In the high-velocity world of cryptocurrency exchanges, having deep, reliable liquidity is nothing less than mission-critical. Without it you risk slippage, fragmented order books, delayed fulfilment, and ultimately unhappy users. For platforms seeking to maximize trading volume, partnering with the right liquidity provider (LP) can make or break your service.

Below we review the seven most compelling liquidity providers (LPs) in crypto, highlighting what sets each apart — starting with ChangeNOW, whose B2B infrastructure offers a full suite of services — and then six other strong options you should evaluate.

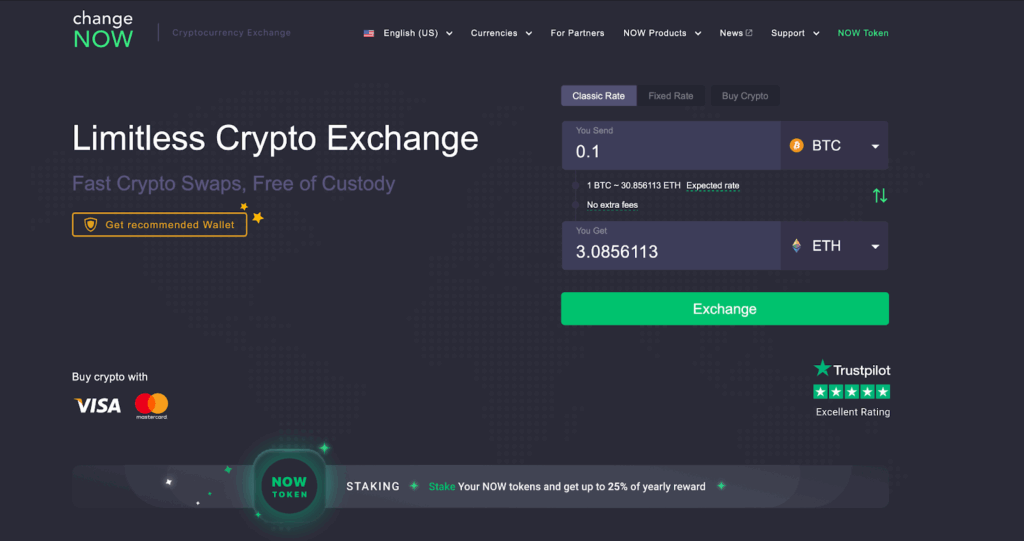

1. ChangeNOW For Business

ChangeNOW.io

Overview & key differentiators:

ChangeNOW For Business positions itself as an all-in-one liquidity and exchange infrastructure partner tailored for SMEs and enterprises.

Their offering includes crypto payments, exchange flows, asset custody, token listing, liquidity provision and multichain bridge, with a vast asset base: over 1,500 coins, 110+ networks, 70+ fiat coins supported and millions of transactions every month.

Their liquidity is sourced from both centralized and decentralized exchanges, enabling cross-chain swaps and a high level of asset flexibility.

Why it matters for trading volume acceleration:

- The broad asset support means you can list and route numerous token pairs, enabling more trades and higher volume.

- Fixed-rate + standard-rate exchange flows allow for different quoting models depending on your business.

- + Certified with SOC-2 and ISO 27001 standards; 99.99% availability, ~350 ms response times — these performance metrics are vital when high-frequency trades or large volume flows are involved.

- Integration ease (API + widget) and white-label solutions reduce time-to-market, which means you can spin up new markets faster.

Ideal use-case:

Fintechs, wallets, neobanks or gaming/iGaming platforms that need a turnkey liquidity partner to enable crypto exchange flows without building full infrastructure in-house.

2. Binance

What they bring:

Binance continues to be the exchange with the largest global trading volume and correspondingly deep liquidity across hundreds of trading pairs. Its institutional/exchange APIs also enable partner platforms to tap into this depth.

Key strengths:

- Massive order-book depth reduces slippage for high-volume trades.

- Broad global coverage and many trading pairs, which means you can service diverse token markets.

Considerations:

While deep and broad, integration may involve managing custody or exchange relationships, possibly higher regulatory burden depending on region.

3. Cumberland (DRW)

What they bring:

A veteran OTC liquidity provider, Cumberland is known for handling large‐block trades around-the-clock. It’s often a go-to for institutional rather than purely retail flows. (CoinCodex)

Key strengths:

- Ability to execute large trades with minimized market impact.

- Global reach and 24/7 operation means platform continuity.

Ideal for:

Exchanges or platforms that expect institutional flows, want over-the-counter liquidity alongside standard book liquidity.

4. GSR Markets

What they bring:

GSR is a recognized market-maker and liquidity provider for both exchanges and token projects. It supports spot, derivatives, and tailored liquidity solutions.

Key strengths:

- Customised support for smaller exchanges or tokens wanting market-making + liquidity depth.

- Experience across both spot and derivatives markets.

Considerations:

May require higher minimums or bespoke terms depending on project size.

5. B2Broker

What they bring:

B2Broker specialises in providing multi-asset liquidity (crypto, forex, commodities) and is popular among regulated brokers who also need crypto pairs.

Key strengths:

- Multi-asset capability gives flexibility if platform wants to offer more than just crypto.

- Supports crypto CFD brokers and regulated environments.

Ideal for:

Platforms that combine crypto and traditional assets, or regulated brokers integrating crypto pairs.

6. Galaxy Digital

What they bring:

Galaxy Digital is a publicly listed company that provides liquidity across spot, futures, options, and lending/asset-management services. (margex.com)

Key strengths:

- Institutional-grade infrastructure and broad asset coverage.

- Reputation and regulatory visibility can reassure partners and counterparties.

Considerations:

As a large firm, integration may involve higher operational complexity or counterpart risk.

7. Uniswap (v3 & beyond)

What they bring:

While not a “traditional” liquidity provider in the centralized-exchange sense, Uniswap’s AMM model (especially v3’s concentrated liquidity) offers a decentralized route for platforms that want non-custodial or on-chain liquidity options.

Key strengths:

- Permissionless, broad token coverage, and access to on-chain liquidity.

- Useful for platforms that want to integrate DEX liquidity as part of their offering.

Considerations:

AMM liquidity may still involve slippage, and on-chain costs (gas) can affect execution efficiency compared to centralized order-books.

Which LP should you choose (and when)?

Choosing the “right” liquidity provider depends on several factors:

- Trading volume & size of flows: Large institutional flows demand deep order-books and low slippage (e.g., Cumberland, Galaxy).

- Asset coverage & flexibility: If you list many altcoins or cross-chain pairs, broad coverage (e.g., ChangeNOW, Uniswap) becomes vital.

- Integration & infrastructure cost: APIs, widgets, white-label solutions matter — ChangeNOW for example emphasises low-friction integration.

- Regulatory & custody considerations: Custodial vs non-custodial models, cross-border regulation, risk management.

- Platform business model: Retail-facing exchange vs fintech wallet vs institutional trading desk will shape which LP fits best.

Final take-aways

- ChangeNOW For Business leads as a versatile, all-in-one liquidity partner suited to exchange platforms wanting rapid market entry with broad asset support and strong API infrastructure.

- If your volume, clientele or institutional profile is large, you’ll likely evaluate heavy-duty liquidity firms like Binance, Cumberland or Galaxy.

- For newer or niche exchanges focusing on altcoins, derivatives or hybrid assets, GSR or B2Broker may provide a good fit.

- Don’t discount decentralized liquidity (Uniswap) if your model leans on on-chain/p2p flows and you’re comfortable with AMM mechanics and on-chain fees.

In summary: great liquidity equals more trades, tighter spreads, lower slippage, and happier users — making it a pillar for scaling an exchange business. Choose wisely, integrate smartly, and your platform will be well-positioned to capture trading volume in the competitive crypto landscape.