- SEC and CFTC joint statement supports crypto asset trading on registered exchanges.

- Regulatory clarity aims to facilitate transparent trading venues.

- Focus on BTC and ETH for enhanced market participation.

On September 2, 2025, the SEC and CFTC jointly announced in the U.S. a collaborative effort to regulate specific spot crypto assets on registered exchanges.

The move could refine trading transparency and boost market confidence, potentially influencing investment strategies amid cautious optimism without specific crypto assets immediately identified.

U.S. Regulators Signal Support for Crypto Trading Transparency

Market response remains cautious as traders and investors consider the implications of this regulatory clarity. While the statement does not directly impact laws, it signals a supportive stance from regulators on crypto markets. Paul Atkins, SEC Chairman, stressed the importance of allowing market players the freedom to select trading platforms.

Community reactions among industry figures, including exchange operators and legal experts, show tentative optimism. Caroline Pham, Acting Chairwoman, CFTC, remarked, “The statement highlights our common goal of supporting the growth and development of these markets, and this will not be the last.” This development could lead to an increase in investor confidence, especially in the spot markets.

Did you know? The ongoing collaboration between the SEC and CFTC follows a historical pattern of regulatory coordination, reminiscent of joint initiatives seen during previous major financial reforms.

Bitcoin Dominance and Expert Views on Regulatory Clarity

Did you know? The ongoing collaboration between the SEC and CFTC follows a historical pattern of regulatory coordination, reminiscent of joint initiatives seen during previous major financial reforms.

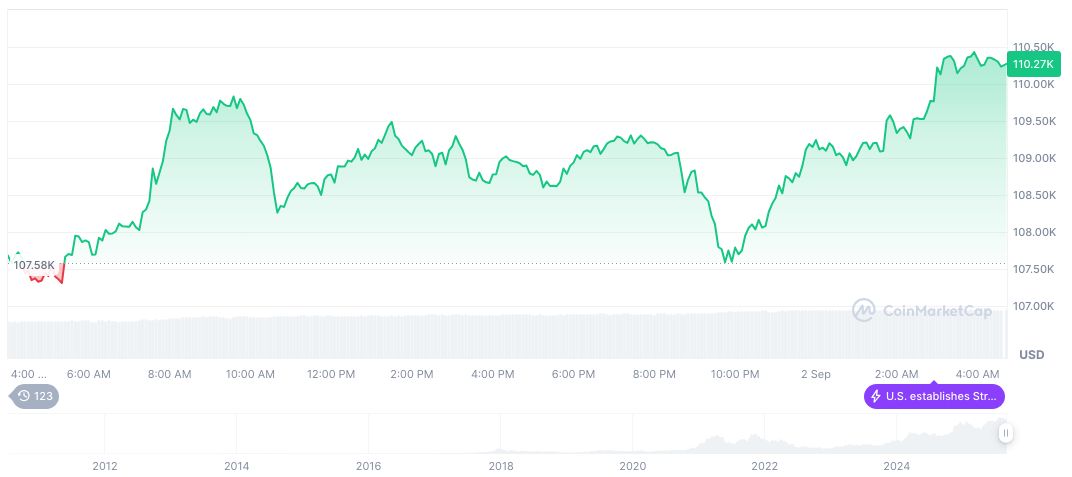

Bitcoin (BTC), priced at $111,090.60 as of September 2, 2025, has a market cap of $2.21 trillion and dominates 57.78% of the market, according to CoinMarketCap. Its trading volume stood at $75.47 billion, marking a 12.51% change. BTC saw slight recent fluctuations; 24-hour up 2.32%, month drop of 2.86%.

The Coincu research team anticipates that regulatory clarity may fuel greater institutional participation in spot markets, notably benefiting BTC and ETH. This collaboration may accelerate the adoption of new financial technologies, ushering in potential long-term market stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sec-cftc-crypto-trading-rules/