With the U.S. presidential race becoming closer, the crypto market is feeling significant repercussions. As Donald Trump‘s chances of winning on websites like Polymarket declined, Bitcoin’s price fell under $69,000, resulting in significant liquidations totaling more than $350 million. For investors, this “Trump Dump” is a cautionary example of the high level of volatility that the crypto market can exhibit due to external factors.

Amid such unpredictability, it is vital to think about strategies and resources to protect your portfolio from these abrupt declines. Here is an examination of how political events can impact cryptocurrency and some strategies to maintain stability in your investments during periods of volatility.

Why External Events Rock the Crypto Market

The cryptocurrency market has always been responsive to political and economic changes, particularly regarding regulatory possibilities. One instance is when certain crypto supporters started to favor Donald Trump because of his commitment to loosen regulations and revamp the Securities and Exchange Commission (SEC). The traders were highly speculative about his chances of winning the election, with many optimistic that a positive policy environment would boost growth in the market.

Nevertheless, with the competition becoming closer, doubt is seeping into the markets. The latest Trump Dump serves as a notable instance, leading to liquidations exceeding $350 million as Bitcoin price briefly fell below $69,000. Traders who had made significant bets on a growing Bitcoin value saw themselves vulnerable to market volatility, as their long positions were sold off in large quantities..

Understanding Liquidation and Its Ripple Effect

For traders using leverage borrowing funds to amplify their positions, liquidation can be a sudden and severe risk. When Bitcoin and other major assets experience sharp declines, leveraged traders face forced liquidation as they’re unable to cover the losses. This liquidation event creates a ripple effect, often leading to more sell-offs and lower prices.

Liquidations aren’t unique to Bitcoin; when the market experiences a significant drop, altcoins also feel the squeeze. This chain reaction emphasizes the need for stability within a portfolio and consideration of assets that may hold strong despite market fluctuations.

Diversification as a Shield Against Volatility

Diversification is among the most efficient methods to safeguard your portfolio from significant declines. Although Bitcoin and Ethereum are popular cryptos to buy, events like the Trump Dump emphasize the need to diversify with investments in more stable or potentially growing projects.

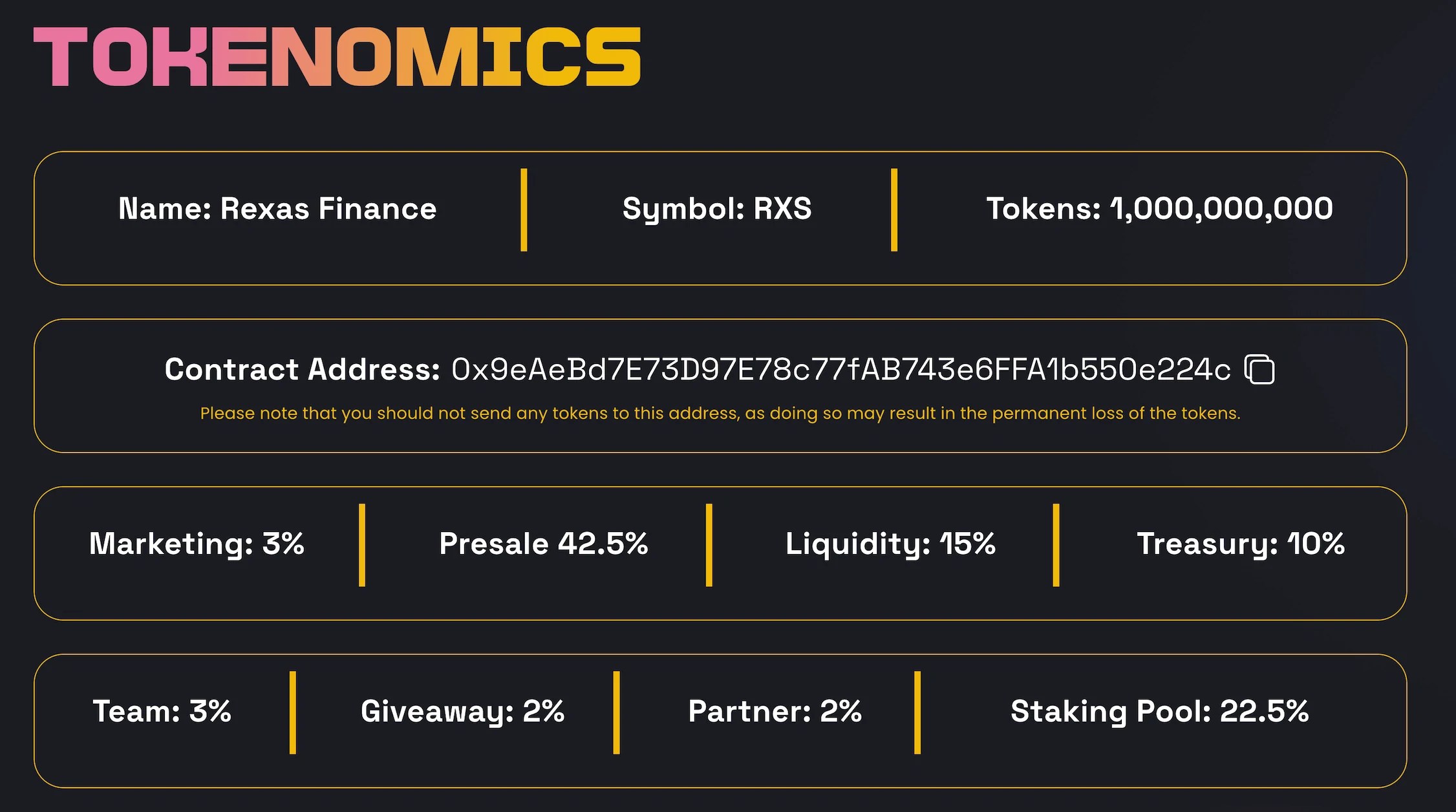

For instance, some emerging projects, particularly those focused on real-world assets (RWAs), are gaining traction as safer investments. These assets link cryptocurrency with tangible value, potentially providing a more stable base than typical market coins. One notable project in this category is Rexas Finance (RXS), a platform that’s turning heads with its approach to real-world asset tokenization.

Why Real-World Asset Tokenization Could Be a Game-Changer

Real-world asset tokenization allows investors to possess divided portions of physical assets such as real estate, commodities, or fine art. Platforms such as Rexas Finance close the distance between cryptocurrency and traditional investments by tokenizing these assets, providing investors with new chances to maintain a varied portfolio without completely leaving the cryptocurrency market.

With a current price of approximately $0.060, Rexas Finance is expected to increase in value in the upcoming years, with forecasts projecting it to reach $17 by 2025. RWA crypto tokens are an appealing choice for investors seeking to mitigate volatility within the blockchain ecosystem, thanks to their combination of growth potential and stable underlying assets.

Visit Rexas Finance (RXS)

Additional Strategies for a More Resilient Portfolio

Besides diversification, there are a few other strategies that can help protect your portfolio against market swings:

Implement Dollar-Cost Averaging (DCA) strategy

With the concept of Dollar Cost Averaging (DCA), you can invest a certain amount regularly over a period of time, instead of investing all at once. As you spread out your buying cost, you minimize the effects of market fluctuations, as you run a steady investment in the long run.

Assess different stablecoin choices

During periods of high volatility, stablecoins tied to fiat currencies offer a secure refuge. Having some of your investments in stablecoins can help safeguard against market downturns without having to completely leave the crypto space.

Make use of stop-loss orders

Here, you indicate the specific price you would like to automatically sell your asset , should it reach that price. This method will help safeguard your asset from sudden price drops, although it may not avoid losses entirely.

Example: If you bought Ethereum at $2,500 and want to limit your losses, you could set a stop loss order at $2,300. If the price drops to $2,300, your order will get executed for selling, helping you avoid any further losses. Otherwise, it’ll remain there until the position is closed.

Keep yourself updated on external Events

Political and economic circumstances will probably keep affecting the market. Being aware of upcoming important events, like elections or regulatory updates, can assist you in predicting market changes and adapting your investments.

Taking a broad view over time and effectively handling potential risks

Crypto has experienced both positive and negative moments, and having a long-term perspective can assist in enduring temporary disruptions. Dedicating a small portion of your investment portfolio to cryptocurrency and establishing achievable objectives for each asset can assist in maintaining strength during market volatility.

Conclusion

The Trump Dump highlights how political dynamics impact the cryptocurrency market. However, these occurrences also act as prompts that market instability should not cause alarm; instead, it presents a chance to review and improve your approach. Diversifying through innovative projects such as tokenizing real-world assets, using risk management tools, and staying updated can help you build a portfolio more resilient to unforeseen downturns.

Source: https://coingape.com/blog/the-trump-dump-effect-how-to-protect-your-crypto-portfolio/