- President Trump announced doubling tariffs on steel and aluminum imports.

- New tariffs effective June 4; aim to bolster U.S. steel industry.

- Industry experts express concerns over potential trade wars.

President Donald Trump will sign an executive order today to increase tariffs on steel and aluminum imports to 50%. The White House confirmed the new rates, set to take effect on June 4, amid discussions to boost domestic manufacturing.

Karen Leavitt, the White House Press Secretary, confirmed the tariffs’ immediate implementation.

Trump Announces 50% Tariffs on June 4 Effective Date

President Trump announced at a rally in Pittsburgh that tariffs on steel and aluminum imports would double to 50%. He stated that this move would secure the U.S. steel industry further. “We’re going to bring it from 25% percent to 50%—the tariffs on steel into the United States of America—which will even further secure the steel industry in the United States. Nobody’s going to get around that.” – Halifax City News

Changes due to this increase include heightened costs for imported steel and aluminum, which could affect various U.S. industries relying on these materials. The latest tariffs reflect the administration’s stance on leveraging trade policy for industrial gain.

Market reactions to this decision have been mixed. Industry stakeholders expressed concern over potential repercussions within global trade relations. Business leaders underline the risk of retaliatory measures by trade partners, influencing international markets. The U.S. administration’s recent public comments on Section 232 investigations were part of an ongoing strategy to reassess national security threats linked to imports.

Historical Context, Price Data, and Expert Analysis

Did you know? Steel industry insights suggest that tariffs were previously imposed at lower rates—25%—under prior administrations, primarily targeting surplus imports to spur local production.

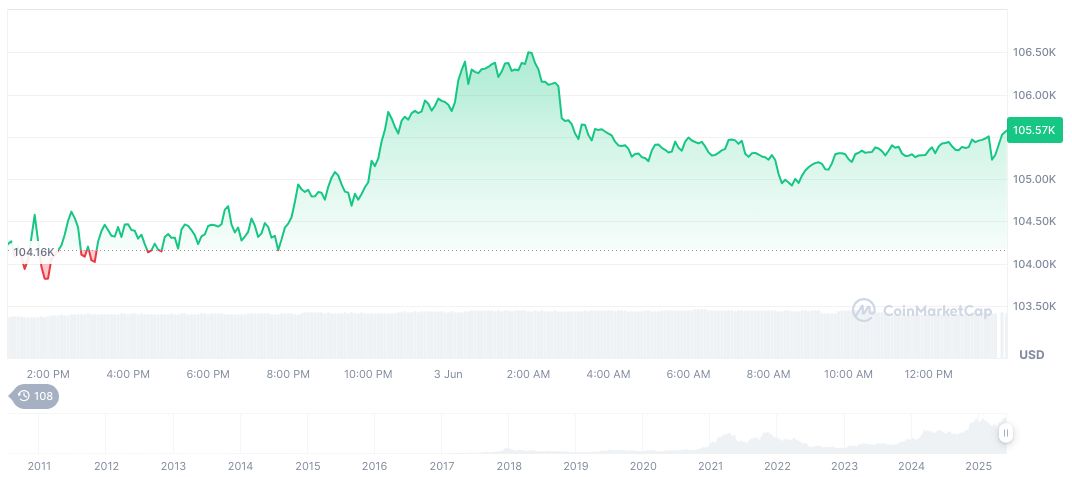

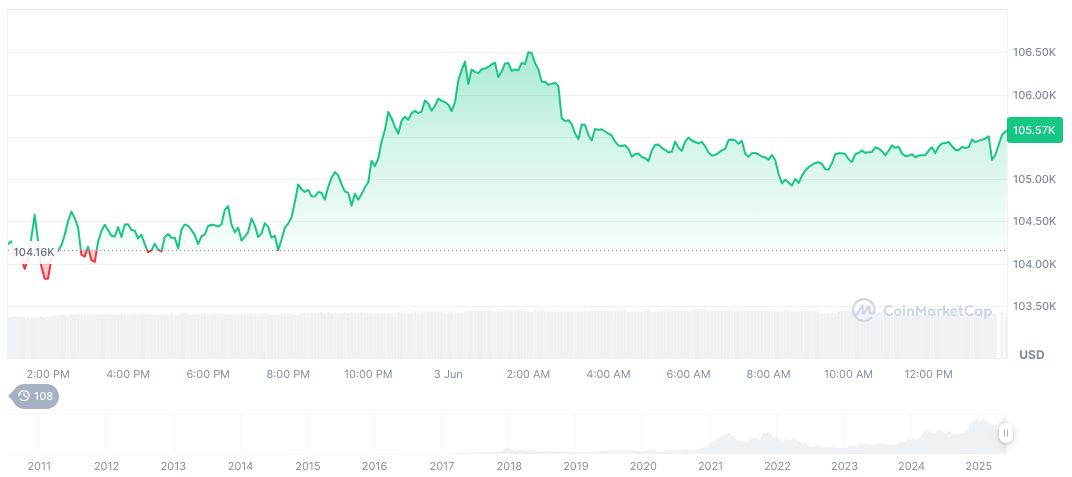

According to CoinMarketCap, Bitcoin (BTC) is priced at $105,794.25, with a market cap of 2,102,552,638,012 trillion and a dominance of 63.19%. Trading volume reached $47.30 billion, rising 7.83% over 24 hours. Price changes show 1.13% in the past day and 10.79% over the last month.

The Coincu research team suggests that the rise in tariffs may influence crypto markets by shifting investor focus towards decentralized assets as a hedge against traditional economic policies. Historical analysis shows similar patterns during heightened geopolitical tensions.

Source: https://coincu.com/341440-trump-steel-aluminum-tariff-impact-crypto/