- Ric Edelman increases recommended crypto allocation to 40%, citing market evolution.

- Crypto assets show higher returns and portfolio diversification benefits.

- Confidence rises as regulatory risks diminish and technology matures.

Ric Edelman, chairman of Digital Assets Council of Financial Professionals (DACFP), has increased his recommended cryptocurrency portfolio allocation to 10-40%, up from 1% four years ago. This announcement was made during an interview on June 28, according to CNBC.

Edelman cites significant advancements in the regulatory landscape, technology adoption, and consumer acceptance as reasons for revising his investment strategy. Crypto assets have demonstrated diversification benefits and high return potential.

Ric Edelman Recommends 10-40% Crypto Allocation

Ric Edelman, a prominent financial advisor, now advises allocating 10% to 40% of investment portfolios to cryptocurrencies. This shift from a conservative 1% recommendation reflects increasing confidence in the crypto market. Edelman’s change stems from resolved concerns about regulations, technology obsolescence, and market acceptance. He stated, “The regulatory environment for crypto has stabilized.”

The newly suggested allocation highlights the non-correlated nature of crypto assets like Bitcoin and Ethereum to traditional asset classes such as stocks, bonds, and commodities. Edelman’s recommendation aims to integrate cryptocurrencies into modern investment strategies. Market experts agree that such a reallocation underscores the maturation of digital currencies.

Market reactions indicate positive sentiment, with financial advisors and investors taking notice of Edelman’s new stance. Institutional interest in crypto continues to rise as advisors assess the long-term viability of crypto holdings. Edelman also emphasized that portfolios including crypto often outperform those without.

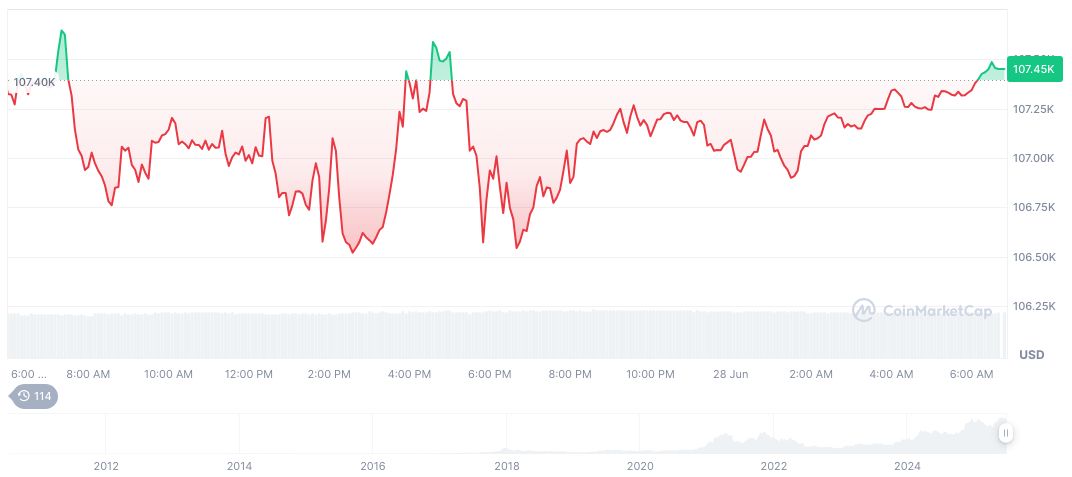

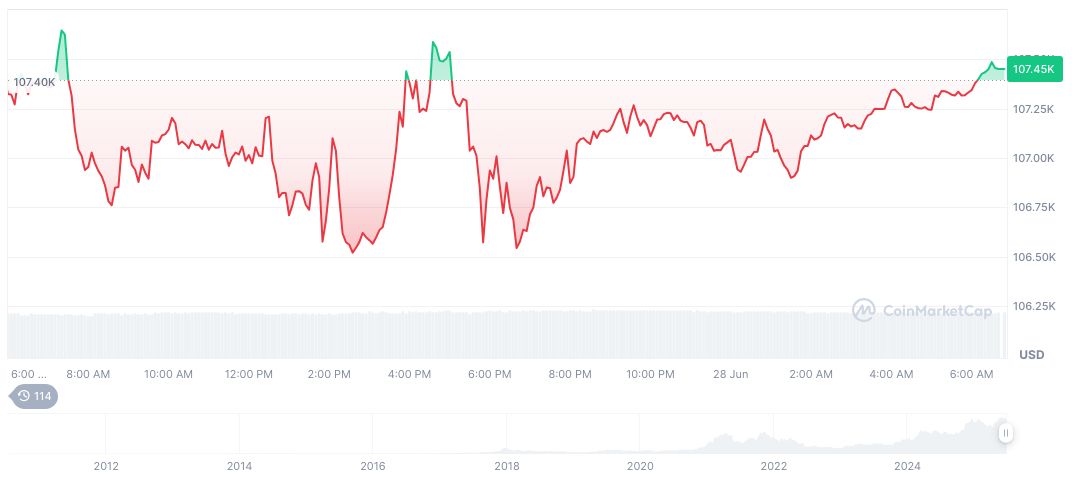

Bitcoin Shows Strong 28.83% Rise Over 90 Days

Did you know? Historically, many financial advisors echoed Ric Edelman’s conservative 1% allocation in crypto, but increasing institutional involvement and technological advances have led to recommendations now reaching up to 40%, demonstrating a significant shift in confidence.

According to CoinMarketCap, Bitcoin (BTC) holds a price of $107,312.44 and a substantial market capitalization of $2.13 trillion. It shows a robust 28.83% price rise over 90 days and a trading volume of $39.74 billion in the last 24 hours. Recent performance indicates a gradual recovery, with a slight 0.16% increase over the past 24 hours and a 3.32% spike over the last 7 days, reflecting growing investor interest.

Research by Coincu indicates that mature crypto markets can offer long-term diversification and growth. The evolution of regulatory clarity and technological robustness aligns with Edelman’s advice, providing new opportunities for portfolio innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345693-ric-edelman-crypto-investment-guidance/