- U.S. President Trump hosts crypto dinner amid market and regulatory shifts.

- Bitcoin open interest reaches high on political ties.

- Legislation raises concerns on political-crypto conflicts.

President Donald Trump hosted a significant cryptocurrency dinner on May 22, 2025, at Mar-a-Lago, inviting major industry figures like Justin Sun and Jihoz.ron.

The event underscores increasing intersections between political actions and the cryptocurrency market, with impacts noted through traded tokens, market metrics, and legislation.

Trump’s Mar-a-Lago Crypto Dinner Highlights Industry-Political Ties

President Trump’s dinner at Mar-a-Lago attracted key players in the cryptocurrency arena, including industry leaders Justin Sun and Jihoz.ron. A notable detail is how entry was secured through a meme coin associated with Trump himself, highlighting the growing intersection of politics and digital currencies.

Post-dinner activities included immediate fluctuations in meme coins like $TRUMP and usd1doge in the digital asset markets. There is an evident push and pull between the evolving political landscape and the digital asset space, as evidenced by the U.S. Treasury’s anticipation of new international trade agreements.

“The Stop Trading, Retention, and Unfair Market Payoffs in Crypto Act of 2025 aims to prohibit the President, Vice President, members of Congress, and their immediate family from holding a proportion of digital assets sufficient to allow them to unilaterally alter digital assets.” — Maxine Waters, U.S. Representative

U.S. Crypto Policy Shifts Amid High Political Involvement

Did you know? On March 6, 2025, Trump formalized the U.S. government’s strategic reserve for cryptocurrencies, paralleling the historical establishment of federal gold reserves in the early 1900s.

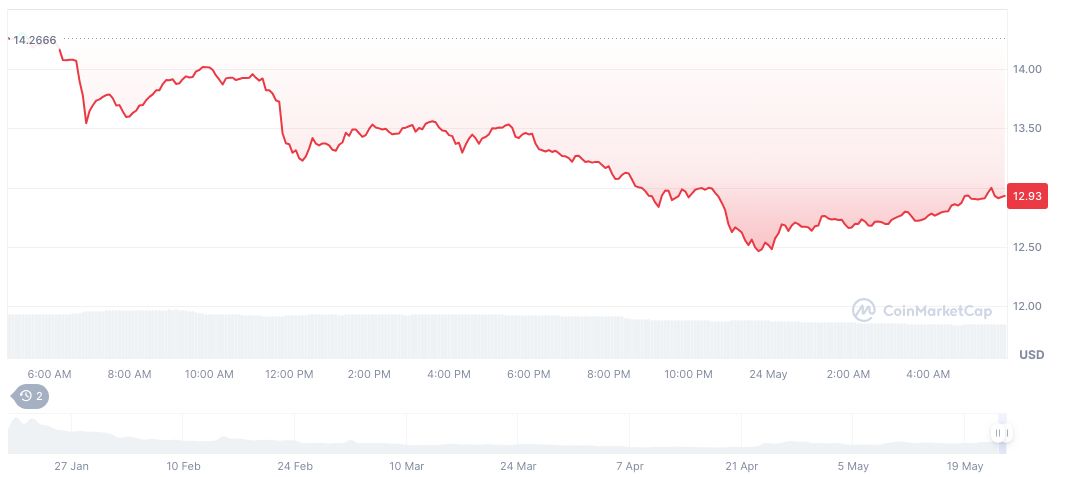

According to CoinMarketCap data, OFFICIAL TRUMP (TRUMP) is priced at $13.03 with a market cap of $2.61 billion and dominance of 0.08% as of May 24, 2025. The circulating supply is noted at 199,999,380 with a max supply just below one billion. The 24-hour trading volume is $1.06 billion, showing a 58.08% decrease.

Insights from Coincu researchers indicate that the intertwining of political narratives with crypto investments magnifies both market volatility and policy sentiment. As regulatory measures evolve, particularly with presidential involvement, digital assets may face renewed scrutiny, thus influencing future market trends.

Source: https://coincu.com/339457-trump-crypto-dinner-market-impact/