- SEC approves in-kind ETP processes for Bitcoin and Ethereum.

- Shift aligns crypto ETPs with mainstream assets.

- Institutional benefits anticipated with lower investor costs.

The U.S. Securities and Exchange Commission has approved in-kind creation and redemption mechanisms for Bitcoin and Ethereum ETPs, aligning them with mainstream commodity ETPs.

This regulatory shift enhances market efficiency, reduces costs, and is expected to increase participation among institutional investors.

SEC Aligns Crypto ETPs with Traditional Commodities

The SEC’s decision to permit physical subscriptions and redemptions for crypto ETPs marks a notable shift. This change allows Bitcoin and Ethereum products to function similarly to commodity ETPs, enhancing efficiency and lowering expenses.

The approval’s financial implications include increased liquidity and retention of value in ETPs, a benefit to both retail and institutional investors. The shift is likely to attract more institutional players, leveraging the reduced operational complexity.

I’m pleased to share the SEC approved in-kind creations and redemptions for crypto ETPs. The approvals continue to build a rational regulatory framework for crypto, leading to a deeper and more dynamic market, which will benefit all American investors. – Paul S. Atkins, Commissioner, SEC, Twitter, July 29, 2025

Paul S. Atkins highlighted the importance of creating a structured market, which should encourage broader adoption and investor participation. While his statement captures a positive outlook, reactions from other prominent industry figures were not immediately available.

Bitcoin Price Surges 24% Amid Regulatory Advancements

Did you know? In 2025, the regulatory shift that allowed in-kind creation for crypto ETPs was considered pivotal, marking the U.S. crypto market’s first integration of mechanisms traditionally reserved for commodity ETPs.

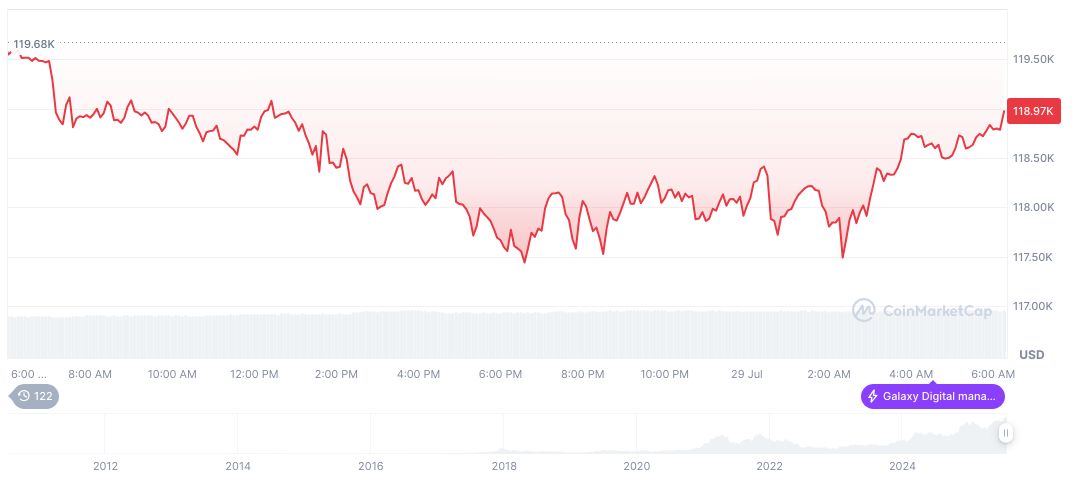

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $118,019.62, with a market cap surpassing $2.35 trillion. The cryptocurrency shows a price increase of 24.45% over the past 90 days, reinforcing its position as a dominant asset with a circulating supply of over 19.89 million BTC. Last updated at 02:58 UTC on July 30, 2025, these figures highlight the crypto’s sustained market influence.

The Coincu research team suggests ongoing regulatory advancements and clearer guidelines will likely facilitate higher institutional involvement in the crypto sector. Data-driven insights also predict increased market volumes, fostering adoption and liquidity in line with traditional asset classes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sec-approves-crypto-etp-mechanisms/