So you’ve decided to invest in cryptocurrencies. Congratulations! This is a wise decision, and many profitable opportunities await you in the crypto world. However, before you start trading, you need to learn how to trade cryptocurrencies.

One popular way to get started with crypto trading and investing is through automated crypto trading bots. Crypto trading bots are automated computer programs that use different algorithms to analyze cryptocurrency markets and make trading decisions. Crypto bot platforms often tout how easy it is to make money using them, but they come with their own risk factors. In fact, if used recklessly, crypto trading bots can be a sure recipe to lose money fast.

This beginner’s guide will provide an overview of automated crypto trading bots. We will discuss how to use them safely and profitably so they can help you make money in the cryptosphere!

What are crypto trading bots, and how do they work?

Crypto trading bots are computer programs that analyze market data and make trading decisions for you. They can easily track market trends, execute trades, and manage your portfolios 24/7, all without spending hours researching or monitoring the markets.

There are different kinds of crypto trading bots available. Some are simple and require minimal setup, which is an excellent choice for beginners. In contrast, others use complex algorithms and market indicators reserved for more experienced traders. Most automated trading bots come with customizable settings to help you tailor your trading strategies according to your risk tolerance and goals.

There are many benefits of using crypto trading bots:

- They are automated and can run 24/7 without human intervention.

- Trading bots are highly customizable, so you can set up the parameters to ensure that your trading strategy is executed exactly how you want it.

- Thanks to their fast execution and speed, trading bots can help you take advantage of market opportunities before anyone else even knows about them!

While automated crypto trading bots can offer many advantages, some risks are also associated with them. Crypto bots must be monitored often and tailored to current market conditions. If market conditions change and the bot is no longer suited to them, it can quickly start racking up losses.

How to use crypto trading bots safely and profitably

If you decide to use automated crypto trading bots, it is vital to make sure that you are adequately educated on the topic. You should understand the different types of automated trading bots available and how they work. Additionally, you should always practice risk management, something that is often overlooked by beginner traders lured by the idea of quick profits.

There are several automated crypto trading bots available on the market. Today we will focus on the most popular bot choices for beginners: DCA and Grid bots.

DCA Bots

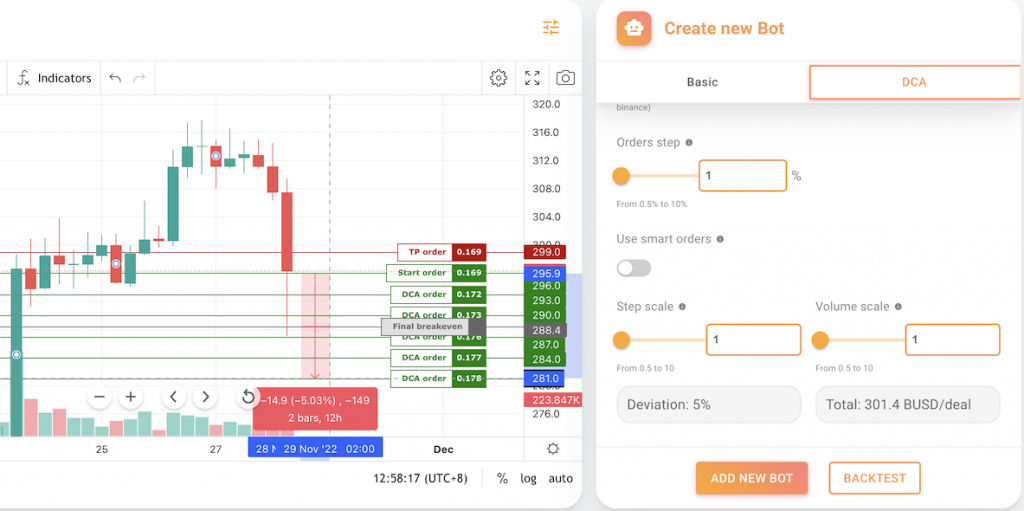

“Dollar Cost Average” (DCA) bots utilize the Martingale strategy. In short, the bot makes additional trades of the asset as prices start to fall (DCA orders), allowing the position size to grow and getting a better average price than if it had just stuck with the original order. DCA bots can effectively average down the cost of the asset as the price decreases, selling it back for a profit as soon as the market bounces back.

There are a few main parameters to take into consideration when building a DCA bot:

- Strategy: long or short

- Number of DCA orders

- DCA order amount

- Price deviation: this is the price % separation between the DCA orders. For example, if you set this to 1%, there will be one DCA order for every 1% price drop from the current price.

- Step scale: this is the factor by which the price deviation is multiplied each time. For example, if the price deviation is 2% and the step scale is 1, there will be one DCA order placed for every 2% drop in price. However, if the price deviation is 2% and the step scale is 2, the spacing between the DCA orders will double at each step (2%, 4%, 8%, etc.).

- Volume scale: this is the factor by which the order volume of each DCA is multiplied each time. For example, when the volume scale equals 1, the volume of all DCA orders is the same. However, if you were to set the volume scale to 2, the volume would double each DCA order.

DCA bots are a great way to profit as long as the settings are well-suited for market conditions. The parameters detailed above directly determine the final average price the bot can achieve if all DCA orders are filled. The higher the number of DCA orders and the more separation between them (in other words, the higher the price coverage), the lower the final average order price.

During bull runs, aggressive bot configurations with few DCA orders or little space between them do very well. On the other hand, when there is a down-trending market, a higher price coverage is essential to avoid “red bags.” Red bags is the term used to describe the situation where the bot is holding deals at a loss due to sudden price drops.

Grid Bots

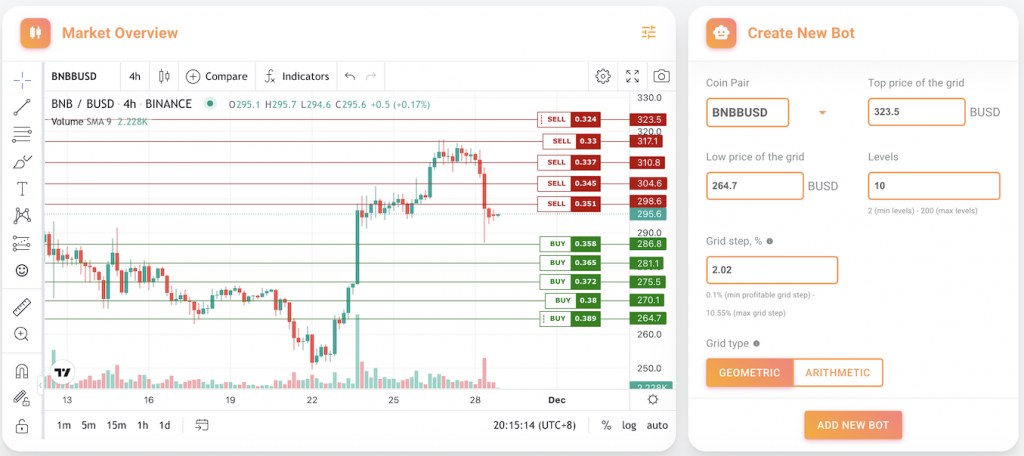

Grid bots use a method where orders to buy and sell are placed at fixed intervals above and below the current market price. A corresponding buy or sell order is placed whenever one buy or sell order is triggered. The goal of grid trading is to profit from small changes in the price of an asset.

Grid bots are great to profit during sideways market conditions. However, setting up a grid bot can be tricky, and there are a lot of factors to take into consideration:

- Upper and lower price of the grid: This is how wide the range the grid bot will cover. As a general rule, the wider the range the more likely the bot is to stay within the range and generate profit. However, wide-range grid bots produce smaller profits per transaction as the assets are distributed across the range. A narrow-range grid bot might make profit faster, but it is more likely to fall out of the range.

- Budget: The bot budget determines the total amount of quote currency the bot will manage. A higher-order amount will result in higher profits per order but also increases the risk of ending up with a sizeable “red bag” if there is an unexpected market downtrend. Most exchanges have a minimum order per trade, so the budget will determine the maximum levels the bot can manage. If you are trading in an exchange such as Binance, where the minimum value per trade is $10, then the budget of the bot will be around $10 x Levels.

- Grid spacing: The grid space is the distance between a buy order and its corresponding sell order. Narrow grid spacing results in more transactions but smaller profit per transaction. Wider grid spacing results in fewer transactions but more significant gains per transaction.

- Levels: The grid levels refer to how many buy and sell orders will be placed. For example, if you set the levels to 10, the bot will place five buy and five sell orders. As explained before, the maximum number of levels the bot can handle is directly correlated to the budget.

All of the above parameters are interdependent. A good rule of thumb to find the optimum parameters for your grid bot is to set your budget, find a decently wide upper and lower bound, and fit as many levels as possible. You should aim for 1-2% grid spacing when possible.

The importance of backtesting and paper trading

Backtesting tests trading strategies against historical market data to validate their performance and ensure they meet your trading goals. Paper trading (a.k.a. forward testing) uses virtual money to mimic real trading. While backtesting focuses on historical performance, paper trading executes the strategy in real-time.

Both backtesting and paper trading are great tools to help you make more informed decisions about which automated trading strategy to choose, as well as identify any potential errors and weaknesses before investing real capital.

How to choose the right bot platform for you

Choosing the right trading bot platform for your needs can be daunting. Hundreds of different options are available in the market, each with its features and capabilities. Before making a decision, research which bot platform is most suitable for your trading goals and risk tolerance. For a comprehensive list of crypto bot options and their features and prices, check Gainium’s crypto bot comparison.

Tips for successful trading with bots

When trading with automated crypto trading bots, here are some tips to help you get the most out of your automated trading experience:

• Make sure to keep up to date with market trends and news.

• Set realistic expectations for your trading returns, and avoid taking too much risk in pursuit of profits.

• Don’t forget to diversify your portfolio; use different strategies and coins.

• Monitor your automated trading bots regularly. Remember that crypto bots should be adapted to current market conditions.

• Only trade with an amount of money you can afford to lose.

By following these tips, you can maximize your crypto trading profits and minimize the risks associated with automated trading bots.

FAQs about crypto trading bots

1. Is automated trading legal?

Yes, automated trading is legal in most countries as long as you comply with local regulations and use an authorized automated trading bot.

2. Are automated trading bots profitable?

Yes, automated trading bots can be very profitable if used correctly. However, it is essential to remember that automated trading is still risky, and there are no guarantees of success.

3. How do I know which automated trading bot to use?

The best way to find an automated trading bot that suits your needs is to research different bots and their features. Additionally, make sure to compare the fees associated with each bot before you make a decision.

Conclusion

By understanding automated crypto trading bots and learning how to use them correctly, you can take advantage of trading opportunities in the cryptosphere. With a little effort and practice, automated trading bots can open up an exciting new world of profits for you. Good luck with your automated trading journey!

Disclaimer: This is a guest post. Coinpedia does not endorse or is responsible for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to the company.

Source: https://coinpedia.org/guest-post/the-beginners-guide-to-crypto-trading-bots/