- Sovereign wealth funds to become major players in Bitcoin and staking.

- Sovereign funds to drive energy balance in AI-driven futures.

- Staking yields could become a sovereign “digital dividend.”

Jamie Coutts, chief cryptocurrency analyst at Real Vision, suggests that sovereign wealth funds will increasingly hold Bitcoin due to the booming blockchain staking market.

This shift could economically stabilize nations, similar to 20th-century oil royalties, as blockchain revenues fund welfare programs in an AI-dominated era.

Sovereign Funds May Redefine Blockchain Staking Participation

Coutts has stated that sovereign wealth funds could dominate Bitcoin holdings, leveraging blockchain’s growth. Their incorporation into blockchain staking could mirror how nations used oil royalties to fund social programs in the 20th century.

The increasing role of sovereign wealth funds in the blockchain space could transform how countries derive significant income. This development could lead to widespread benefits for citizens through what Coutts terms as a sovereign “digital dividend.”

“The explosive growth of blockchain staking market capitalization means sovereign wealth funds, tasked with protecting national prosperity, will become the largest holders of Bitcoin and related industries in the future… Staking returns could evolve into a sovereign ‘digital dividend’ redistributed to citizens.” – Jamie Coutts, Chief Cryptocurrency Analyst, Real Vision

Sovereign Funds’ Crypto Strategy Under Scrutiny

Did you know? Norway’s Oil Fund model has significantly contributed to citizen dividends, offering a historical parallel to Coutts’ sovereign “digital dividend” proposal.

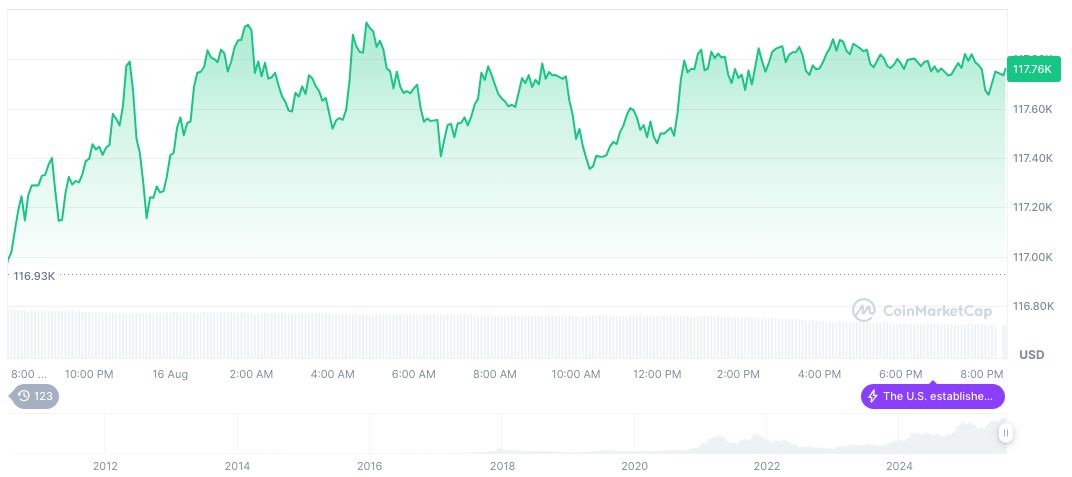

Bitcoin’s current market data reflects a price of $118,061.49, with a market cap of 2.35 trillion and 24-hour trading volume down 27.57% according to CoinMarketCap. Prices have seen a 15.40% rise over 90 days, demonstrating strong market resilience.

Coincu research suggests that if sovereign wealth funds actively engage in blockchain staking, the financial landscape could witness profound shifts. Technological and regulatory advancements will be critical in enabling such large-scale institutional participation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/sovereign-wealth-funds-crypto-holdings/