- The Financial Supervisory Service directs South Korean managers on ETF crypto exposure.

- 14.59% of ACE US Stock Best-selling ETF in Coinbase.

- Possible reduced investment in crypto-related equities.

South Korea’s Financial Supervisory Service (FSS) has issued verbal guidance to domestic asset managers, mandating the limitation of crypto-related stock exposure, particularly those holding companies like Coinbase, within ETFs.

The Financial Supervisory Service of South Korea has advised domestic fund managers to avoid increasing crypto-related stocks in their ETFs following the 2017 “Emergency Measures for Virtual Currency.” This measure underscores the government’s continued cautious stance towards crypto assets.

South Korea Limits Crypto Stocks in ETFs to Mitigate Risks

South Korea’s guidance targets a reduction in risk exposure to crypto stock holdings, such as Coinbase, within ETFs. These changes are pivotal for aligning traditional financial products with existing regulations governing virtual assets. According to the Financial Services Commission, the current guidance aims to “limit the indirect risk of domestic investors to the volatility of virtual assets.”

While official channels from Korean regulators such as the FSS and Financial Services Commission have yet to address these changes publicly, significant attention remains on future crypto ETF approvals and policy shifts as the market observes potential impacts. President Lee Jae-myung stated, “Under my administration, we are committed to modernizing digital capital markets with initiatives that include the approval of spot crypto ETFs and the introduction of a won-based stablecoin.”

Coincu research suggests South Korea’s measures may drive tighter ETF composition management, signaling more conservative strategies for mitigating potential market volatility. Historical data indicates a trend towards regulatory conservatism, reflecting a broader global sentiment in crypto asset oversight. This is much like the ongoing review with the SEC’s position on Singapore Exchange and their potential Bitcoin Perpetual.

2017 Regulations Still Shape South Korean Crypto Strategies

Did you know? The 2017 “Emergency Measures for Virtual Currency” still governs South Korean institutional crypto interactions, reflecting a persistent cautious regulatory approach.

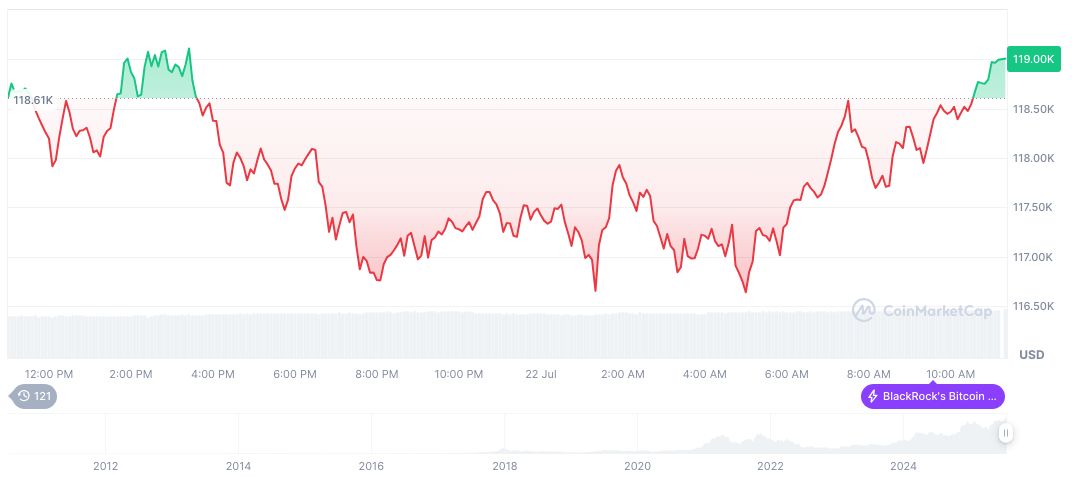

Bitcoin (BTC) reports a current price of $119,649.08, with a market cap of $2.38 trillion and a 60.10% dominance. Its market activity includes a 24-hour trading volume of $76.72 billion, showing a 1.51% price increase. Recent 30-day data indicates an 18.51% uptick. CoinMarketCap data as of July 23, 2025.

Recent 30-day data indicates an 18.51% uptick. CoinMarketCap data as of July 23, 2025.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/350234-south-korea-etf-crypto-restriction/