- Pure Crypto aims to initiate a fourth fund, anticipating a major growth phase.

- Pure Crypto’s first fund appreciated around 1000%.

- The fund’s strategy will prioritize partnerships in blockchain initiatives.

Pure Crypto, based in Chicago, plans to raise its fourth fund, anticipating a “last great boom” in cryptocurrency, as reported by its founder Jeremy Boynton and managing partner Zachary Lindquist.

This move potentially signals the final opportunity for venture capital returns in crypto before it becomes mainstream, prompting shifts in market strategies and investment focuses.

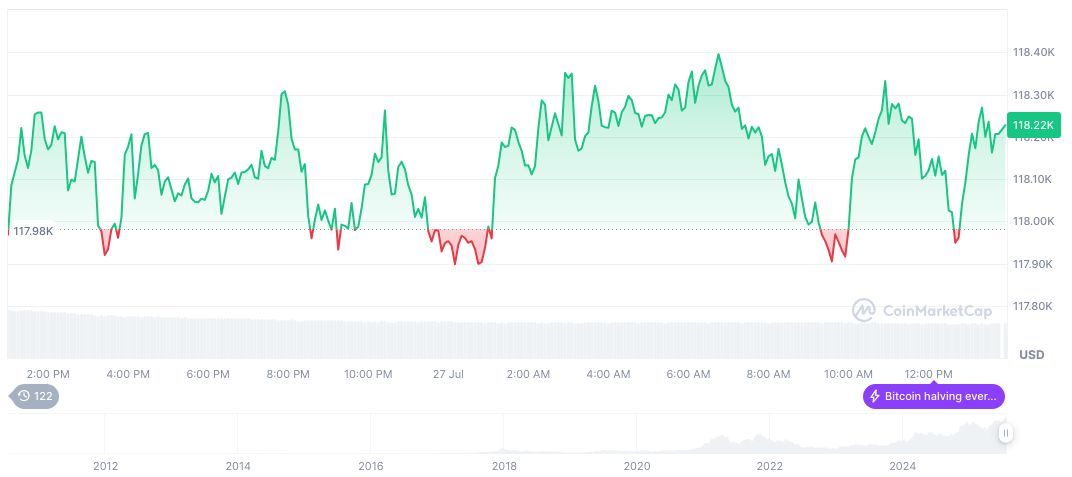

Bitcoin Surges 26.42% as Market Awaits Crypto Infrastructure Investments

Pure Crypto’s plans for a fourth fund highlight their anticipation of a substantial potential boom in the cryptocurrency sector. Jeremy Boynton and Zachary Lindquist emphasize the opportunity for sizable returns before the sector’s mainstream adoption. The fund currently manages approximately $100 million in assets. The new strategy aims to shift focus from speculation to tangible blockchain applications.

Within the community, Pure Crypto’s announcement did not immediately spark significant reactions among leading industry figures. However, Boynton’s remarks about seeking partnerships signal a strategic direction in fund management. The broader market focus remains on Bitcoin and Ethereum, with Bitcoin’s performance seeing notable gains.

“We are not predicting the end of crypto, but rather the final window for extraordinary investment returns before market maturity.” – Jeremy Boynton, Founder, Pure Crypto

Historical Context, Price Data, and Expert Insights

Did you know? Bitcoin has seen significant price fluctuations, making it a key indicator of market sentiment and investment opportunities.

Bitcoin (BTC) currently trades at $119,074.79, holding a market cap of $2.37 trillion, according to CoinMarketCap. BTC’s price has risen by 26.42% over the past 90 days. Holding a market dominance of 60.26%, Bitcoin continues to reflect a key metric for market sentiment.

Coincu analysts note that Pure Crypto’s strategy indicates an increasing institutional focus in the sector. By prioritizing regulated stablecoins and DeFi, the fund aligns with trends toward secure, practical blockchain solutions, potentially influencing long-term technological integration.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/pure-crypto-fourth-fund-boom-3/