- Thai SEC to close five crypto exchanges, citing unlicensed operations.

- Action affects Bybit, CoinEx, OKX, 1000X, and XT.COM.

- Regulation aims to prevent illegal use and protect investors.

Thailand SEC announces the closure of five cryptocurrency exchanges, including Bybit, OKX, and CoinEx, effective June 28, 2025, due to unlicensed operations. Legal actions will accompany the shutdowns.

The Thai SEC’s crackdown targets these exchanges to protect investors and curb illegal financial activities. This is part of wider regulatory enforcement in the country.

Thailand SEC to Shut Down Five Crypto Exchanges

The Thailand SEC detailed a shutdown order against Bybit, 1000X, CoinEx, OKX, and XT after identifying them as unlicensed business operators. The exchanges must cease operations by June 28, 2025. Accompanying lawsuits will address legal non-compliance under the Royal Decree on Technological Crime Prevention.

Immediate repercussions include restricted access to these platforms for Thai users post-deadline, with potential shifts in trading volume to licensed exchanges. Assets like BTC, ETH, and major altcoins may face disrupted trading within affected networks.

Public statements from the exchanges’ leadership regarding the SEC’s action are notably absent, though community reactions focus on concerns about asset migration and compliance. The SEC emphasized measures to prevent platforms’ misuse for money laundering and investor endangerment. As noted by the Thailand SEC, “To protect investors and prevent illegal platforms from being used for money laundering by criminals.” – Source

Crypto Market Faces Uncertainty: Potential Shifts and Legal Backdrop

Did you know? The Thai SEC’s decision mirrors strategies from India and China, where regulatory crackdowns realigned crypto exchange operations, leading to a migration to compliant platforms.

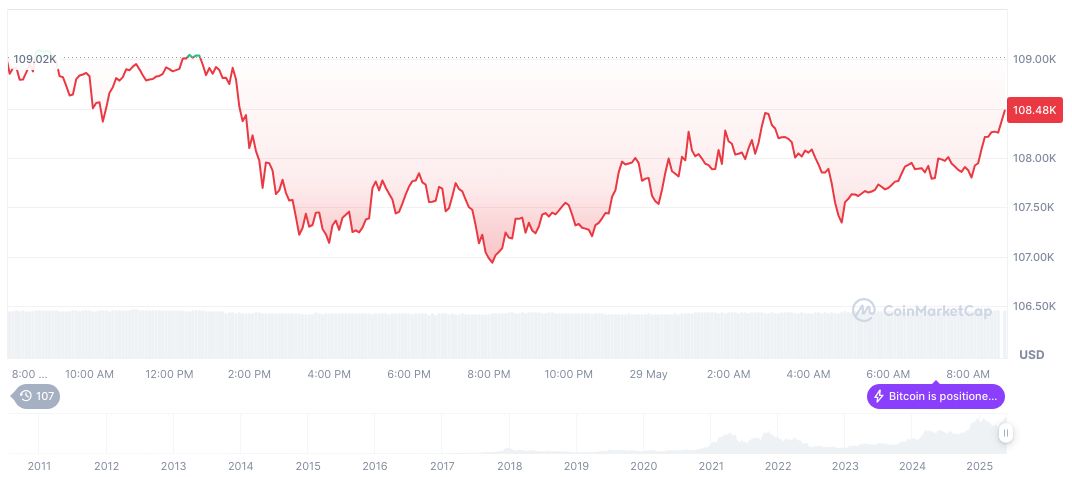

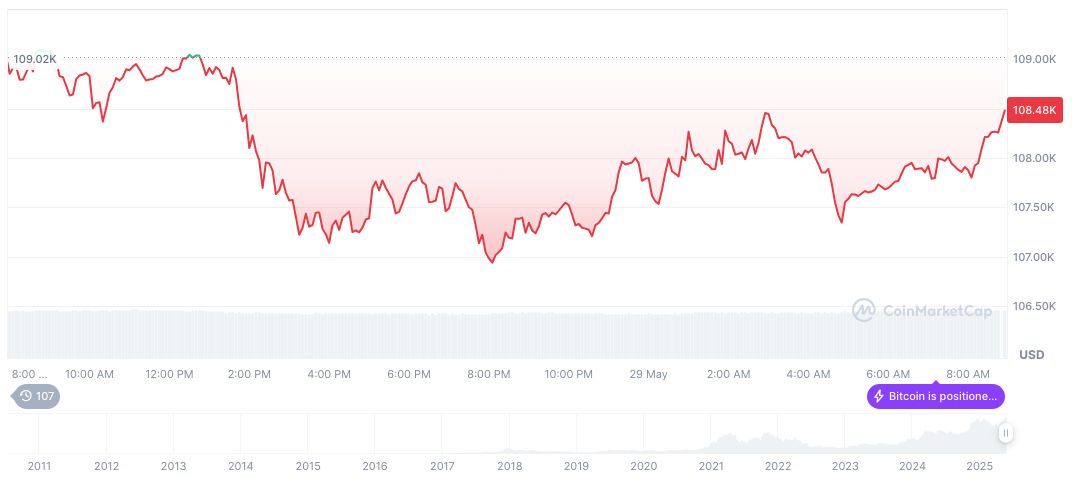

Bitcoin’s current standing on CoinMarketCap shows a trading price of $106,073.52, with a market cap of $2.11 trillion. Recent price fluctuations include a 1.49% decline over 24-hours and an 11.73% increase over 30 days, highlighting dynamic market responses.

Industry analysts suggest potential reallocation of trading activity towards exchanges compliant with local laws, possibly reshaping Thailand’s crypto landscape. Data shows historical patterns where regulatory actions elsewhere have spurred increased compliance and reshaped user trading behaviors globally.

Source: https://coincu.com/340626-thailand-sec-closes-crypto-exchanges/