- U.S. core PCE stable in August, no immediate crypto market shift.

- Market expectations met, leading to stability.

- Historically moderate inflation data supports steady crypto prices.

The U.S. core PCE price index for August reported a 2.9% year-on-year increase, remaining steady and aligning with market forecasts, according to Jinshi’s analysis.

Market stability prevails as the U.S. inflation data meets expectations, leaving crypto asset prices and on-chain flows largely unchanged, suggesting continued economic steadiness.

Stable U.S. Inflation Holds August at 2.9%

The U.S. core PCE price index remained at 2.9% in August, aligning with predictions and maintaining the July rate. This measure of inflation is crucial for economic planning and forecasting. ChainCatcher, while a key crypto media outlet, did not comment directly on the event. However, investors and economic analysts closely watch this metric.

Market reactions were measured following the August PCE report. Many key opinion leaders and institutional players have not issued comments explicitly tied to crypto changes, reflecting a cautious observance of consistent inflation trends. This aligns with typical investor behavior in predictable economic conditions.

Crypto Steadiness Amid Market Expectations

Did you know? When the U.S. PCE matches market expectations, cryptocurrencies like Bitcoin often see stable trading, as it reduces uncertainty among investors, echoing historical trends of fiscal responses.

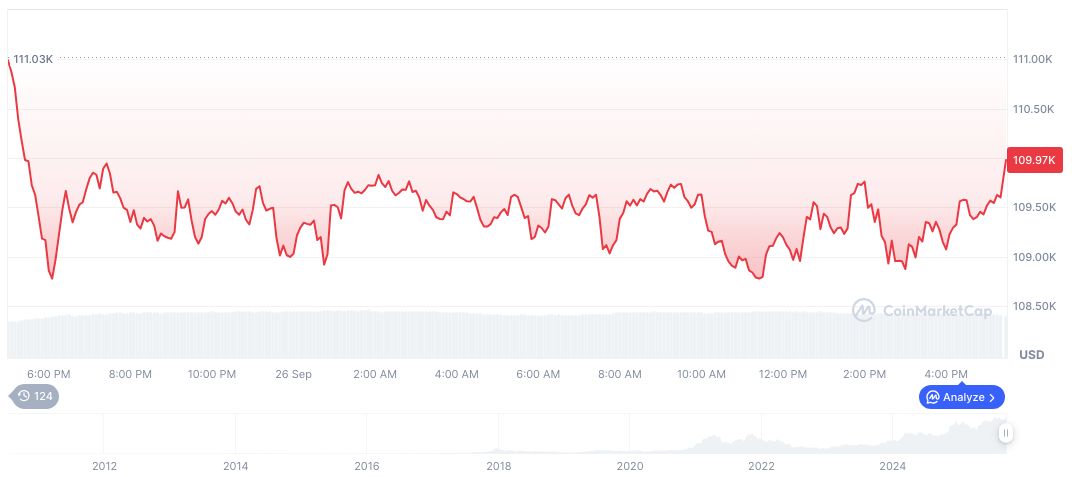

According to CoinMarketCap, Bitcoin (BTC) currently trades at $109982.81 with a market cap of $2.19 trillion, showing a 0.66% gain in the past 24 hours. Despite a recent 4.87% dip over seven days, Bitcoin remains a critical market driver.

The Coincu research team notes that stable inflation data like these can maintain interest in risk assets. Economic steadiness supports a neutral trading environment and encourages continued exploration of crypto’s potential in diversified portfolios.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-core-pce-crypto-impact/