- SEC Chairman Paul Atkins declares U.S. lag in crypto; prioritizes new frameworks.

- Framework goals include encouraging innovation and reversing talent loss.

- Industry leaders see potential market reshaping from regulatory clarity.

SEC Chairman Paul Atkins addressed the U.S. crypto regulatory gap at an October 2025 event in Washington D.C., highlighting the decade-long lag in oversight.

Atkins calls for robust frameworks to attract innovators back to the U.S., aiming to enhance competitive advantage and spur domestic crypto market growth.

SEC Framework to Bridge Decade-Long Regulatory Gap

SEC Chairman Paul Atkins emphasized the United States’ lag in cryptocurrency oversight, estimating a gap of about a decade compared to global peers. The SEC aims to create a robust regulatory framework to foster innovation and enable those who departed the U.S. to return. In collaboration with U.S. Senate Finance Committee members and industry experts, discussions covered digital assets, financial surveillance, and market structures. Atkins highlighted the need for a framework to encourage growth within the crypto industry and noted that recent findings underscore this imperative. “U.S. regulators recognize a substantial lag in crypto oversight and are prioritizing frameworks to revitalize domestic innovation and competitiveness.” – Paul Atkins, SEC Chairman

The changing landscape calls for new regulatory frameworks to stimulate domestic crypto innovation and stem talent losses to more favorable markets. Noteworthy objectives include clear regulatory lines, disclosure frameworks, realistic registration paths, and targeted enforcement. Stakeholders from Coinbase and the SEC Crypto Task Force are actively involved in refining these frameworks.

Market reactions have been mixed. Some industry leaders welcomed the focus on innovation as overdue, while others express concern about potential regulatory overreach. SEC Commissioner Hester M. Peirce noted the importance of policies that enable Americans to protect their privacy and support emerging financial technologies.

Historical Context and Potential Market Impact

Did you know? In January 2025, the approval of Bitcoin and Ethereum ETFs led to significant price increases and broader market activity. The current SEC actions could stimulate similar effects in listed altcoins, inviting renewed investor interest.

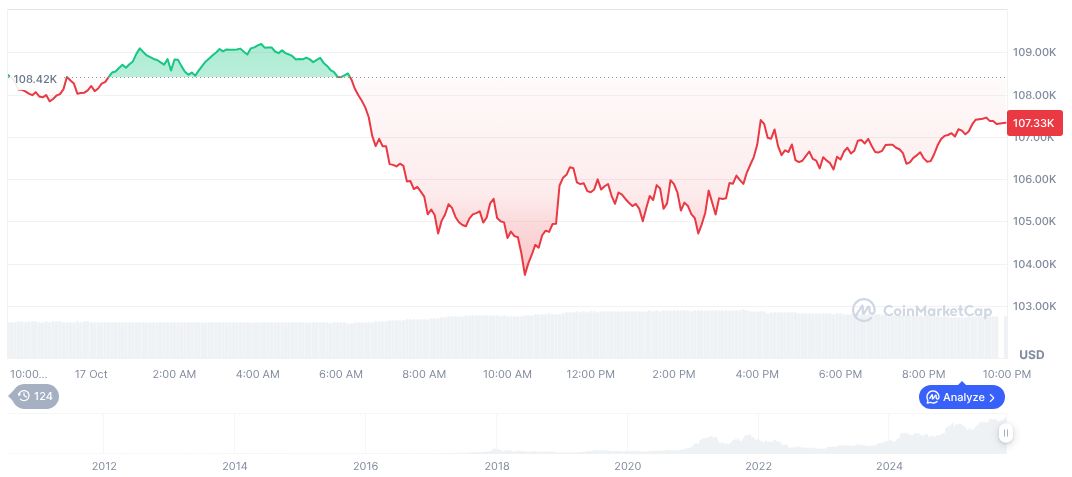

Bitcoin’s market cap stands at $2.13 trillion, with a trading volume of $78.30 billion, reflecting a 1.90% 24-hour price uptick. It shows price changes of -4.32% over the past 7 days and -8.84% over 30 days, according to CoinMarketCap. The circulating supply approaches its maximum of 21 million.

Coincu’s research highlights potential benefits from this regulatory focus, including increased market participation and enhanced transparency. Historical trends suggest positive price impacts from regulation-driven clarity, which markets may welcome, potentially limiting volatility in the longer term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sec-crypto-framework-innovation-boost/