Sei Network is catching traders’ attention after breaking out of a long-term falling wedge pattern, a setup often associated with powerful bullish reversals.

The move marks a key technical milestone for the Layer-1 blockchain, suggesting that momentum could be shifting in favor of buyers after months of compression and lower volatility.

Breakout From Falling Wedge Sparks Reversal Hopes

In a recent post on X, analyst Bitcoinsensus highlighted that the asset has officially broken out from a massive falling wedge on the weekly timeframe, a formation that typically signals trend exhaustion followed by a bullish reversal. After months of declining highs and consistent compression, SEI’s breakout through the upper trendline represents a major technical shift.

Source: X

The chart shared by the analyst illustrates a clean breakout followed by a pullback retest, where price briefly returned to the wedge resistance (now acting as support) before bouncing back upward. This behavior reinforces the validity of the pattern and strengthens the case for continued upside momentum. According to Bitcoinsensus, the next technical target sits around $1.15, suggesting significant upside potential if the token maintains its bullish structure.

Market Data: SEI Faces Volatility as Price Pulls Back

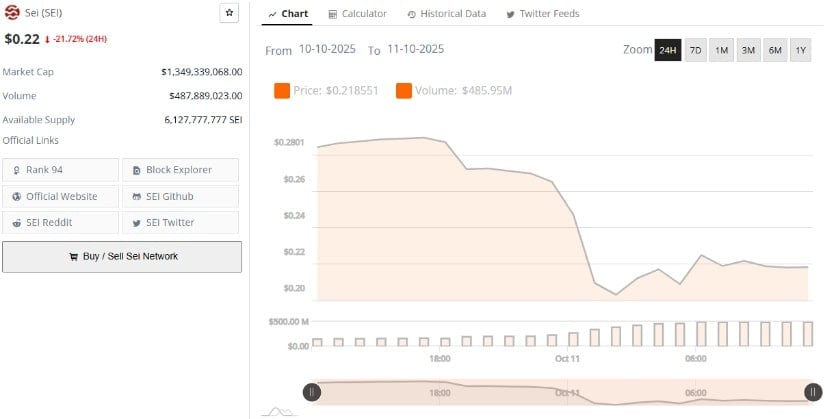

According to BraveNewCoin data, SEI is currently trading around $0.22, reflecting a sharp 21.7% decline over the past 24 hours. The correction follows several weeks of increased volatility as traders digested the breakout and adjusted to changing market dynamics. Despite the pullback, the coin’s market capitalization remains strong at $1.34 billion, supported by $487 million in daily volume, signaling that participation remains active even amid profit-taking.

Source: BraveNewCoin

This decline could represent a healthy technical retest rather than a full reversal, aligning with the classic post-breakout pullback behavior often seen in wedge formations. Analysts view this dip as part of the natural cycle of consolidation before continuation, with bulls likely to step in if the asset maintains its structure above key support levels.

Key Support Levels Define Next Steps for The Asset

Technical analyst Lennaert Snyder added that SEI has found strong support around the $0.26 range, calling it a critical zone for maintaining bullish structure. Snyder notes that the token is currently “trading within range until invalidated,” highlighting the ongoing tug-of-war between buyers defending support and sellers reacting to recent volatility.

Source: X

According to Snyder, deeper retests near $0.264 could provide favorable long entries if the price rebounds with confirmation of strength. Conversely, a breakdown below this region would expose the coin to a test of the $0.22 support, where demand has previously emerged. This framework offers traders clear levels to monitor for directional clarity.

Market watchers agree that the crypto’s near-term trajectory depends on whether it can preserve its higher-low structure and build momentum above the mid-range. A confirmed rebound above $0.30 could reignite momentum and potentially validate the broader breakout narrative outlined by Bitcoinsensus. For now, consolidation within this range may be healthy, allowing the market to absorb profit-taking while setting the stage for a more decisive advance.