- Trump alleges manipulation of U.S. employment data impacting crypto markets.

- Crypto volatility minimal despite political commentary.

- Stable on-chain data amidst previous macroeconomic cycles.

Former U.S. President Donald Trump, on August 2nd, accused manipulation of employment data to damage Republican interests via a statement on Truth Social, impacting financial sentiment.

Trump’s assertion causes minor volatility in Bitcoin and Ethereum markets, yet no substantial institutional or regulatory responses materialize, mirroring past political-economic cycles.

Trump’s Employment Data Allegations Affect Crypto Stability

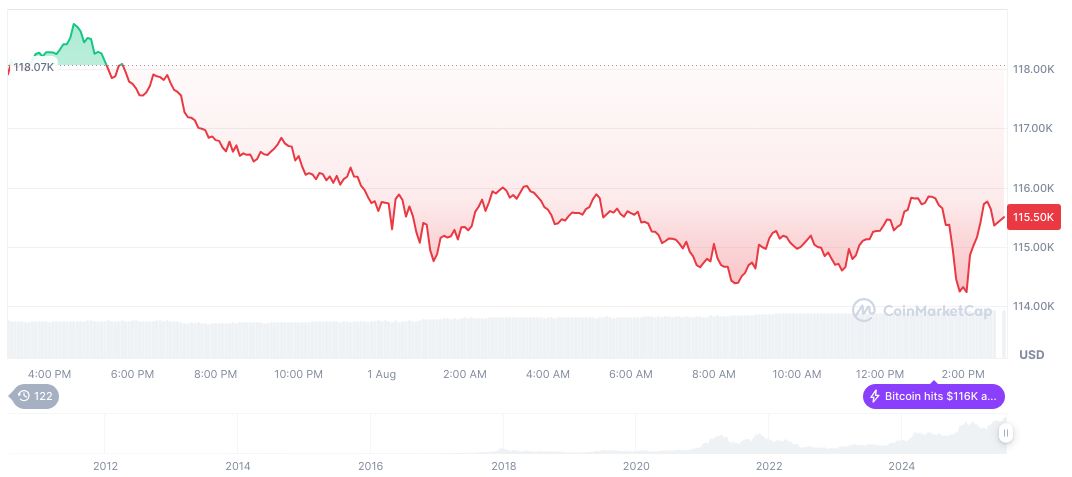

On August 2, 2025, Donald Trump alleged manipulation of employment data via his social media platform. He suggested the data had been manipulated to undermine his political image. U.S. Bureau of Labor Statistics released its employment report without directly addressing these accusations. The crypto market, particularly Bitcoin and Ethereum, saw slight volatility, with prices shifting within a ±1.5% range. No major outflows or changes in total value locked in DeFi protocols were observed.

BlackRock and Fidelity did not publicly react despite Trump’s comments. The overall institutional sentiment remained stable, with no market disruptions recorded. Arthur Hayes of BitMEX, highlighting potential volatility when macro data is politicized, saw crypto volatility as a reaction to market uncertainty. No new regulatory comments or actions from the U.S. Federal Reserve, the SEC, or CFTC addressed these allegations.

Political Turmoil and Historical Crypto Resilience

Did you know? Historical analysis reveals that political commentary seldom affects long-term cryptocurrency market trends, with adjustments typically seen in the short term only.

Bitcoin traded at $113,228.97 with a market cap of $2.25 trillion, as per CoinMarketCap. Its trading volume rose 30.70% in 24 hours. Despite the political backdrop, Bitcoin’s 24-hour price declined by 2.49%, showing market resilience.

The Coincu research team highlighted that historical data consistently demonstrates a return to stability in crypto markets post-political fluctuations. Macro trends continue to drive market movements beyond political statements, dictating long-term price behavior.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-employment-data-crypto-impact/