- Several banks have closed crypto business accounts without explanations.

- Moves defy supportive U.S. government stance on cryptocurrencies.

- Legislation, not executive orders, guides current regulatory framework.

Unicoin CEO Alex Konanykhin disclosed ongoing account closures by major U.S. banks, including Wells Fargo, impacting crypto businesses despite new supportive federal legislation in 2025.

This highlights persisting risk aversion in financial institutions, affecting crypto integration and necessitating defined regulatory guidelines for full industry adherence.

U.S. Banks’ Stance Conflicts with Federal Crypto Support

According to Cointelegraph, U.S. banks, such as Citibank and JPMorgan Chase, have been terminating accounts associated with cryptocurrency businesses, including Unicoin. Although the Trump administration has shown support for cryptocurrencies, these closures occur despite regulatory changes. Unicoin, along with subsidiaries, faced services termination by four banks.

There remains a disconnect between the advances in U.S. cryptocurrency regulations and their implementation by financial entities. Even with the GENIUS Act signed into law, mandating greater oversight for stablecoins, banks retain a risk-averse stance toward crypto firms.

Industry experts agree that considerable shifts in financial institutions’ approaches require explicit regulatory guidelines. In the current atmosphere, banks remain cautious, choosing to de-risk rather than adapt to new crypto-friendly strategies.

Regulatory Ambiguity Fuels Caution in Banking Sector

Did you know? Record bank closures of crypto accounts often occur during regulatory transitions, illustrating historical tensions between traditional finance and digital assets.

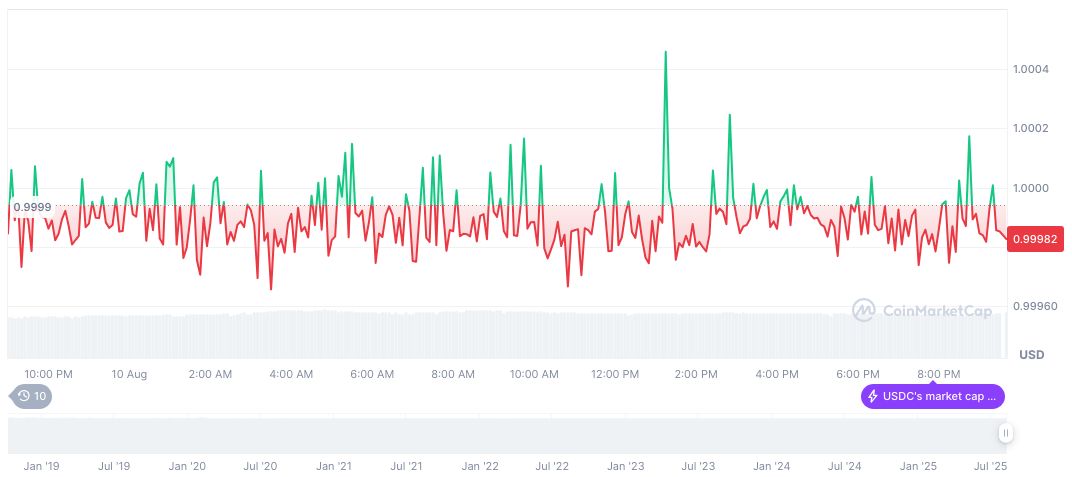

According to CoinMarketCap, USDC remains stable with a $65.23 billion market cap and a 1.65% market dominance. The trading volume surged by 13.41% in the past 24 hours, indicating its continuous use amidst market fluctuations.

Insights from the Coincu research team suggest that without clear, well-defined rules, financial institutions are less likely to change their cautious stance on crypto transactions. Historical trends indicate ongoing wariness, affecting digital currency integration into traditional finance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/us-banks-crypto-account-closures/