- Santander’s Openbank seeks EU crypto license for digital services expansion.

- License aims for stablecoin and retail crypto service launch.

- Potential shift in euro and dollar-denominated stablecoin landscape.

Santander’s digital bank Openbank has applied for a crypto license under the EU MiCA framework, aiming to expand digital asset services, including stablecoins, by year-end. This move positions the bank alongside peers like BBVA and Société Générale in the emerging regulated crypto markets.

The initiative could strengthen Santander’s role in the digital finance landscape, providing retail customers enhanced access to stablecoin products. “As of this update, there are no public statements from Santander’s leadership on company-owned platforms or verified social media.”

Openbank’s Strategic Move Toward Stablecoin Integration

Santander’s Openbank is evaluating the feasibility of introducing euro and dollar stablecoins, considering both in-house development and integration of existing solutions. The bank, Spain’s largest financial institution, has a history of fintech innovation and blockchain engagement.

This strategic move could mark a significant shift in the regulated stablecoin market within Europe. Openbank looks to leverage MiCA regulatory compliance, potentially launching these services across Spain, Portugal, Germany, and the Netherlands.

Market reactions remain muted as no official press releases or leadership comments are currently available. The broader crypto community, including renowned experts and institutions, awaits further developments and official statements from Santander.

Institutional Trust and Retail Adoption Under MiCA

Did you know? Previously, BBVA and Société Générale have paved the way for regulated bank-issued stablecoins, signaling increasing institutional interest in secure digital asset integration.

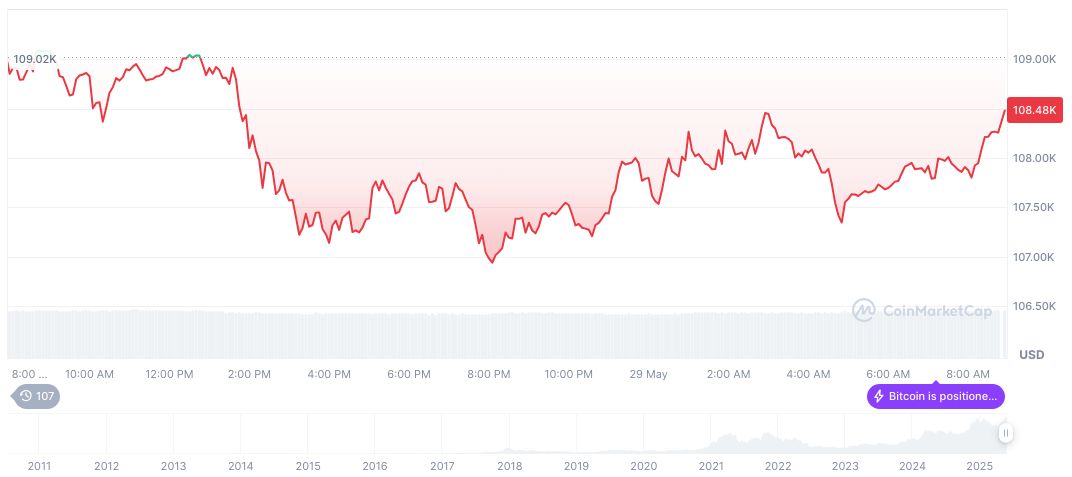

Bitcoin (BTC) stands currently at $106,132.99, as reported by CoinMarketCap. The market capitalization has reached $2.11 trillion, holding a dominance of 62.72%. BTC saw a 24-hour trading volume at approximately $55.62 billion, reflecting an 11.87% change within this span.

The Coincu research team highlights the potential for enhanced institutional trust and retail adoption of regulated stablecoins under MiCA. Regulatory clarity could lead to increased integration of stablecoins with traditional financial systems, providing valuable market stability.

Source: https://coincu.com/340567-santander-openbank-eu-crypto-license/