- South Korea requires crypto sale disclosures in real estate transactions for transparency.

- Aims to prevent illicit capital in real estate.

- Potentially boosts legitimacy of crypto-derived profits.

The South Korean government revised real estate transaction regulations on September 8th, mandating full disclosure of funds from virtual asset sales for home purchases.

This move aims to enhance transparency and prevent illicit capital inflows into the real estate market, potentially affecting cryptocurrencies commonly used in substantial transactions.

New Crypto Disclosure Rules Reshape South Korea’s Real Estate Market

The revised regulations stipulate mandatory reporting of proceeds from virtual asset sales in real estate financing plans. Ministries, including Finance, Land, and Transport, are responsible for joint implementation. Supporting documentation for transactions is obligatory. This initiative targets transparency, decreasing the chances of illegal capital infiltration into the real estate market.

Immediate implications suggest a tougher barrier for illicitly sourced cryptocurrency funds to penetrate real estate. Legitimate use of crypto-derived funds is acknowledged as owned capital for property purchases, potentially reinforcing the legitimacy of digital assets within the legal economy.

Financial Services Commission Statement

“Stricter enforcement targets tax evasion and forced liquidations, as South Korea positions itself as a global digital asset regulation leader.”

Market reactions to this announcement have been measured. Both the Financial Services Commission and the Korea Financial Intelligence Unit oversee compliance, ensuring integrity in finance regulations. No immediate statements from key industry figures have surfaced thus far regarding these rules.

South Korea’s Crypto Policies Echo Global Financial Trends

Did you know? South Korea’s move to include cryptocurrencies in real estate finance plans resembles earlier measures targeting cash transactions to enhance fund transparency.

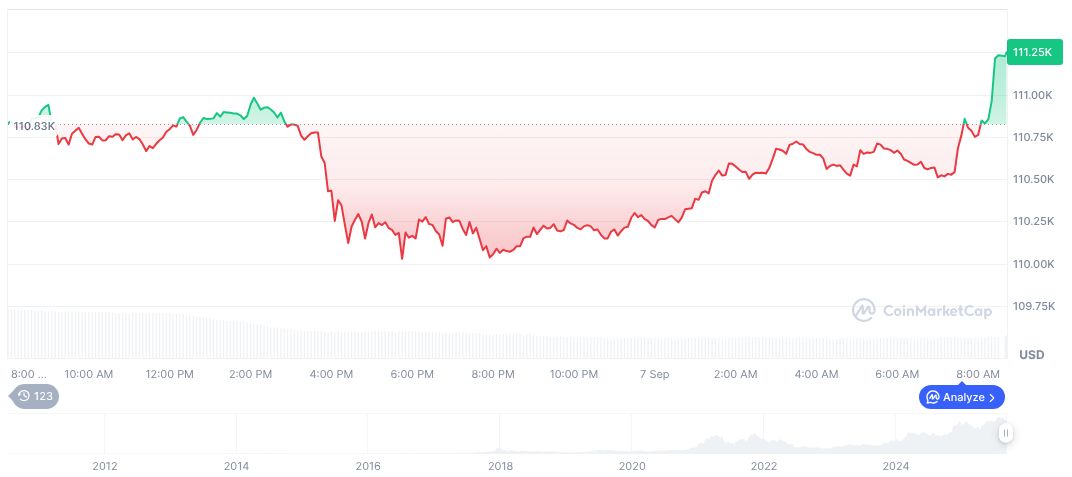

Per CoinMarketCap, Bitcoin (BTC) trades at $110,845.03 with a market cap of $2.21 trillion. BTC’s price shifted 0.27% over 24 hours, with a 90-day change of 1.28%, highlighting volatility amidst recent policies affecting crypto flows globally.

Coincu researchers suggest these rules could prompt increased adoption of crypto compliance frameworks. Such regulatory moves are steps toward international standards for asset disclosure, leveraging South Korea’s comprehensive approach to digital finance oversight.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/south-korea-crypto-real-estate/