- Draft legislation to define U.S. crypto market structure impacts major assets.

- House Financial Services Committee leads the regulatory initiative.

- White House anticipates regulatory progress by August deadline.

Key figures in Congress are set to release a draft crypto regulation before the May 6 hearing, aimed at structuring the U.S. cryptocurrency market.

This regulation could redefine market dynamics and boost bipartisan cooperation, potentially impacting digital asset valuations and innovations.

Financial Services Committee Stakes Out Legislative Framework

The House Financial Services Committee, led by French Hill, will introduce a draft regulation for the cryptocurrency market, targeting a clearer legislative framework for the industry. This regulatory draft represents a step toward defining the U.S. crypto landscape, aligning with last year’s “Financial Innovation and Technology for the 21st Century Act” efforts, which aimed to establish precise definitions and oversight.

Proposed updates could stabilize and clarify regulations for stablecoins, impacting assets like Bitcoin (BTC) and Ethereum (ETH). A structured approach may enhance investor confidence and market integrity, promoting innovation and compliance within legal frameworks.

Market observers and industry leaders are expected to scrutinize the draft’s implications, with stakeholder reactions being pivotal. Bo Hines, White House crypto liaison, remarked, “The presidential administration was ‘adamant’ that both a market structure and stablecoin bill be passed by August.” The White House’s support for speedy legislation aligns with broader calls for regulatory clarity from all sectors involved in cryptocurrency.

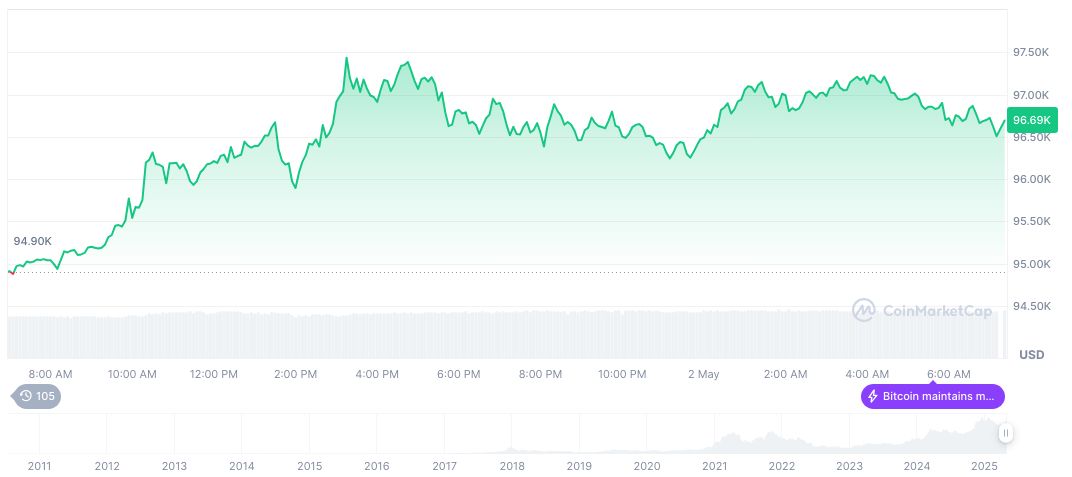

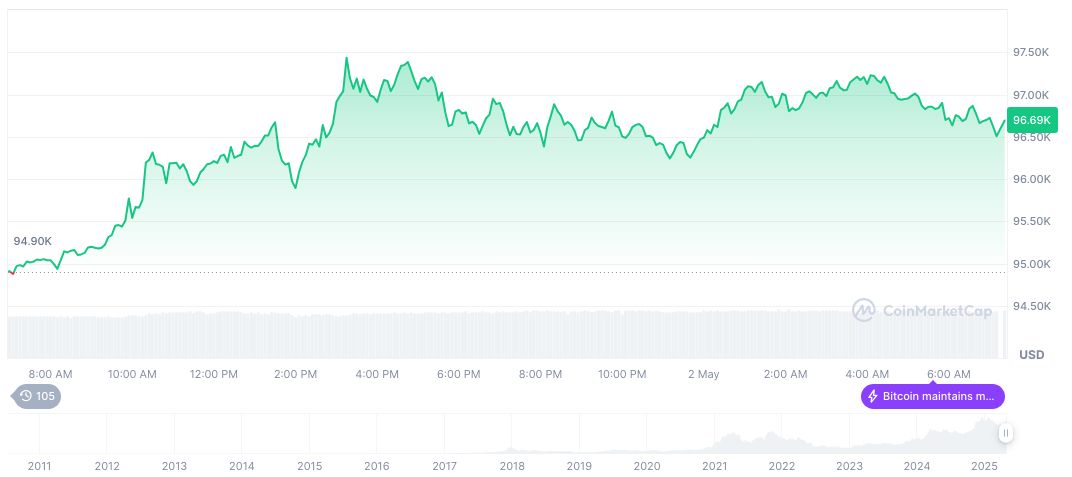

Bitcoin Surges Amid Anticipated Regulatory Progress

Did you know? The “Financial Innovation and Technology for the 21st Century Act” passed the House but stagnated in the Senate years before, indicating historical challenges in achieving comprehensive cryptocurrency legislation.

Bitcoin (BTC), currently traded at $96,679.83, maintains a market cap of $1.92 trillion, representing 63.84% of the market. Throughout the past month, BTC increased 16.53%, highlighting its recent volatility, as per CoinMarketCap.

Financial analysts suggest that implementing a detailed regulatory framework could solidify market positions and address systemic risks, enabling the U.S. to be a global leader in crypto innovation. Meanwhile, historic patterns indicate potential short-term market fluctuation following such legislative moves.

Source: https://coincu.com/335412-us-congress-crypto-regulation-draft/