- Tether’s investment in Crystal Intelligence enhances blockchain forensics.

- Investment aims to reduce USDT-linked crypto crimes.

- Market response yet to be confirmed by industry leaders.

Paolo Ardoino, CEO of Tether, announced a strategic investment in Crystal Intelligence to strengthen blockchain forensics. Although the investment amount remains undisclosed, it marks a significant step in tackling crypto-related crime.

The investment underscores Tether’s effort to safeguard the integrity of its USDT stablecoin in the face of rising crypto scams and frauds.

Tether Amplifies USDT Security with Crystal Intelligence Investment

Tether confirmed its strategic investment in blockchain forensics company Crystal Intelligence, enhancing capabilities to combat cryptocurrency crime. Paolo Ardoino, Tether’s CEO, emphasized their commitment to compliance and security. “We’re fully committed to enhancing compliance and security measures in the crypto space, doubling down on partnerships that harness advanced technology for effective monitoring.” This initiative focuses on curbing illegal usage of USDT, strengthening the company’s efforts in supporting law enforcement and ensuring financial security.

Immediate implications are expected to refine Tether’s compliance tools, focusing on the illegal use of USDT and other assets tracked by Crystal Intelligence. These enhancements are pivotal in the evolving regulatory climate where digital assets are under heightened scrutiny.

Market reactions remain measured, with industry leaders yet to provide public statements. Tether’s investment forms part of a larger trend of increasing cooperation between crypto firms and analytical solutions, with enhanced focus on regulatory compliance and security measures enhanced by AI-driven blockchain analysis.

USDT Holds Market Strength Amidst Compliance Focus

Did you know? Tether’s prior collaborations with law enforcement led to a notable increase in wallet blacklisting and seizure support during major enforcement actions, illustrating the crucial role of blockchain analytics in regulatory compliance.

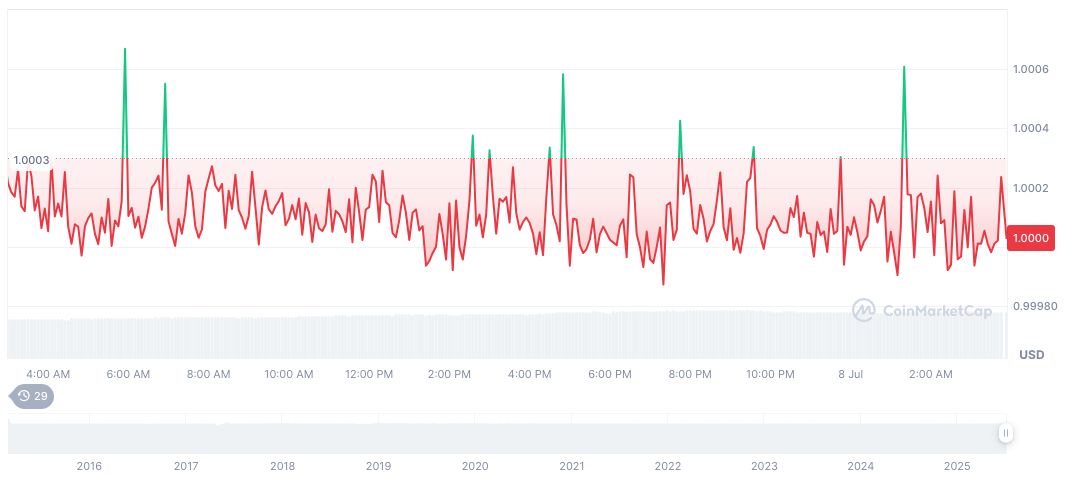

Tether’s USDT, trading at $1.00, maintains a 4.71% market dominance with a significant market cap of 158.69 billion dollars. Trading volumes reached 60.53 billion dollars, reflecting a 0.01% price decrease in 24 hours, according to CoinMarketCap.

Analysis from Coincu research highlights the potential for stricter regulatory measures and technology-driven tracking capabilities as outcomes of Tether’s association with Crystal Intelligence. The focus on blockchain security is expected to contribute to regulatory compliance advancements and secure digital finance environments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347595-tether-invests-in-crystal-intelligence/