- Defense alleges withheld evidence in crypto legal case.

- FinCEN call suggests non-custodial protocols might not be MSBs.

- Significant implications for privacy-focused crypto projects.

Samourai Wallet and Tornado Cash defense lawyers are accusing U.S. prosecutors of withholding exculpatory evidence linked to a FinCEN phone call. The case challenges regulatory boundaries for non-custodial crypto protocols, impacting future litigation.

Defense attorneys for Samourai Wallet and Tornado Cash have accused the prosecution of not disclosing key evidence. A phone call from August 2023 with FinCEN suggested non-custodial protocols might not classify as MSBs, affecting allegations against co-founders Keonne Rodriguez, Roman Storm, and William Lonergan Hill. The core contention centers on potentially withheld exculpatory evidence that could undermine charges of money laundering and unlicensed money transmissions. The prosecution, however, argues that this evidence had been shared earlier and that FinCEN’s remarks should be seen as “informal personal views.” These legal arguments focus on differences between Tornado Cash and Samourai.

Regulatory Impact of FinCEN Call on Non-Custodial Protocols

Financial and community responses have stemmed from this clash over non-custodial operations and crypto anonymity. Roman Storm expressed concerns on social media about the timing of the charges and the FinCEN call being concealed.

Zack Shapiro of the Bitcoin Policy Institute criticized this case as an example of “regulation by criminal indictment.” As Shapiro stated in a quoted remark, “FinCEN explicitly informed SDNY prosecutors that Samourai Wallet’s non-custodial design did not require money transmitter licensing, yet the DOJ indicted the developers regardless. This prosecution exemplifies regulation by criminal indictment, directly defying Deputy AG Blanche’s directive and undermining the Trump Administration’s crypto policies.”

Market Data and Future Implications

Did you know? The FinCEN’s previous guidance has notably influenced regulatory approaches across various sectors, often being pivotal in legal cases involving crypto anonymity and non-custodial protocols.

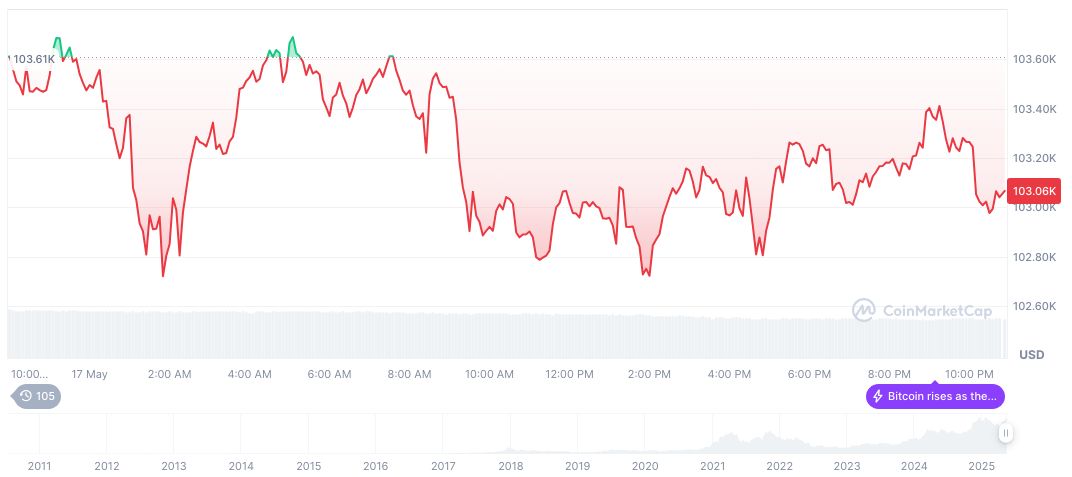

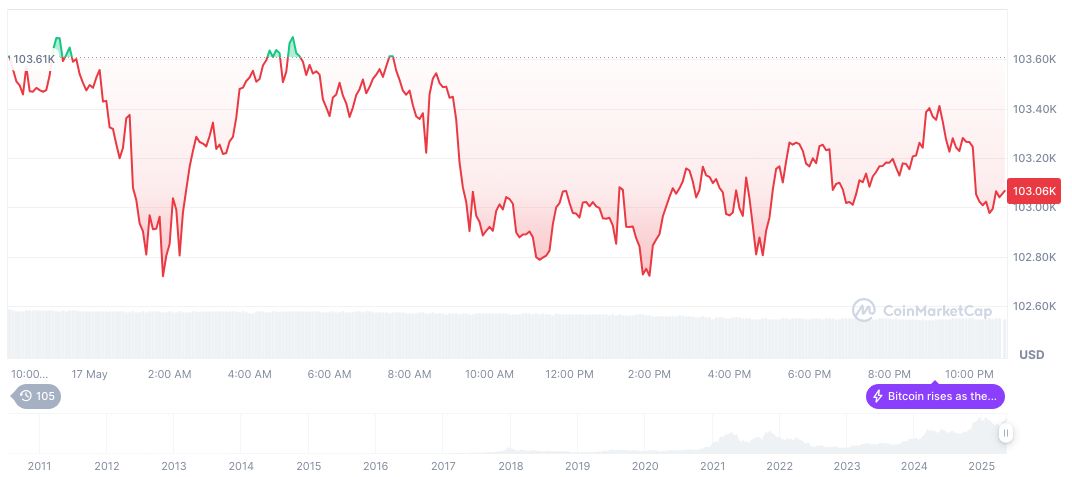

According to CoinMarketCap, Bitcoin (BTC) is priced at $103,251.16 with a market cap of $2.05 trillion. Recent trading volume decreased by 18.76% with price shifts of 0.53% in 24 hours and 21.57% over 30 days. These figures underscore Bitcoin’s current market influence.

Experts suggest significant repercussions from this case as it could set a precedent for privacy tools in crypto. Financial, regulatory, and technological challenges may increasingly shape cryptocurrency policy, highlighting the impact of non-custodial operations on the market and future regulations.

Source: https://coincu.com/338203-prosecutors-accused-withholding-evidence-crypto-case/