- Donald Trump announced 30% tariffs on EU and Mexican goods from August 1.

- U.S. markets showed resilience post-announcement.

- Potential implications for stablecoin volumes amidst global trade shifts.

U.S. President Donald Trump declared a 30% tariff on European Union and Mexican goods, effective August 1, 2025.

Trump’s tariffs aim to pressure trade partners, reflecting his assertive trade strategy. Financial markets adjusted rapidly, indicating economic resilience despite anticipated tariff impacts.

Trump’s Tariff Move Pressures Global Economies

President Trump made the tariff announcement through letters on his social media platform, Truth Social, indicating potential increases if the EU and Mexico retaliate. Historically, such trade measures have been characteristic of Trump’s administration. The imposition of 30% tariffs is designed to pressure economic concessions from U.S. trade partners.

The introduction of these tariffs is set to alter global trade dynamics significantly, prompting analysts to speculate about its effects on international economic relationships. Previous tariff amplifications during Trump’s terms led to fluctuations in various markets.

“These moves are in line with my previous leadership style—characterized by aggressive unilateral trade actions.”

— Donald Trump, President, United States

Bitcoin Activity and Stablecoins in Focus Amid Tariff Impacts

Did you know? Historically, tariffs have often led to retaliatory measures that can escalate into trade wars, affecting global economies.

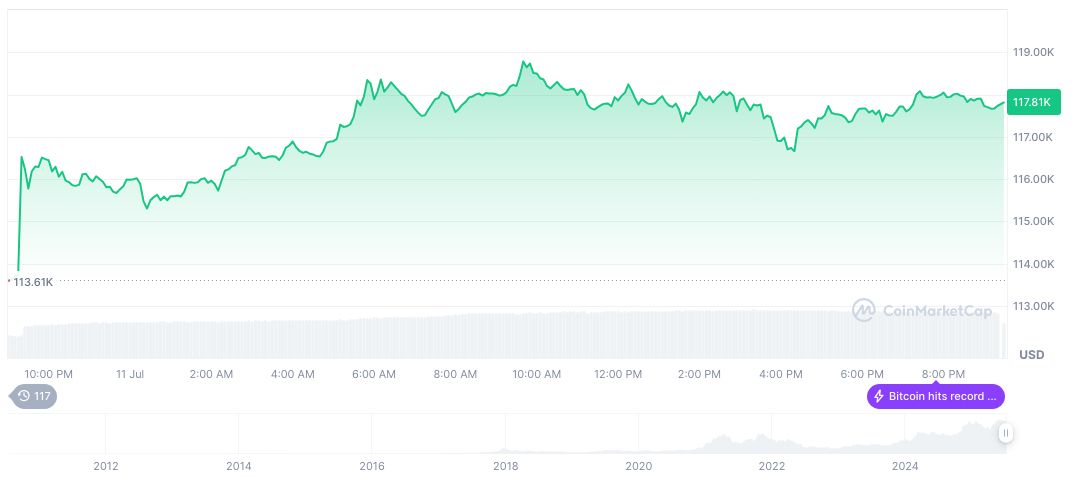

Bitcoin (BTC), trading at $117,537.94, holds a market cap nearing $2.34 trillion, according to CoinMarketCap data at 13:00 UTC, July 12, 2025. BTC’s dominance stands at 63.88%, with recent days showing minor fluctuations but a notable 39.14% gain over 90 days. Trading volumes fell by 52.76% in the past 24 hours, with a circulating supply of 19,891,312 BTC.

Insights from Coincu research underline potential economic shifts due to these tariffs, as well as possible regulatory responses. Expert interpretations highlight a focus on stablecoin activities, given their historical rise in volumes during macroeconomic uncertainties. Such patterns may continue as traders adjust to forthcoming global trade challenges.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348253-trump-tariffs-eu-mexico-crypto-impact/