After facing strong resistance at $61,300 levels this week, the Bitcoin price tanked all the way under $57,000 on Thursday before recovering partially. All eyes will be on Friday’s Bitcoin options expiry which suggests a tight fight between the bulls and bears currently.

Bitcoin Options Expiry and Easing Market Volatility

On Friday, August 16, a total of 24,000 Bitcoin options are set to expire with a put call ratio of 0.83 a notional value of 41.4 billion, and a max pain point of $59,500. This put-call ratio which is close to 1 shows that the bulls and bears are having a tough fight among themselves. As of press time, the Bitcoin price is trading 5% down at $58,077 with technical indicators hinting at a BTC price drop to $54,000.

The current options expiry represents only 10% of the total open positions currently in the market, with upcoming August, September, and December positions accounting for just over 20% each. Thus, the options term distribution remains relatively balanced and has strong resilience. The options market hints at easing crypto market volatility in the future which shows that the market could be entering a more stable phase.

Along with Bitcoin options, a total of 184,000 Ethereum (ETH) options are expiring today with a put-call ratio of 0.80, a notional value of $470 million, and a max pain point of $2,650. The Ethereum price is also facing some selling pressure down 3.47% at press time and trading at $2,587.96 with a market cap of $311 billion.

Macro Tailwinds Block the Bitcoin Rally

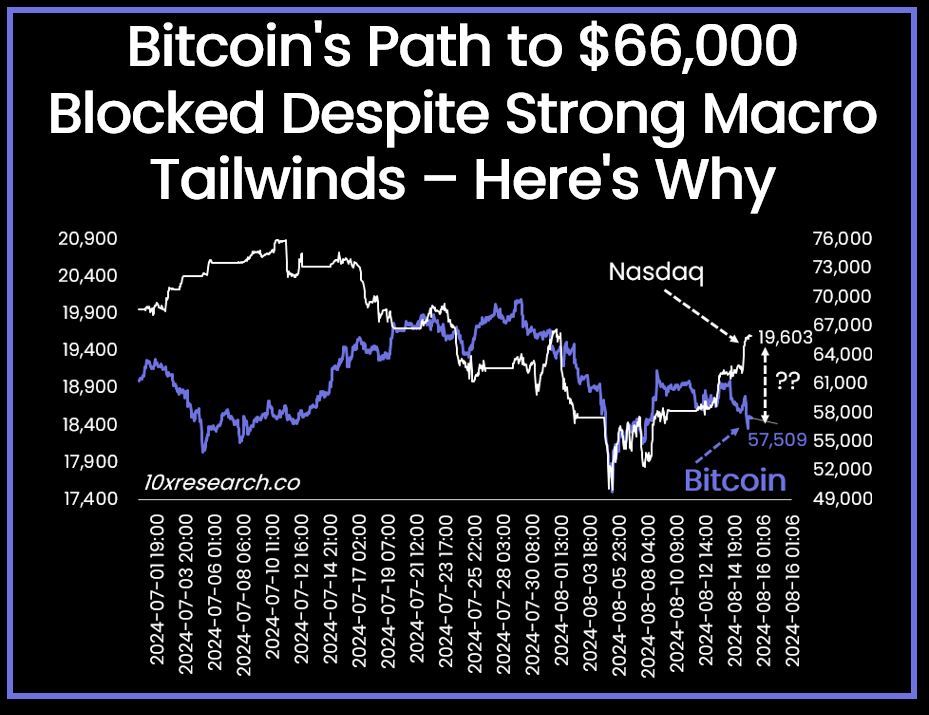

Despite the cooling CPI inflation data, Bitcoin bulls have failed to regain strength during the current market volatility facing strong rejections at $61,300 levels. 10x Research noted that the macro tailwinds have been preventing the Bitcoin rally to $66,000 with traders staying confused amid the strong disconnect between US tech stocks and the underperformance of the crypto market.

As per the report from 10x Research, Bitcoin could retreat into the trading zone between $50,000 and $60,000. On the upside, BTC is facing strong resistance in the range between $60,000-$61,000. This potential slowdown might also give oversold technical indicators a chance to reset, raising the likelihood of Bitcoin retesting its August 5 low near $50,000—a move that could catch many investors by surprise.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/bitcoin-options-expiry-put-call-ratio-signals-easing-crypto-market-volatility/

✓ Share: