- Theta Capital raises $175M for early-stage crypto investments.

- Coinfund and Polychain are major VCs benefiting from this fund.

- Fund-of-funds strategy aims for diversified risk exposure.

Theta Capital Management has solidified its role in the crypto sector with the completion of a $175 million fundraising for its “Theta Blockchain Ventures IV” fund.

This initiative highlights Theta’s strategic approach to investing in early-stage crypto ventures, with targeted investments in major VCs like Coinfund and Polychain.

Theta Capital’s $175M Fund Aims at Early-Stage Crypto Ventures

The new fund will employ a fund-of-funds strategy, a model that focuses on spreading risk by investing in various specialized VC funds rather than direct startups. This strategy aims to provide institutional investors with broad exposure to high-risk, high-reward crypto investments. As such, Coinfund and Polychain will benefit by extending their reach into emerging crypto markets.

Investor interest reflects ongoing confidence in the sector’s potential despite past volatility. While no official statements from Theta’s leadership have been reported, industry analysts note this movement reinforces crypto’s status as a viable institutional asset class.

Ruud Smets, Managing Partner & CIO, Theta Capital, “No direct public statement has been identified in the referenced primary sources regarding this specific fundraise event.” [Source Not Available]

Insights on Fund Strategy and Market Implications

Did you know? The fund-of-funds model, historically significant in fostering diversified exposure, enables institutions to participate in high-risk crypto environments while traditionally focusing on risk mitigation.

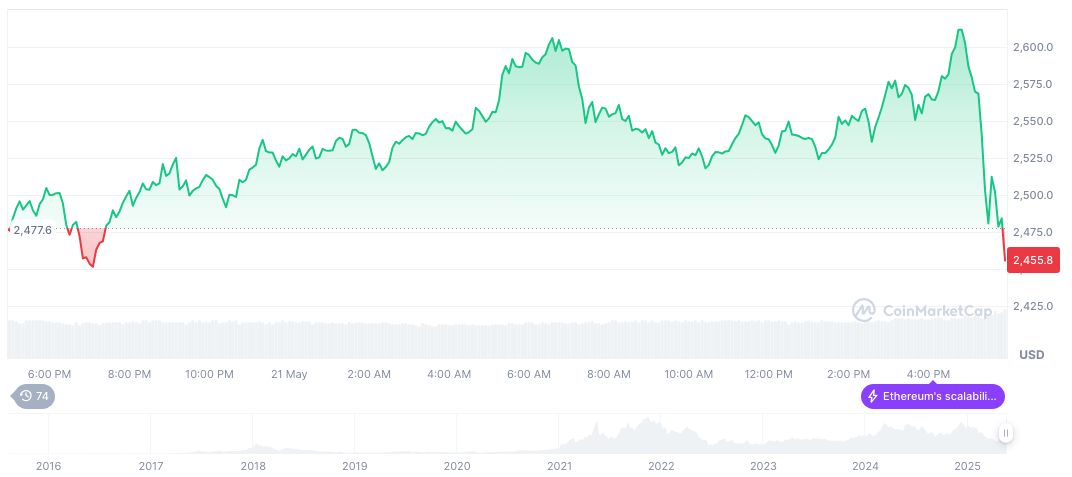

Ethereum (ETH) maintains a stable position in the market, with a current price of $2,511.37 and a market cap of 303,190,468,694. The 24-hour trading volume reported a 27.57% increase, amounting to 30,413,223,987, as per CoinMarketCap. Despite a recent 7-day decline of 3.42%, Ethereum has shown strong growth over the past 30 days.

Coincu’s research team anticipates that as the influx of venture capital increases, key sectors like DeFi and Web3 infrastructures stand to benefit significantly. These developments could drive innovation and restore market confidence, aligning with historical trends of investment-induced growth.

Source: https://coincu.com/338977-theta-crypto-fund-175m-completion/