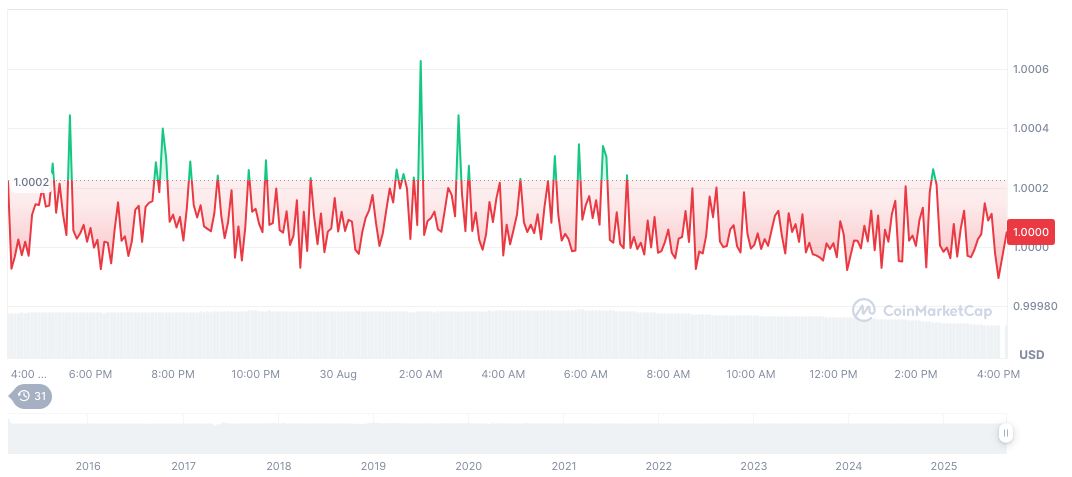

CoinMarketCap data shows Tether (USDT) currently priced at $1.00, with a market cap of $167.61 billion and dominance at 4.41%. The 24-hour trading volume reached $77.73 billion, declining by 45.85%. Recent monthly performance includes a 30-day rise of 1.33% despite a 90-day dip of 2.12%.

According to Coincu research, recent blockchain interoperability efforts by projects like Chainlink highlight enhanced stability in crypto exchanges, easing cross-chain transfer operations. Analysis of historical trends, such as pre-rate decision crypto inflows, underlines markets’ adaptive strategy to centralized monetary changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-economic-data-crypto-impact-3/