- The Solana price shows a V-top reversal from the $146 region, signaling the continuation of short-term consolidation trend.

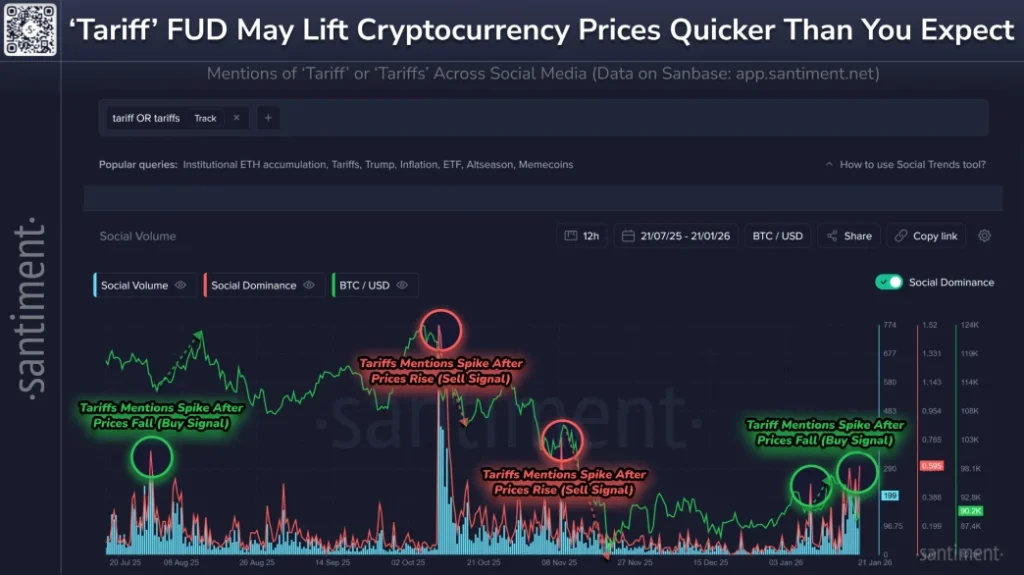

- Cryptocurrency communities recorded their highest tariff-related discussion volume in three months across X, Reddit, and Telegram.

- The momentum indicator RSI at 44% accentuated a neutral to bearish sentiment among market participants.

SOL, the native cryptocurrency of Solana ecosystem, witnessed a nearly 3% increase during Wednesday’s U.S. market hours to trade at $130. However, the buying pressure aligns with broader market relief rally but gained traction as President Donald Trump revoked its revised tariffs on eight European nations. However, the heightened discussion on tariff across social media platforms has often resulted in a notable downfall in the crypto market.

Crypto Tariff Talks Surge as Trump Drops EU Trade Threats

Cryptocurrency communities have experienced the highest number of discussions on tariffs over the last three months, according to the amount of activity on platforms such as X, Reddit, and Telegram. The surge is directly linked to a revived geopolitical conflict over the U.S. trade policy.

Approximately three hours prior to the most recent update, President Donald Trump confirmed that he would withdraw intended tariffs on eight European countries- Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland. Their purpose was to initiate these measures at 10 percent on February 1 and at 25 percent on June because of disagreement over U.S. ambitions in Greenland, an autonomous Danish region.

Trump told reporters that he had reached an outline of a future agreement on Greenland and the wider Arctic after meeting with NATO Secretary General Mark Rutte at Davos. He said that the knowledge eliminated the necessity of the tariffs.

The cryptocurrencies responded by an increase in price, with Bitcoin temporarily rising to above 90,000 after falling amid earlier uncertainty. The action followed a trend of the last few months: the more tariffs are mentioned, the more the market falls, sometimes leading to short-term recoveries and additional declines based on the overall tone.

The online crypto discussions surged during the tariff-related headlines as a sign of the persistent sensitivity to the United States policy changes and their subsequent impact on digital assets.

Solana Price Poised for 8% Drop Before Major Support Test

Over the past week, the Solana price witnessed a notable drawdown from $148.7 to $130, registering a loss of 15.8%. This pullback shows a second reversal from the $147 resistance area for the second time in two months, signaling a potential sideways trend in the market.

The price consolidation between $147 and $168 accentuates market uncertainty and lack of initiation from buyers or sellers.

Despite an intraday gain, the exponential moving average 20 and 50 could act as headwind against buyers and revert the price to lower level. If the bearish momentum persists, the SOL coin will plunge 8.42% and retest a long-coming support trendline at $119.

Since February 2024, the ascending triangle has acted as an active accumulation zone for buyers to recoup their bullish momentum. If the support holds again, the Solana price could rebound fast and challenge the overhead trendline as shown in the chart below.

The descending trendline acts as the key dynamic resistance that carries the current downtrend in SOL. A potential breakout from this barrier will be key to drive a sustainable recovery in price.

Source: https://www.cryptonewsz.com/solana-tariff-flood-crypto-social-media/